- United States

- /

- Insurance

- /

- NYSE:ASIC

Exploring July 2025's Undervalued Small Caps With Insider Buying

Reviewed by Simply Wall St

The United States market has experienced a flat performance over the last week but is up 18% over the past year, with earnings projected to grow by 15% annually. In such an environment, identifying small-cap stocks that are perceived as undervalued and exhibit insider buying can offer intriguing opportunities for investors looking to capitalize on potential growth.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Lindblad Expeditions Holdings | NA | 1.0x | 30.75% | ★★★★★★ |

| Byline Bancorp | 10.1x | 3.1x | 49.55% | ★★★★★☆ |

| Columbus McKinnon | NA | 0.5x | 40.52% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.8x | 35.19% | ★★★★★☆ |

| Citizens & Northern | 11.1x | 2.7x | 47.43% | ★★★★☆☆ |

| Southside Bancshares | 10.5x | 3.6x | 38.99% | ★★★★☆☆ |

| S&T Bancorp | 10.9x | 3.8x | 42.26% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 35.70% | ★★★★☆☆ |

| Montrose Environmental Group | NA | 1.1x | 32.70% | ★★★★☆☆ |

| Farmland Partners | 7.5x | 9.0x | -10.78% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

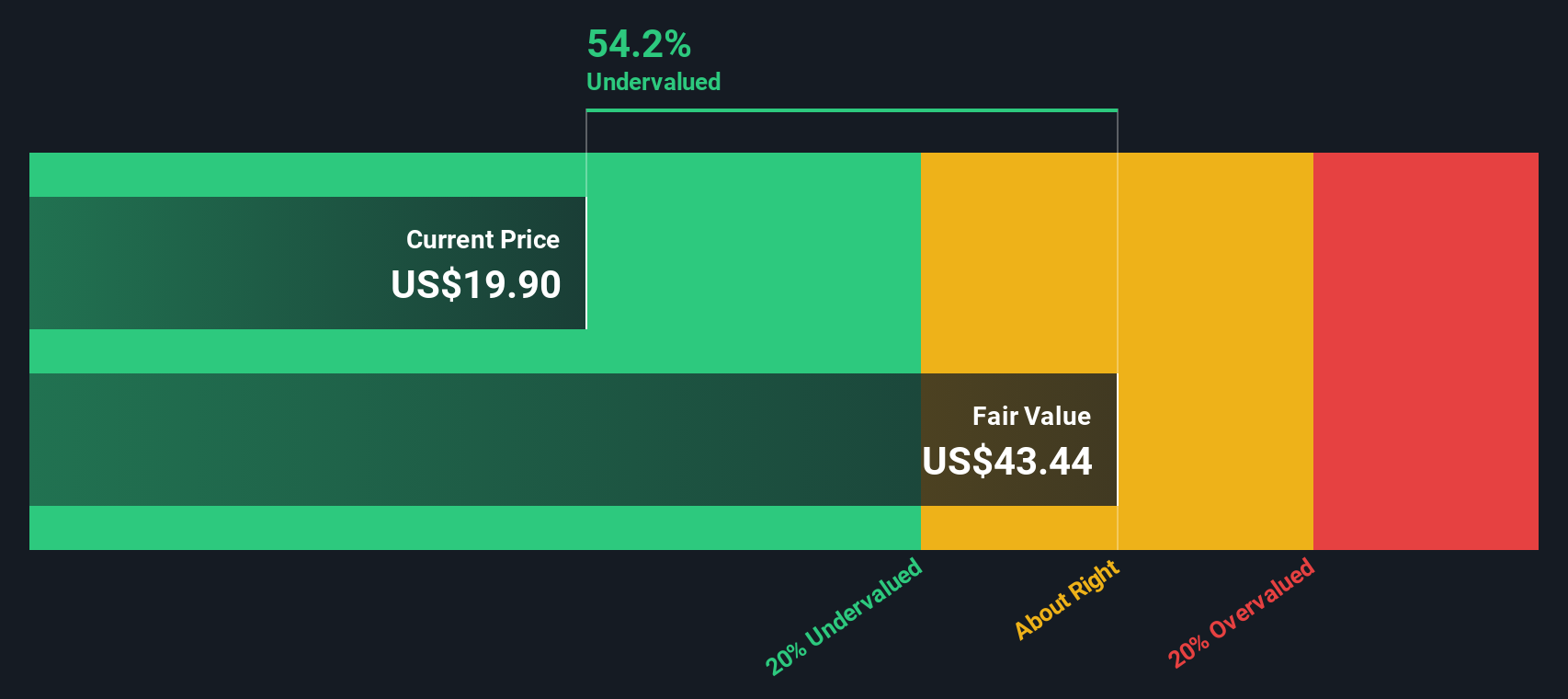

Ategrity Specialty Insurance Company Holdings (ASIC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Ategrity Specialty Insurance Company Holdings operates in the insurance sector, focusing on specialty insurance products, with a market capitalization of $1.25 billion.

Operations: ASIC's primary revenue stream is from its insurance business, generating $350.89 million. The company reported a gross profit margin of 20.37% in 2024 and 19.89% in early 2025, indicating an improvement compared to the previous year’s margin of 6.24%. Operating expenses are minimal relative to revenue, with notable non-operating expenses impacting net income margins, which reached approximately 13.54% by March and July of 2025 after a rise from around 4.16% in December 2023.

PE: 21.5x

Ategrity Specialty Insurance Company Holdings, a recent IPO with US$113 million raised, is positioned for potential growth with earnings forecasted to increase by 36% annually. Insider confidence is evident through share purchases in June 2025. However, reliance on external borrowing highlights funding risks. The recent conversion to a Nevada corporation and shelf registration filing of US$78 million indicate strategic moves for capital flexibility. As it navigates these changes, the company may present opportunities within its industry segment.

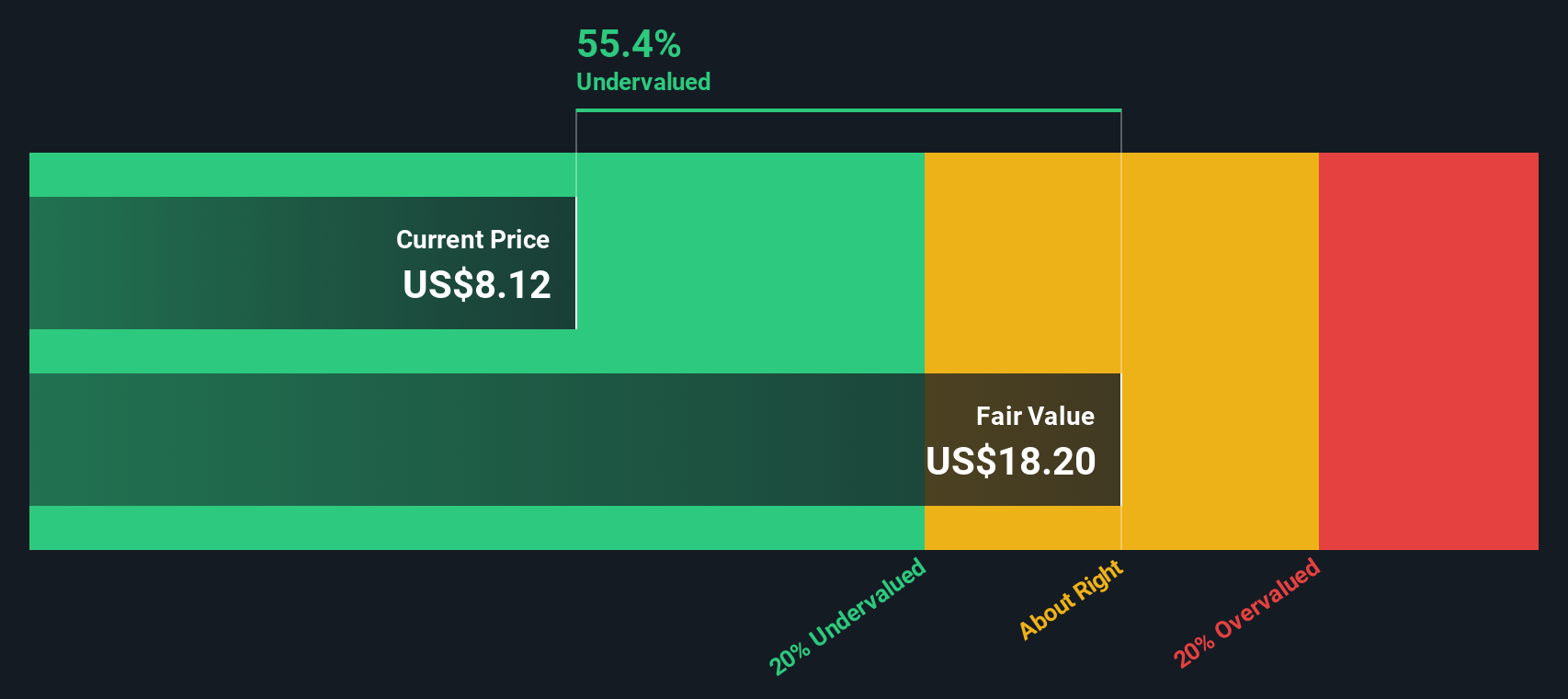

Topgolf Callaway Brands (MODG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Topgolf Callaway Brands is a company engaged in the operation of entertainment venues, manufacturing golf equipment, and providing active lifestyle products with a market cap of $3.66 billion.

Operations: Topgolf Callaway Brands generates revenue primarily from its Topgolf, Golf Equipment, and Active Lifestyle segments. The company's gross profit margin has fluctuated over the years, reaching 32.68% in March 2024 before declining to 31.70% by December 2024. Operating expenses have been a significant cost component, with general and administrative expenses consistently forming a substantial part of these costs.

PE: -1.2x

Topgolf Callaway Brands, a smaller player in the market, is expanding its footprint with new venues in Florida and New Jersey. Despite recent earnings showing a slight dip to US$1.09 billion for Q1 2025, insider confidence is evident as Adebayo Ogunlesi acquired 461,583 shares valued at approximately US$3.06 million from January to March 2025. The company projects full-year revenues up to US$4.19 billion while launching innovative products like movie-inspired golf equipment, suggesting potential growth opportunities despite reliance on external funding sources.

- Unlock comprehensive insights into our analysis of Topgolf Callaway Brands stock in this valuation report.

Gain insights into Topgolf Callaway Brands' past trends and performance with our Past report.

Manitowoc Company (MTW)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Manitowoc Company is a leading manufacturer of cranes and lifting solutions, operating globally with significant revenue contributions from the Americas, Europe and Africa, and the Middle East and Asia Pacific regions.

Operations: The company's revenue is primarily derived from the Americas, Europe and Africa (EURAF), and Middle East and Asia Pacific (MEAP) regions. Over recent periods, the gross profit margin has shown variation, with a notable increase to 19.64% in September 2023 before declining to 17.29% by March 2025. Operating expenses have been consistently significant relative to gross profit, impacting overall profitability trends.

PE: 10.3x

Manitowoc, a player in the construction equipment sector, is currently navigating financial challenges. Their recent earnings report for Q1 2025 showed sales of US$470.9 million, down from US$495.1 million the previous year, with a net loss of US$6.3 million compared to prior profits. Despite these hurdles, insider confidence is evident as they continue to invest in shares over time. Earnings are projected to grow at 11% annually, suggesting potential for future recovery and growth amidst current undervaluation concerns.

Make It Happen

- Delve into our full catalog of 82 Undervalued US Small Caps With Insider Buying here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASIC

Ategrity Specialty Insurance Company Holdings

Through its subsidiaries, provides excess and surplus lines insurance and reinsurance products to small and medium-sized businesses in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives