- United States

- /

- Luxury

- /

- NYSE:NKE

Is NIKE Fairly Priced After Recent Bounce Despite Weak Multi Year Share Performance

Reviewed by Bailey Pemberton

- Wondering if NIKE at around $65 is a bargain or a value trap? You are not alone, and the answer is not as simple as looking at a long term price chart.

- Despite a rough longer term run, with the stock still down about 36.5% over three years and 48.5% over five, NIKE has quietly ticked higher recently, gaining 1.9% over the last week and 6.0% over the past month, even while year to date returns sit at around -10.6% and roughly -14.6% over the last year.

- Much of the recent price action has been shaped by shifting expectations around consumer spending, inventory normalization in athletic retail, and ongoing competition in performance and lifestyle footwear. In addition, headlines about NIKE refining its direct to consumer strategy, reassessing wholesale partnerships, and investing more heavily in product innovation and digital engagement all feed into how investors are repricing the stock.

- On our checks, NIKE scores just 0 out of 6 for undervaluation. That might sound harsh, but it actually opens the door to a deeper question: how do different valuation methods, and an even more nuanced lens we will come to at the end of this article, really frame what this brand is worth today?

NIKE scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: NIKE Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting its future cash flows and then discounting those back to the present using a required rate of return.

For NIKE, the latest twelve month Free Cash Flow sits at roughly $2.9 billion. Analysts and extrapolated forecasts used in this 2 Stage Free Cash Flow to Equity model see FCF rising to about $5.9 billion by 2030, with a step up through the late 2020s as both profitability and cash conversion improve. Simply Wall St uses detailed analyst estimates for the next several years, and then extends the trend at gradually slowing growth rates.

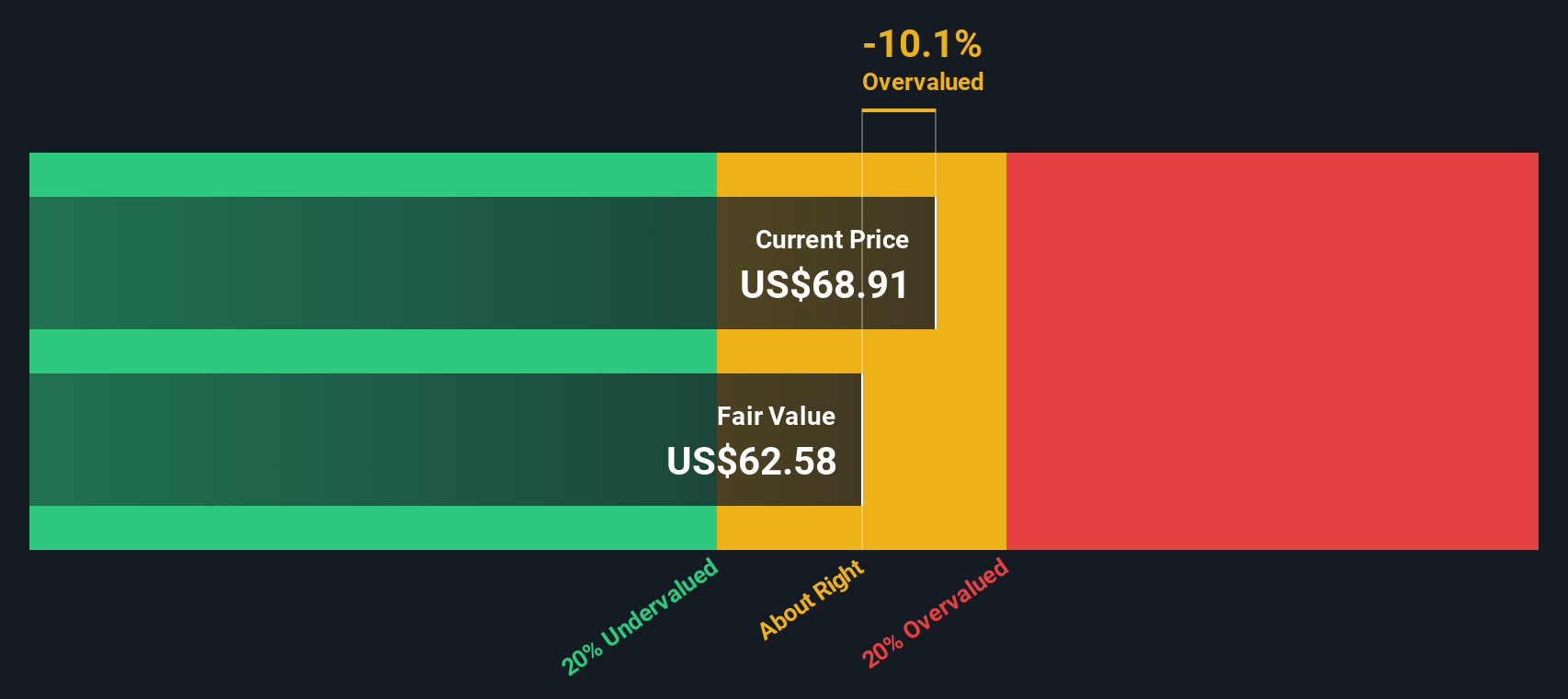

When these projected cash flows are discounted back to today, the model arrives at an intrinsic value of about $62 per share. With NIKE currently trading roughly 6.3% above that estimate, the DCF view suggests the stock is slightly overvalued, but not dramatically so, which implies expectations are already reasonably optimistic.

Result: ABOUT RIGHT

NIKE is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: NIKE Price vs Earnings

For established, profitable brands like NIKE, the Price to Earnings, or PE, ratio is a useful yardstick because it links what investors pay for each share directly to the company’s current earnings power. In general, faster growth and lower perceived risk justify a higher “normal” PE, while slower growth or higher uncertainty should pull it down.

NIKE currently trades on a PE of about 33.6x, which is a premium to the broader luxury and athletic space, where the industry average sits closer to 21.5x and peers average around 30.0x. To refine this further, Simply Wall St uses a proprietary “Fair Ratio” that estimates what NIKE’s PE should be, based on its earnings growth outlook, margins, size, industry positioning, and risk profile. For NIKE, that Fair Ratio comes out at roughly 27.9x, which is notably below today’s market multiple and suggests the stock is pricing in richer expectations than its fundamentals alone would support.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

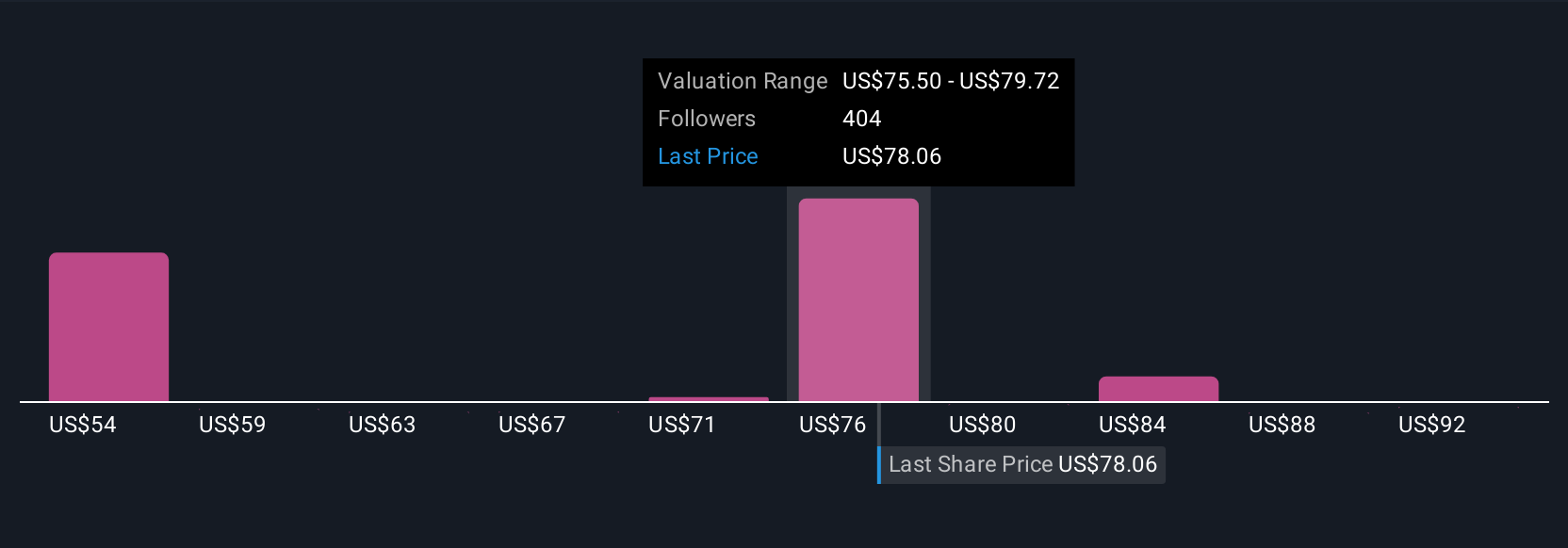

Upgrade Your Decision Making: Choose your NIKE Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a simple framework that lets you connect your view of a business with the numbers behind it. A Narrative is your story for a company, where you spell out how you think revenue, earnings and margins evolve, what feels like a reasonable fair value, and why, instead of just accepting a single model output. On Simply Wall St, Narratives live in the Community page and are used by millions of investors, because they link three pieces together in one place: the company story, a forward looking financial forecast, and a resulting fair value estimate you can compare directly with the current share price to inform whether you want to buy, hold, or sell. They also update dynamically when new information, such as earnings releases or major news, comes in, so your story and fair value do not go stale. For NIKE, for example, some investors see a fair value near $77 per share while others are closer to $97, reflecting different views on how quickly growth, margins and the brand's momentum can recover from here.

Do you think there's more to the story for NIKE? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIKE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NKE

NIKE

Designs, develops, markets, and sells athletic and casual footwear, apparel, equipment, accessories, and services for men, women, and kids in North America, Europe, the Middle East, Africa, Greater China, the Asia Pacific, and Latin America.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026