- United States

- /

- Luxury

- /

- NYSE:LEVI

Levi’s (LEVI) Profit Margin Surge Reinforces Bullish Valuation Narrative Despite Slower Growth Outlook

Reviewed by Simply Wall St

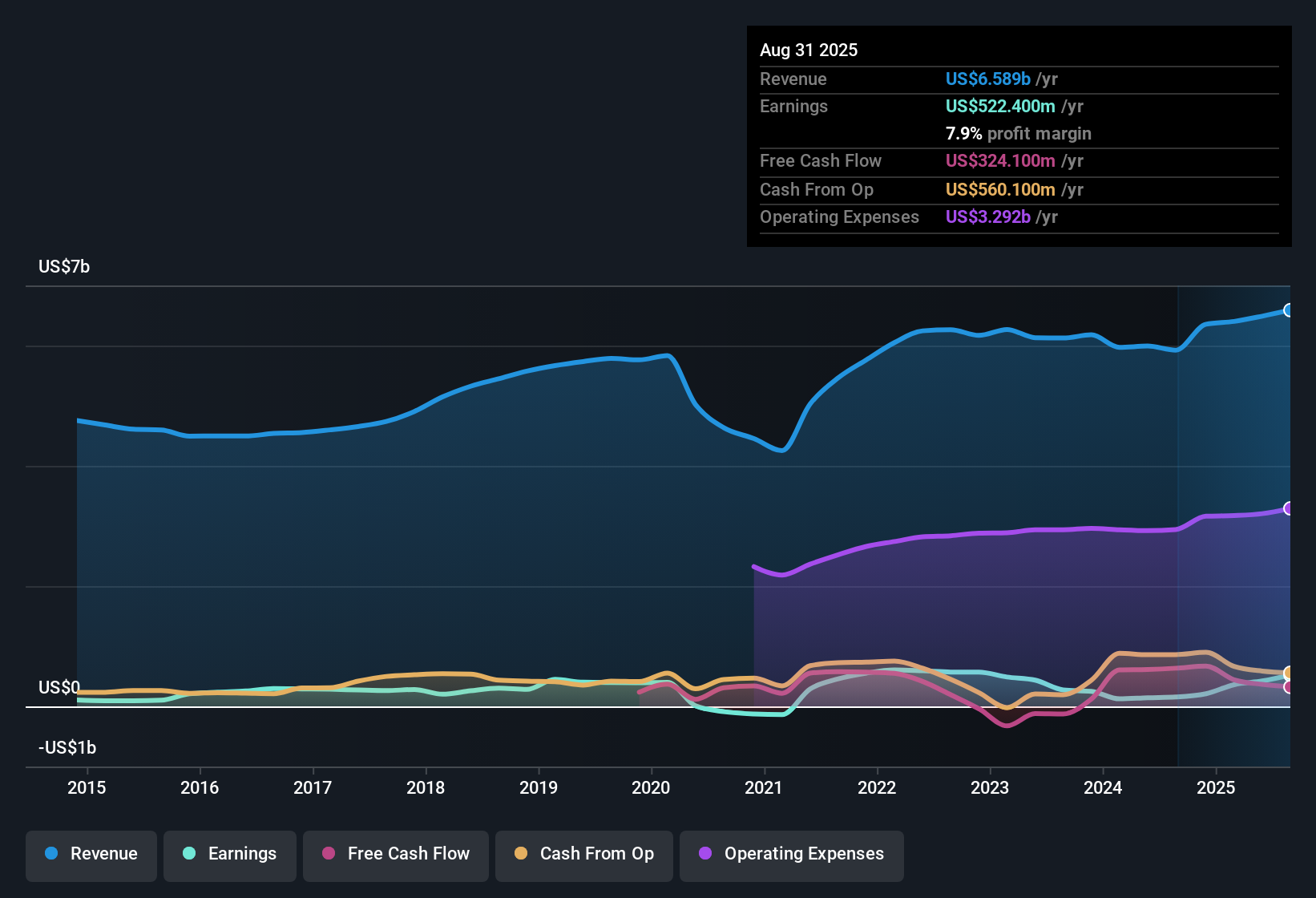

Levi Strauss (LEVI) posted a sharp jump in profitability, reporting net profit margins of 7.9% this year compared to just 2.7% a year ago. Annual earnings growth came in at 226.1%, far surpassing the company's 5-year trajectory of 10.3% per year, and analysts see earnings set to grow at 10.6% annually moving forward. With a price-to-earnings ratio of 16.1x below both industry and peer averages, and shares trading under analyst fair value targets, investors are looking at a setup of improved profitability and attractive value, even as forward growth forecasts trail the broader US market.

See our full analysis for Levi Strauss.Next up, we’ll see how these headline numbers measure against the market’s prevailing narratives. We will also consider whether the latest results confirm or challenge the consensus view.

See what the community is saying about Levi Strauss

Direct-to-Consumer Takes Center Stage

- Direct-to-Consumer (DTC) now represents over half of company sales, with DTC EBIT margins up 400 basis points year-to-date. This highlights substantial improvement in margin quality beyond headline growth.

- According to analysts' consensus view:

- The concerted pivot to DTC channels is credited for driving improved profitability and brand resilience. This approach enables Levi Strauss to capture higher margins, achieve greater brand control, and accelerate product innovation compared to its traditional wholesale model.

- Consensus notes that this strategy, coupled with digital and omnichannel investments, positions Levi’s to strengthen revenue streams and lessen exposure to geographic risks. This is illustrated by recent international market growth rates (Europe up 15%, Latin America up 18%), which support longer-term revenue expansion despite muted near-term forecasts.

Don’t miss how analysts are weighing Levi’s DTC gains against global growth opportunities in the full Consensus Narrative. 📊 Read the full Levi Strauss Consensus Narrative.

Revenue Diversification Beyond Denim

- Lifestyle category expansion is pacing ahead of denim, with tops sales up 16% and women’s apparel up 14% year-over-year. This shows that new product lines are gaining traction and increasing average order value for the company.

- Analysts' consensus view underscores that:

- Levi’s deliberate investment in premium positioning, including collaborations, fit innovations, and brand partnerships, supports higher selling prices and higher average unit revenue. This aligns with the global trend toward more casual workplace and lifestyle attire.

- The focus on omnichannel experiences, including e-commerce growth of 13%, is not just boosting sales but also deepening brand relevance amid shifting apparel trends. This helps the company offset the still-heavy reliance on denim at a time when apparel preferences can be volatile.

Valuation Discount Creates a Safety Net

- Levi Strauss trades at a price-to-earnings ratio of 16.1x, which is well below the US luxury industry average of 20.3x and the peer group average of 41.5x. Its current share price of $21.46 sits at a notable discount to the analyst price target of $26.46, suggesting limited downside risk even if forward growth expectations are moderate.

- According to analysts' consensus narrative:

- They see the stock’s below-average valuation, in combination with recent margin expansion and proven profit and revenue growth, as supporting the case for defensive value relative to higher-priced peers. This holds even as future earnings growth forecasts (10.6% annually) trail that of the broader US market.

- However, ongoing risks such as margin pressures from tariffs and the sustainability of dividends mean that a greater share of the investment case now rests on attractive entry price and quality of profits, rather than breakout sales or EPS momentum versus the market.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Levi Strauss on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data from a new angle? Take just a few minutes to turn your viewpoint into a personalized narrative. Do it your way

A great starting point for your Levi Strauss research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Levi Strauss has delivered margin improvements and better value, its projected earnings growth still lags behind the broader market and top peers.

For those targeting more dynamic expansion, check out high growth potential stocks screener to find companies positioned for stronger forward growth and bigger upside potential right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LEVI

Levi Strauss

Designs, markets, and sells apparels and related accessories for men, women, and children in the United States and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives