- United States

- /

- Consumer Durables

- /

- NYSE:LEN

How Berkshire’s Stake and Dividend Move at Lennar (LEN) Are Shaping Its Investment Appeal

Reviewed by Sasha Jovanovic

- Lennar Corporation announced that its Board of Directors declared a quarterly cash dividend of US$0.50 per share for both Class A and Class B common stock, payable on October 27, 2025, to shareholders of record as of October 10, 2025.

- Berkshire Hathaway's significant investment and Lennar's robust shareholder yield have renewed investor interest, highlighting institutional confidence amid ongoing operational and market challenges.

- We’ll examine how Berkshire Hathaway’s new stake and the emphasis on shareholder returns could influence Lennar’s investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Lennar Investment Narrative Recap

To be a shareholder in Lennar, you need confidence in the sustained demand for new homes, efficient execution of its asset-light model, and the company's ability to defend margins even as mortgage rates and housing affordability pose challenges. The recently announced US$0.50 dividend and Berkshire Hathaway’s large investment may signal institutional conviction, but the most important short-term catalyst, Lennar’s volume growth amid supply constraints, appears largely unaffected by these updates, while high mortgage rates remain the primary risk.

Among recent company announcements, the September 18 Q3 earnings report stands out: revenue and net income both declined year over year, despite recent buybacks and community launches. This underscores that Lennar’s ability to drive future growth relies on balancing community expansion with margin management, which remains central to the current investment narrative.

However, investors should be aware that if mortgage rates stay elevated or consumer confidence weakens, Lennar’s margins could come under pressure...

Read the full narrative on Lennar (it's free!)

Lennar's narrative projects $40.2 billion revenue and $2.5 billion earnings by 2028. This requires 4.3% yearly revenue growth and a $0.7 billion decrease in earnings from $3.2 billion today.

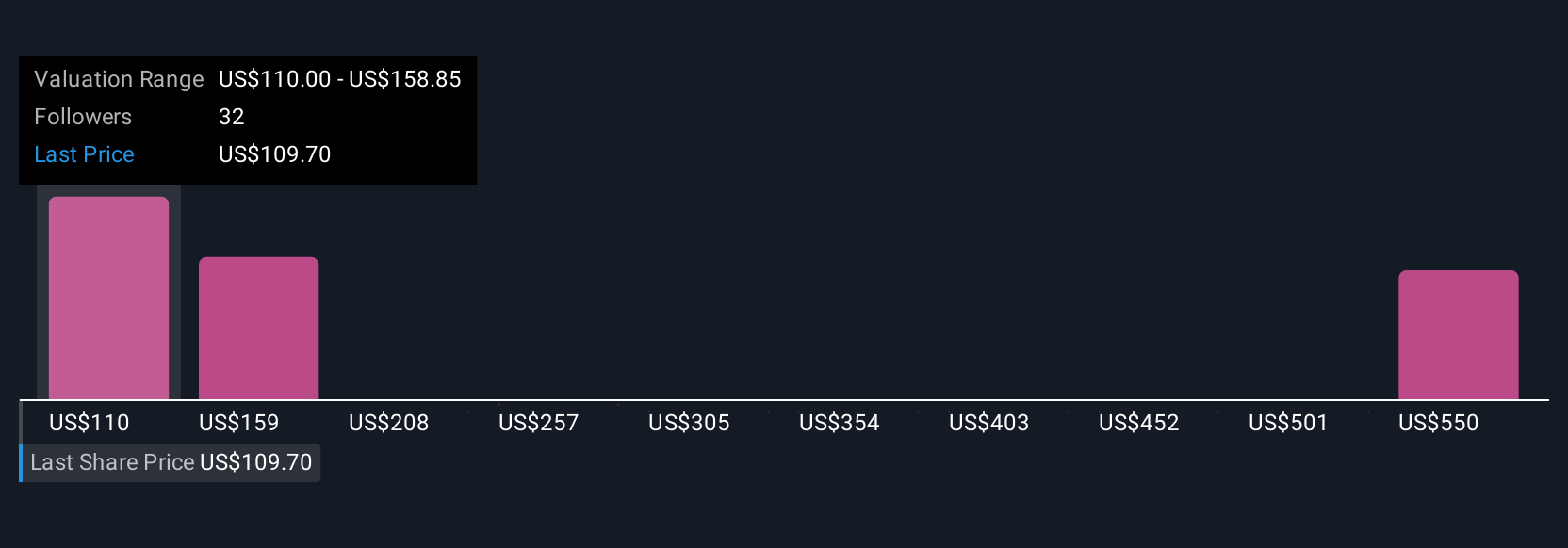

Uncover how Lennar's forecasts yield a $125.43 fair value, a 4% downside to its current price.

Exploring Other Perspectives

Six community fair value estimates for Lennar range from US$125.43 to US$189.60. As you consider these diverse opinions from the Simply Wall St Community, keep in mind that margin pressure from housing affordability remains a key concern shaping the outlook for future performance.

Explore 6 other fair value estimates on Lennar - why the stock might be worth as much as 46% more than the current price!

Build Your Own Lennar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lennar research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Lennar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lennar's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LEN

Lennar

Operates as a homebuilder primarily under the Lennar brand in the United States.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion