- United States

- /

- Consumer Durables

- /

- NYSE:GRMN

Should Garmin's (GRMN) AI-Driven Health Partnerships Shift Investor Expectations?

Reviewed by Simply Wall St

- In recent days, Garmin unveiled a wave of new products and partnerships, including smartwatches with advanced health features, collaborations with Meta and Noonan for integrated AI and performance support, and an exclusive research alliance with King's College London for maternal and child health.

- These combined developments highlight Garmin's push to blend data-driven insights, artificial intelligence, and real-world utility in both consumer wearables and digital health research, setting it apart in the rapidly evolving technology landscape.

- We'll explore how Garmin's recent focus on AI-powered health and sports data partnerships could reshape its investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Garmin Investment Narrative Recap

To own Garmin stock today, you need to believe in the company's ability to leverage innovation and data-driven partnerships to fuel steady, diversified growth, particularly through AI-powered wearables and expanded digital health offerings. The recent surge of new product launches and collaborations strengthens Garmin's profile in smart wearables and health tech; however, these announcements are not expected to materially change near-term catalysts like recurring, higher-margin service revenue from Garmin Connect+, nor do they alter key risks such as margin pressure from rising R&D and SG&A expenses or continued weakness in the Marine and Outdoor segments. Garmin’s partnership with Noonan stands out, instantly bringing real-time golf analytics and decision support to users, tapping into the trend of AI enhancements to digital experiences. This is especially relevant alongside the broader product refresh and could play a supporting role in demand for premium subscription services, one of the crucial near-term revenue drivers for the company. But investors should also be aware that higher operating expenses, if not matched by revenue gains, could threaten future margin expansion...

Read the full narrative on Garmin (it's free!)

Garmin's narrative projects $8.5 billion in revenue and $1.8 billion in earnings by 2028. This requires a 7.9% yearly revenue growth and a $0.2 billion earnings increase from $1.6 billion today.

Uncover how Garmin's forecasts yield a $215.00 fair value, a 9% downside to its current price.

Exploring Other Perspectives

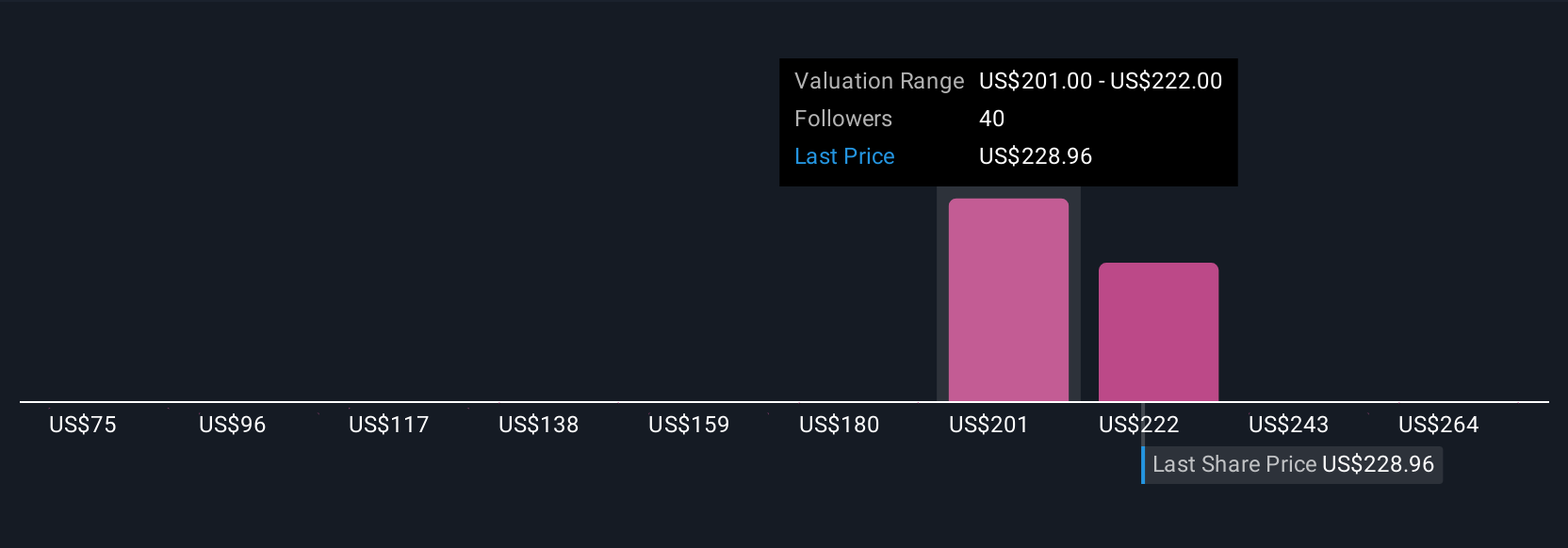

Simply Wall St Community members have set fair value estimates for Garmin from US$119 to US$285, across 10 viewpoints. With expenses on the rise and current revenue growth forecasts moderate, consider how differing views on margin risk may shape your decision.

Explore 10 other fair value estimates on Garmin - why the stock might be worth as much as 20% more than the current price!

Build Your Own Garmin Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Garmin research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Garmin research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Garmin's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GRMN

Garmin

Designs, develops, manufactures, markets, and distributes a range of wireless devices worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives