- United States

- /

- Consumer Durables

- /

- NYSE:LEN

Is Lennar (LEN) Quietly Redefining Its First-Time Buyer Strategy With New Gulf Coast Communities?

Reviewed by Sasha Jovanovic

- Lennar Corporation recently opened two single-family home communities, Magnolia Ridge in Panama City and Cross Creek in Freeport, offering three- to four-bedroom homes from 1,474 to 2,000 square feet with modern finishes and pricing starting in the US$300,000s.

- By combining relatively attainable price points with proximity to Gulf Coast beaches, Tyndall Air Force Base and highly rated local schools, these communities underscore Lennar's focus on first-time buyers seeking convenience and lifestyle access.

- We’ll now examine how Lennar’s focus on attainable Gulf Coast communities for first-time buyers could influence its broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Lennar Investment Narrative Recap

To own Lennar, you generally need to believe in its ability to sell affordable, volume-driven homes while managing margin pressure from incentives and higher construction costs. The new Gulf Coast communities fit that affordable, first-time buyer focus, but their impact on the near term earnings catalyst and current margin risk looks incremental rather than material on their own.

The most relevant recent development alongside these openings is Lennar’s upcoming fourth quarter 2025 earnings release and conference call in mid December. Together, they will give investors a clearer view of how the asset light, high volume strategy is translating into cash flow and profitability at a time when incentives and mortgage buydowns are weighing on margins.

Yet while these new communities look appealing, investors should also be aware of the mounting pressure from incentives on Lennar’s margins and...

Read the full narrative on Lennar (it's free!)

Lennar's narrative projects $40.2 billion revenue and $2.5 billion earnings by 2028.

Uncover how Lennar's forecasts yield a $127.50 fair value, in line with its current price.

Exploring Other Perspectives

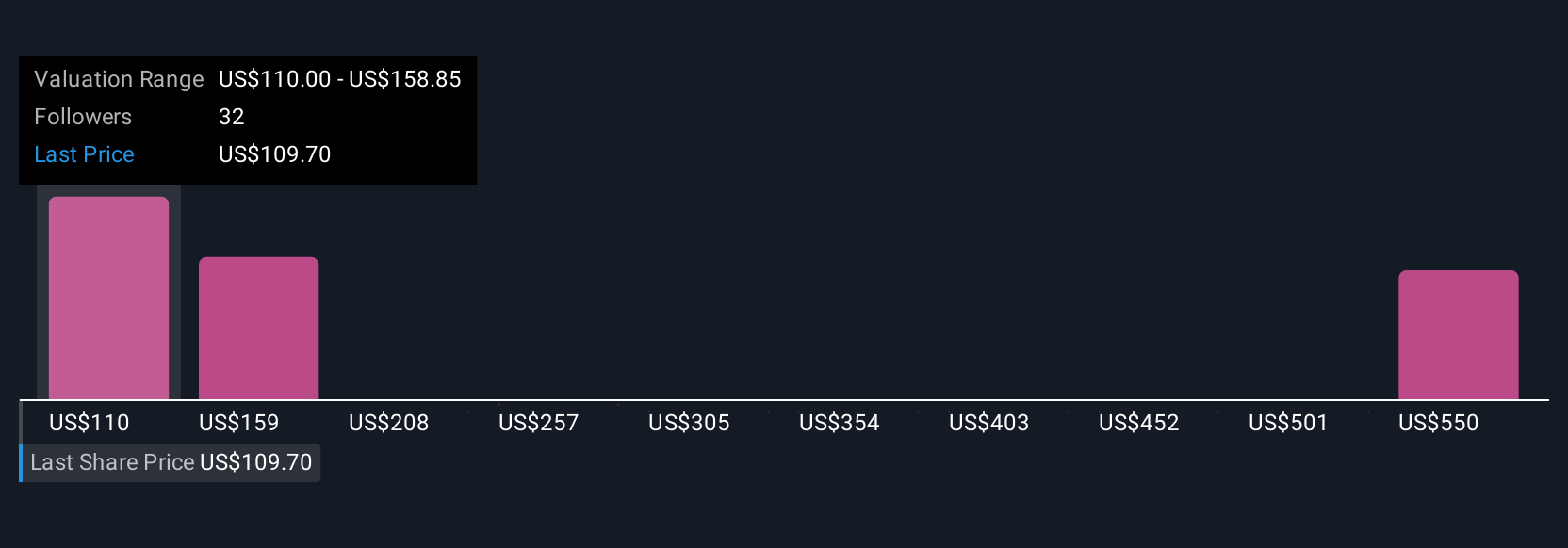

Six fair value estimates from the Simply Wall St Community span roughly US$126.93 to US$189.60, showing how far apart views on Lennar can be. Set that against the current concern that affordability incentives are squeezing margins and you can see why it helps to compare multiple perspectives before forming a view.

Explore 6 other fair value estimates on Lennar - why the stock might be worth just $126.93!

Build Your Own Lennar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lennar research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Lennar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lennar's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LEN

Lennar

Operates as a homebuilder primarily under the Lennar brand in the United States.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026