- United States

- /

- Luxury

- /

- NYSE:NKE

NIKE (NYSE:NKE) Completes US$11.8 Billion Buyback as Shares Remain Flat

Reviewed by Simply Wall St

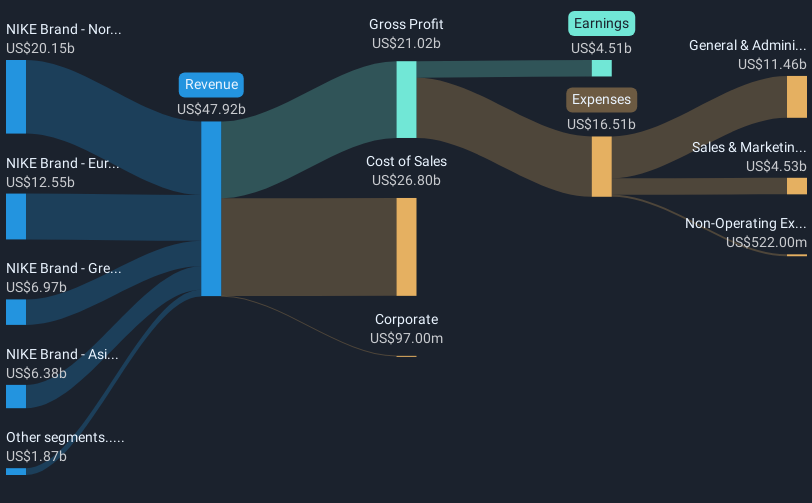

NIKE (NYSE:NKE) recently announced an update to its ongoing share buyback program, having repurchased 6.5 million shares at a cost of $499 million, reinforcing its commitment to shareholder value. Despite this positive signal, the company's stock price remained flat last week, moving just 1% amid a complex backdrop. The broader market showed signs of resilience with the S&P 500 on track to break a four-week losing streak, but Nike faced specific challenges, with news of potential sales impacts from its turnaround plan and tariff concerns contributing to the cautious investor sentiment surrounding the stock.

Buy, Hold or Sell NIKE? View our complete analysis and fair value estimate and you decide.

The past five years have seen NIKE's total shareholder return fall by 9.50%. A notable challenge during this period has been inventory management issues impacting gross margins and contributing to revenue pressure. Another factor influencing long-term performance is the company's attempt to transition to a full-price model, aiming to improve gross margins by reducing reliance on promotions and markdowns.

Despite a strategic refocus on sports partnerships with the NBA and NFL to drive demand, execution challenges, such as missteps in digital engagement, have affected brand perception and sales margins. These challenges were compounded by underperformance compared to the broader US market, with NIKE lagging behind, particularly in regions like Greater China. Additionally, while NIKE has maintained regular dividends, as seen with a US$0.40 declaration in February 2025, the company's overall performance has not kept pace with industry counterparts, as shown by its negative earnings growth over the past year.

Assess NIKE's future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade NIKE, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NIKE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NKE

NIKE

Engages in the design, development, marketing, and sale of athletic footwear, apparel, equipment, accessories, and services worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives