- United States

- /

- Consumer Durables

- /

- NYSE:KBH

KB Home (KBH): Revisiting Valuation After a Recent Share Price Rebound

Reviewed by Simply Wall St

KB Home (KBH) has been quietly grinding higher, with the stock up about 9% over the past month after a choppy past year. That move has investors revisiting the homebuilder’s setup.

See our latest analysis for KB Home.

That 1 month share price return of roughly 9% has come after a flat few months and softer housing data, leaving KB Home still modestly higher year to date while its multiyear total shareholder return remains strong. This suggests momentum is rebuilding rather than fading.

If KB Home’s steady climb has you thinking about what else might be gaining traction, this could be a good time to explore fast growing stocks with high insider ownership.

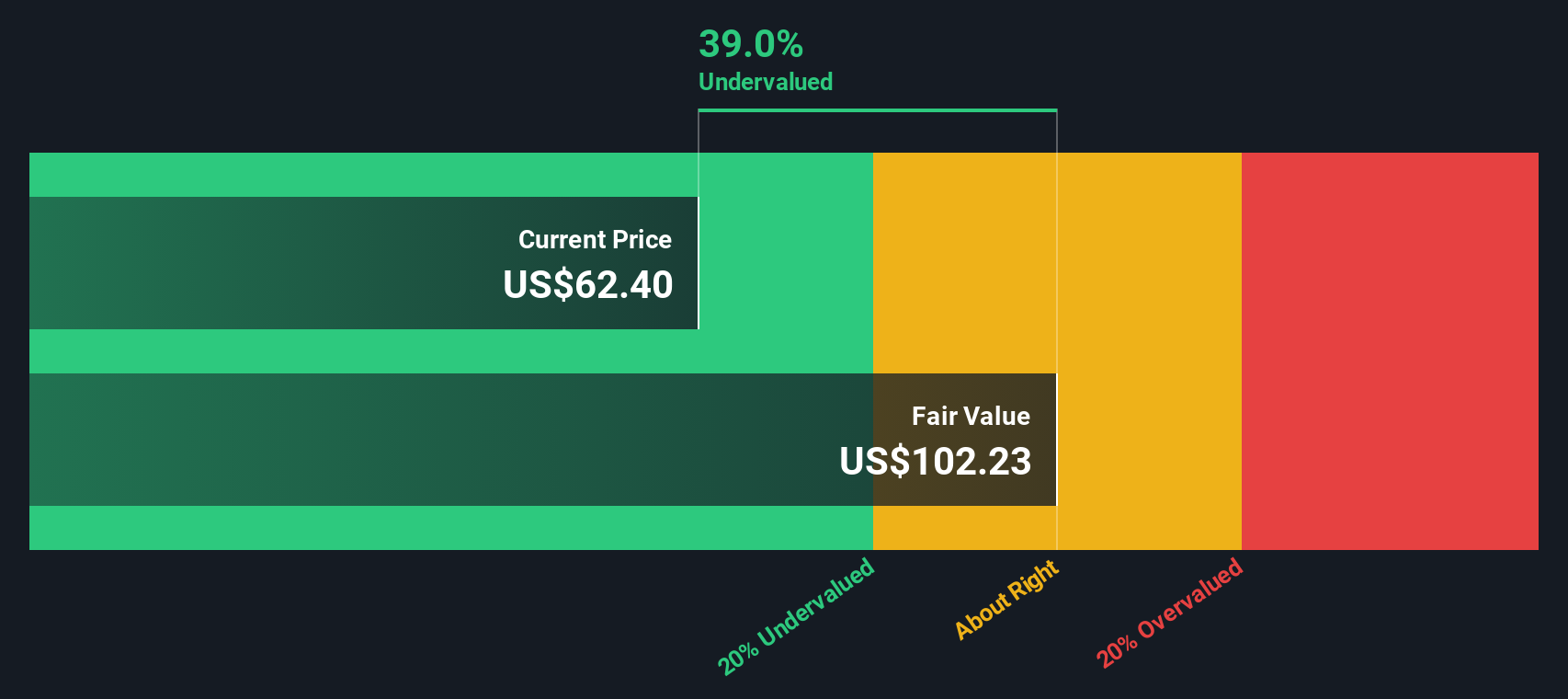

With earnings growth softening and the share price sitting just below analyst targets, the key question now is whether KB Home is quietly undervalued or if the market has already priced in its next leg of growth.

Most Popular Narrative Narrative: 4% Undervalued

With KB Home last closing at $65.55 against a narrative fair value of $68, the story frames a modest upside built on execution rather than breakneck growth.

KB Home is executing a land investment strategy that is increasing their lot position while returning capital to shareholders through share repurchases. This balanced approach aims to enhance earnings growth and shareholder value over the long term.

Want to see how shrinking margins, slower revenues and a richer future earnings multiple still add up to upside potential? Explore the full valuation blueprint behind this call.

Result: Fair Value of $68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer demand and regional pricing pressure, especially in markets like Florida, could undercut margins and challenge the thesis of steady upside.

Find out about the key risks to this KB Home narrative.

Another Angle: Market Price Versus Cash Flow

Our DCF model tells a very different story, suggesting fair value is closer to $46.94, well below the current $65.55 share price. If the cash flow math is right, today’s optimism could already be in the price, leaving less room for error.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out KB Home for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own KB Home Narrative

If you are not fully convinced by this view or would rather dig into the numbers yourself, you can build a fresh perspective in just a few minutes. Do it your way.

A great starting point for your KB Home research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for your next investing move?

Smart investors never stop hunting for the next edge, so use the Simply Wall St Screener now to uncover opportunities you will regret missing later.

- Capture potential mispricings by targeting companies trading below intrinsic value with these 908 undervalued stocks based on cash flows grounded in detailed cash flow analysis.

- Ride structural shifts in healthcare by focusing on innovations powered by these 30 healthcare AI stocks and reshaping patient outcomes and medical efficiency.

- Position yourself early in the digital asset ecosystem by scanning these 80 cryptocurrency and blockchain stocks that are building real businesses around blockchain and decentralized finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if KB Home might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KBH

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)