- United States

- /

- Luxury

- /

- NYSE:NKE

Improving Margins and Digital Success are NIKE's (NYSE:NKE) Best Weapon in the Short-Term

After a good start of the summer, NIKE, Inc. ( NYSE: NKE ) hit the bumpy road as the shares tumbled on supply chain worries.

The latest earnings report did little to help, as shares have now declined down to the key resistance level from earlier in the year, which happens to be a 200-day moving average.

See our latest analysis for NIKE .

Latest Earnings Results

- GAAP EPS: US$1.16 (beat by US$0.04)

- Revenue: US$12.25b (miss by US$220m)

- Revenue growth: 15.6% Y/Y

- Gross margin: Increase 170 basis points (46.5%)

Despite the revenue miss, these numbers are looking solid. Revenue growth is on track while the improving margin boosts already strong free cash flow generation.

CEO John Donahoe reflected on the performance, stating that the changes in the market helped shift the consumers' focus on the digital, giving a tailwind to the company's Consumer Direct Acceleration strategy.

Yet, the company got hit by price target cuts, with Morgan Stanley lowering the target from US$220 to US$201, Cowen from US$196 to US$180, and BMO Capital Markets from US$174 to US$170.

A Look at the Returns

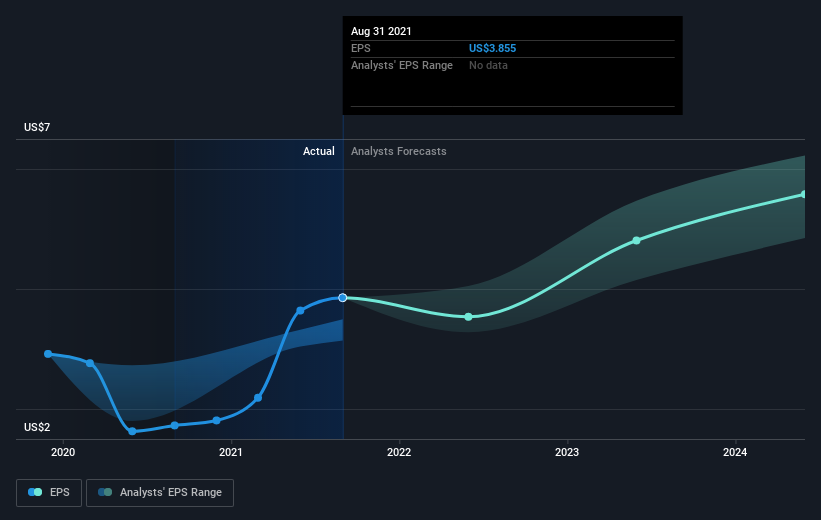

Nike's share price has soared 184% in the last half-decade. During five years of share price growth, NIKE achieved compound earnings per share (EPS) growth of 11% per year.This EPS growth is lower than the 23% average annual increase in the share price.

This suggests that market participants hold the company in higher regard these days.And that's hardly shocking given the track record of growth.

The company's earnings per share (over time) are depicted in the image below (click to see the exact numbers).

It is, of course, excellent to see how NIKE has grown profits over the years, but the future is more important for shareholders.

This free interactive report on NIKE's balance sheet strength is a great place to start if you want to investigate the stock further.

What About Dividends?

It is essential to consider the total shareholder return and the share price return for any given stock.Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off.It's fair to say that the TSR gives a complete picture for stocks that pay a dividend.

We note that for NIKE, the TSR over the last 5 years was 200%, which is better than the share price return mentioned above as t he dividends paid have boosted the total shareholder return.

Although the dividend yield isn't among the highest in the industry, the company has been growing the dividend steadily. With a 29% payout, the dividend is protected from any short-term turmoils.

Solid Returns But Lagging the Market

NIKE shareholders gained a total return of 17% during the year.But that return falls short of the market.On the bright side, the longer-term returns (running at about 25% a year, over half a decade) look better.

It looks like price is taking a breather, fueled by the after-shocks of the 2020 Pandemic.

While it is well worth considering the different impacts of market conditions on the share price, other factors are even more important. For example, we've discovered 1 warning sign for NIKE that you should be aware of before investing here.

Of course, you might find a great investment by looking elsewhere. So please take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market-weighted average returns of stocks that currently trade on US exchanges.

Valuation is complex, but we're here to simplify it.

Discover if NIKE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:NKE

NIKE

Designs, develops, markets, and sells athletic and casual footwear, apparel, equipment, accessories, and services for men, women, and kids in North America, Europe, the Middle East, Africa, Greater China, the Asia Pacific, and Latin America.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives