- United States

- /

- Luxury

- /

- NYSE:LEVI

Is Now the Right Moment for Levi’s Stock After Its Recent 13% Pullback?

Reviewed by Bailey Pemberton

Thinking about what to do with Levi Strauss stock right now? You're not alone. After an impressive run earlier this year, Levi’s share price recently took a breather, slipping 13.1% in the last week and trimming back by 5.1% over the past month. Yet, step back and you’ll see plenty of growth baked into its longer-term trajectory, with 23.0% gains year to date and nearly 65% returns over three years. Even zooming out to five years, Levi’s shareholders are up almost 48%, which is nothing to sneeze at.

The story behind these moves is not about fleeting headlines, but a broader market backdrop. Retailers have enjoyed pockets of optimism as supply chain constraints ease and global appetite for iconic brands like Levi’s stays resilient. Still, investors are clearly weighing some new risks or simply cashing in recent gains. This could offer opportunities for anyone with an eye on the big picture.

If you’re wondering whether Levi Strauss is still worth your confidence, here is an interesting stat: based on six key valuation checks, Levi’s stacks up as undervalued in five of them, giving it a solid value score of 5 out of 6. Of course, the real question is how these valuation frameworks stack up against each other, and whether there is an even more insightful way to understand what you are really getting with Levi’s today. Let’s dig into the details.

Approach 1: Levi Strauss Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s true worth by projecting its future cash flows and then discounting them back to today’s value. This approach aims to capture the long-term earning power of Levi Strauss by looking far ahead rather than focusing just on near-term profits.

According to the latest figures, Levi Strauss generated Free Cash Flow (FCF) of $283.8 Million over the last twelve months. Analysts expect this number to steadily grow, projecting FCF of $468.3 Million by 2026 and $539.5 Million by 2027. Beyond these analyst estimates, longer-term projections extend out to 2035 using moderate growth rates, with estimated FCF approaching $846.1 Million. These projections are all calculated in US dollars.

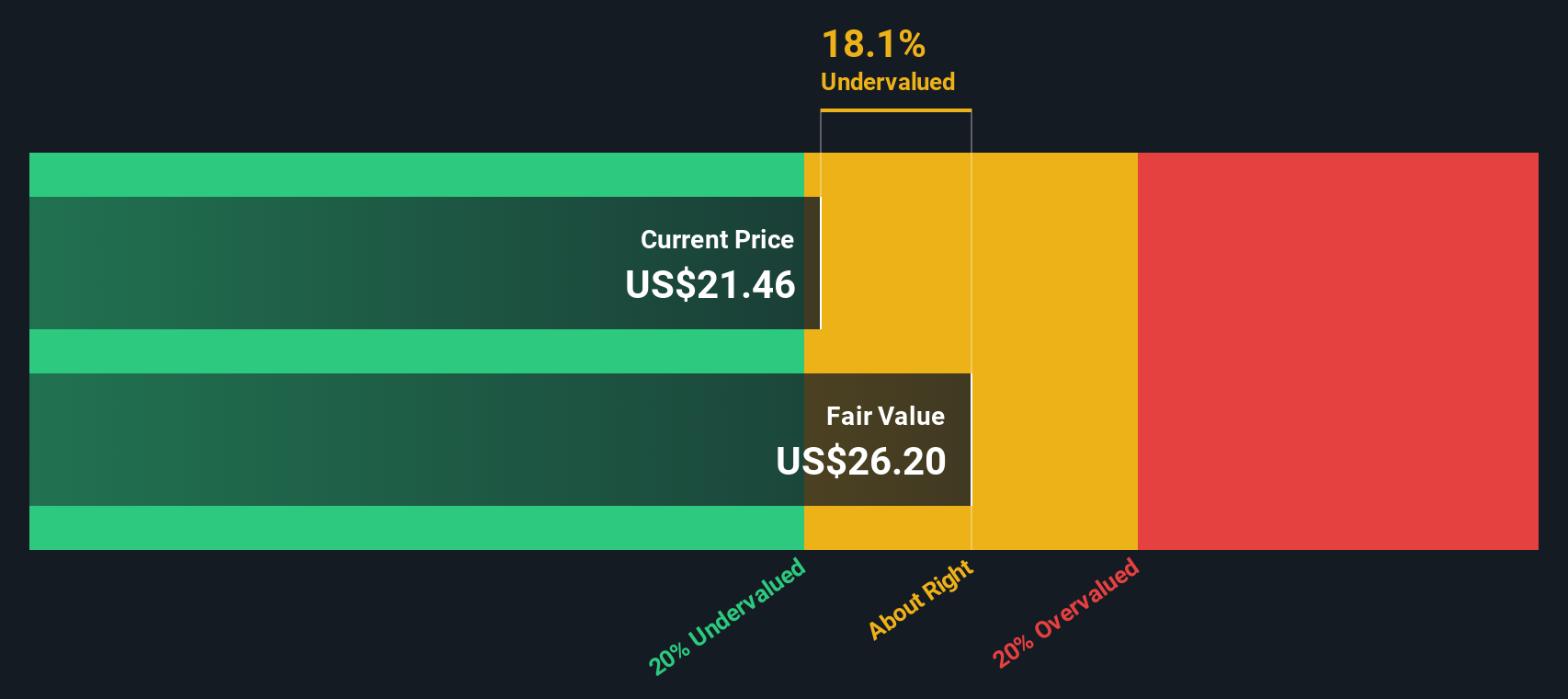

With these estimates, the DCF model arrives at an intrinsic fair value of $25.83 per share. Compared to the current share price, this suggests Levi Strauss stock is trading at a notable 17.0% discount. This means shares appear undervalued based on future cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Levi Strauss is undervalued by 17.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Levi Strauss Price vs Earnings

For profitable companies like Levi Strauss, the price-to-earnings (PE) ratio is often the go-to valuation tool. This metric tells investors how much they are paying for each dollar of current earnings, making it a straightforward way to assess if the stock's price is justified by its profits. Of course, what represents a “normal” or “fair” PE varies by industry, and depends on factors like expected growth rates and underlying risks. Higher growth or stability usually commands a higher PE, while risk or low growth tends to drag it down.

Levi Strauss currently trades at a PE of 16x, which is comfortably below the Luxury industry average of 20x as well as the peer average of 44x. This lower ratio could suggest the market has modest expectations for Levi's future profits compared to its peers, or it may indicate an opportunity for value if those expectations prove too pessimistic.

Simply Wall St uses a proprietary “Fair Ratio” to bring more nuance to this comparison. The Fair Ratio for Levi Strauss sits at 18.8x, adjusting for factors such as the company's earnings growth outlook, profit margins, sector trends, company size, and risk profile. This approach is more robust than simply measuring against an industry average or a single competitor because it considers Levi’s unique strengths and challenges in context.

Stacking up Levi’s current PE of 16x against its Fair Ratio of 18.8x, the stock appears undervalued, signaling that investors are not currently pricing in the full potential of the business’s earnings power.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Levi Strauss Narrative

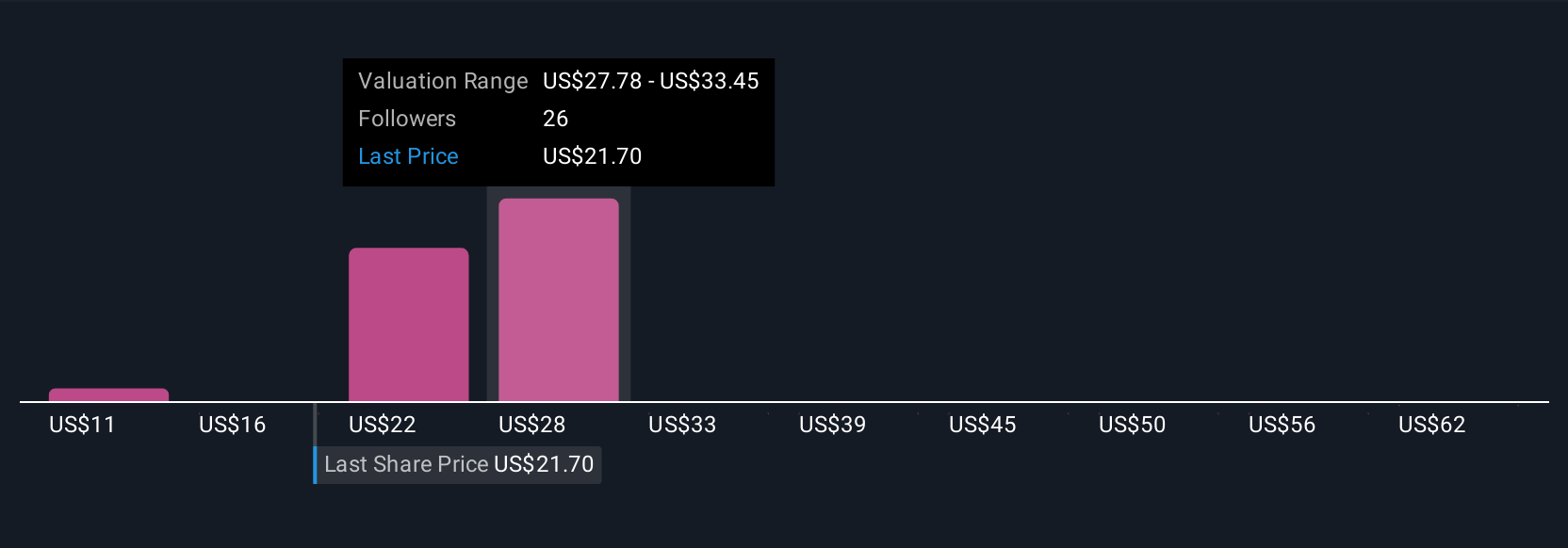

Earlier we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own story about a company, combining your personal perspective on Levi Strauss with the numbers, such as your estimated fair value, revenue growth, earnings, and margins, to build a complete investment view. Narratives go beyond static ratios and simple models by linking the company's broader story to a dynamic financial forecast, so you can clearly see how your assumptions lead to a fair value and whether that means the stock is a buy or a sell right now.

Narratives are accessible and easy to use for investors at any level, available on Simply Wall St's Community page, which is visited by millions. By comparing your estimated Fair Value to the current Price in the context of your chosen story, Narratives help you decide when to act. These Narratives are always up to date and automatically adjust when fresh news, earnings, or company events change the outlook, keeping your convictions aligned with reality.

For example, some investors see Levi’s future driven by global expansion and innovation, leading them to set a Fair Value as high as $28.00 per share, while others see stiffer risks ahead and set it as low as $19.00. Narratives let you make investment decisions that truly reflect your view of Levi Strauss.

Do you think there's more to the story for Levi Strauss? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LEVI

Levi Strauss

Designs, markets, and sells apparels and related accessories for men, women, and children in the United States and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives