- United States

- /

- Life Sciences

- /

- NasdaqGS:BRKR

3 Stocks Estimated To Be Undervalued By Up To 27.5% Offering Investment Opportunities

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations amid tariff threats and economic uncertainty, investors are keenly observing potential opportunities in undervalued stocks. In such a volatile environment, identifying stocks that are estimated to be undervalued by up to 27.5% can offer promising investment prospects for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Roku (ROKU) | $90.25 | $174.09 | 48.2% |

| Robert Half (RHI) | $42.92 | $83.09 | 48.3% |

| Ligand Pharmaceuticals (LGND) | $124.98 | $240.64 | 48.1% |

| Insteel Industries (IIIN) | $39.67 | $77.33 | 48.7% |

| e.l.f. Beauty (ELF) | $115.37 | $228.96 | 49.6% |

| Carter Bankshares (CARE) | $18.22 | $35.50 | 48.7% |

| Camden National (CAC) | $43.50 | $83.56 | 47.9% |

| Atlantic Union Bankshares (AUB) | $33.67 | $65.54 | 48.6% |

| ACNB (ACNB) | $44.16 | $84.62 | 47.8% |

| Acadia Realty Trust (AKR) | $18.43 | $36.55 | 49.6% |

Let's dive into some prime choices out of the screener.

Bruker (BRKR)

Overview: Bruker Corporation, with a market cap of approximately $6.38 billion, develops, manufactures, and distributes scientific instruments as well as analytical and diagnostic solutions across the United States, Europe, the Asia Pacific, and internationally.

Operations: The company's revenue is primarily generated from its BSI CALID segment at $1.15 billion, BSI Nano at $1.11 billion, BSI BioSpin at $930.70 million, and BEST segment at $269.20 million.

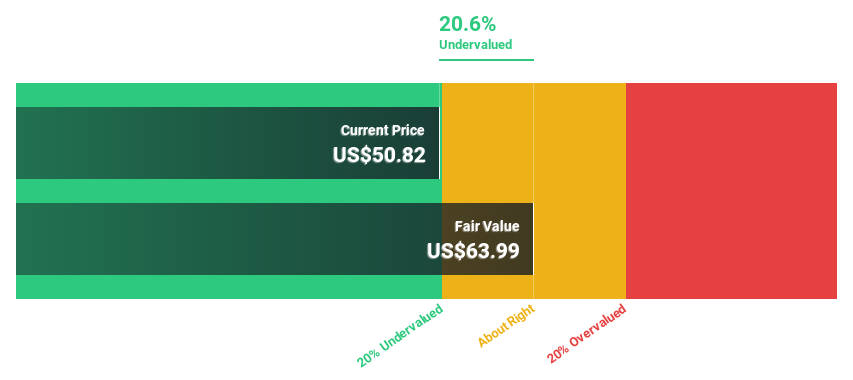

Estimated Discount To Fair Value: 11.5%

Bruker is trading at US$43.58, below its estimated fair value of US$49.22, suggesting it may be undervalued based on cash flows. Despite forecasted revenue growth of 4.5% per year lagging behind the broader US market, Bruker's earnings are expected to grow significantly faster than the market average. Recent product innovations in metrology and mass spectrometry reflect strong demand in semiconductor manufacturing and applied markets, potentially supporting future cash flow improvements despite recent index exclusions.

- According our earnings growth report, there's an indication that Bruker might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Bruker.

Natera (NTRA)

Overview: Natera, Inc. is a diagnostics company that offers molecular testing services globally with a market cap of $22.09 billion.

Operations: The company generates $1.83 billion from its molecular testing services segment worldwide.

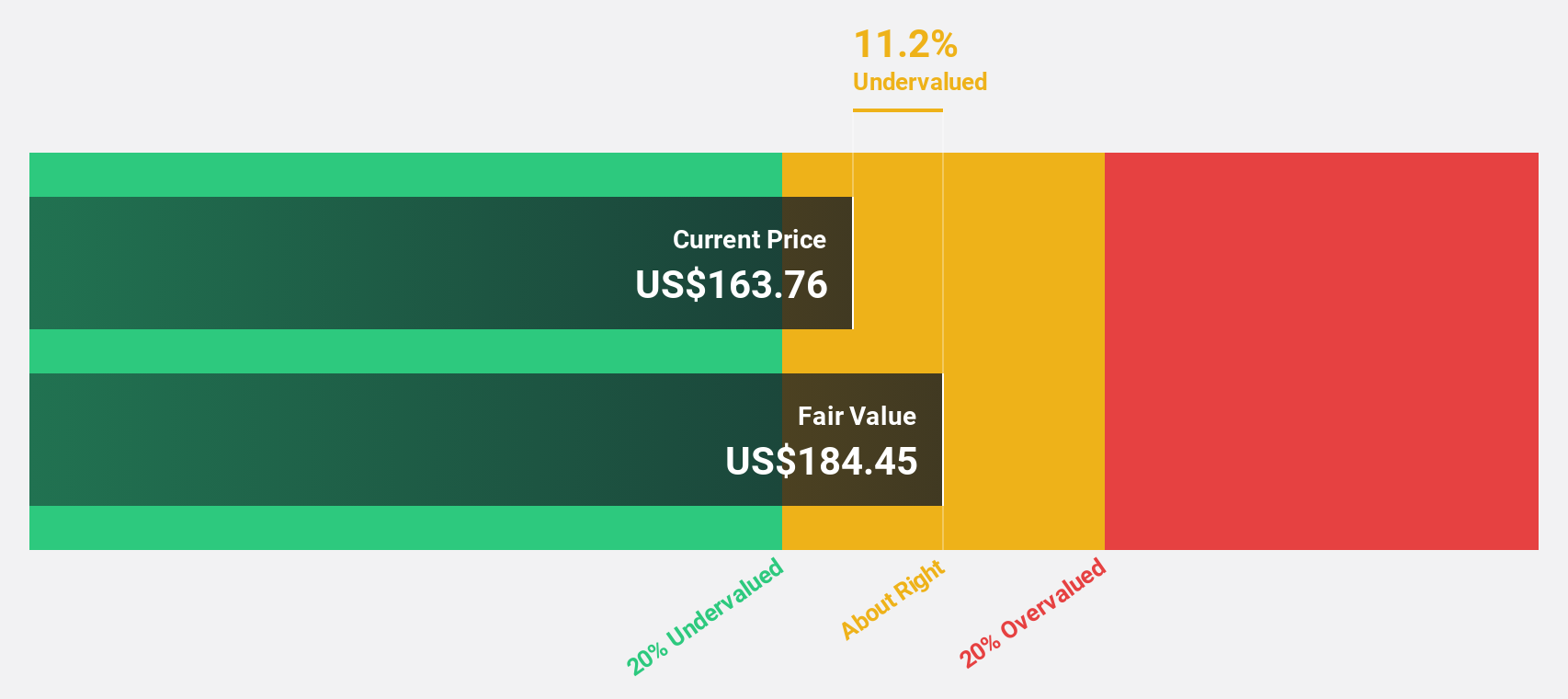

Estimated Discount To Fair Value: 22.4%

Natera, priced at US$163.36, trades below its estimated fair value of US$210.42, potentially indicating undervaluation based on cash flows. The company is anticipated to achieve above-average market profit growth and faster revenue expansion than the broader U.S. market. Despite significant insider selling and recent exclusion from the Russell 2500 Index, Natera's innovative MRD assays in cancer detection demonstrate strong clinical utility and economic benefits, potentially enhancing future cash flow prospects amidst evolving healthcare demands.

- Insights from our recent growth report point to a promising forecast for Natera's business outlook.

- Click here to discover the nuances of Natera with our detailed financial health report.

Levi Strauss (LEVI)

Overview: Levi Strauss & Co. is a global apparel company that designs, markets, and sells clothing and accessories for men, women, and children with a market capitalization of approximately $7.67 billion.

Operations: Levi Strauss & Co.'s revenue is primarily derived from its operations in the Americas ($3.25 billion), Europe ($1.59 billion), and Asia ($1.10 billion).

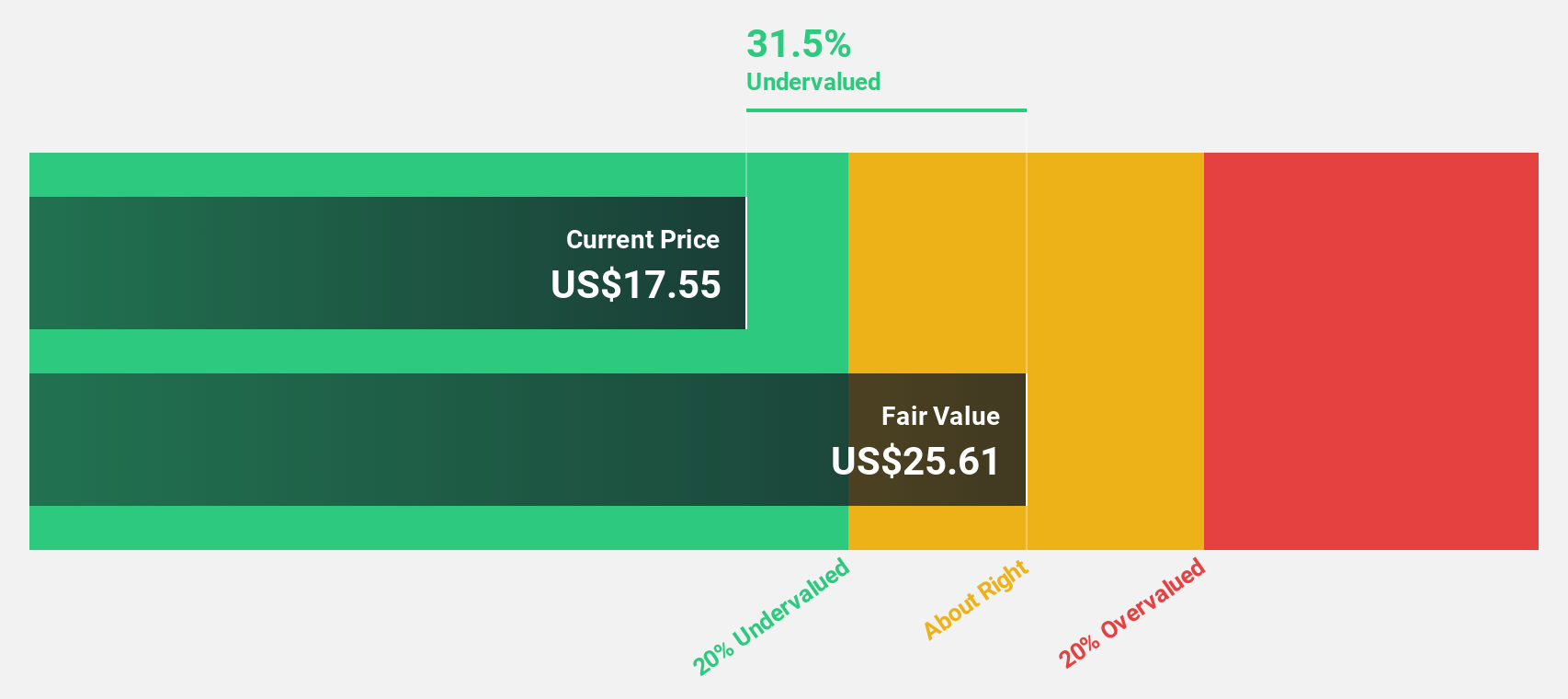

Estimated Discount To Fair Value: 27.5%

Levi Strauss, priced at US$19.73, trades below its estimated fair value of US$27.2, highlighting potential undervaluation based on cash flows. The company reported strong earnings growth with net income rising to US$67 million in Q2 2025 from US$18 million a year ago and raised its annual revenue guidance. Despite slower revenue growth than the market, Levi's significant earnings expansion and improved dividend offer a compelling case for cash flow-focused investors.

- Our earnings growth report unveils the potential for significant increases in Levi Strauss' future results.

- Click to explore a detailed breakdown of our findings in Levi Strauss' balance sheet health report.

Turning Ideas Into Actions

- Access the full spectrum of 181 Undervalued US Stocks Based On Cash Flows by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bruker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BRKR

Bruker

Develops, manufactures, and distributes scientific instruments, and analytical and diagnostic solutions in the United States, Europe, the Asia Pacific, and internationally.

Reasonable growth potential low.

Similar Companies

Market Insights

Community Narratives