- United States

- /

- Consumer Durables

- /

- NYSE:GRMN

Garmin's (GRMN) New eTrex Touch Could Be a Game Changer for Outdoor Navigation

Reviewed by Sasha Jovanovic

- In recent weeks, Garmin launched the rugged eTrex Touch GPS handheld navigator, featuring a high-resolution color touchscreen, multi-band GPS accuracy, preloaded TopoActive maps, and up to 130 hours of battery life, targeting outdoor enthusiasts and adventurers.

- This product introduction highlights Garmin’s continued push into premium mapping subscriptions and durable devices designed for demanding outdoor activities.

- We’ll look at how Garmin’s expansion into rugged, feature-rich navigational devices like the eTrex Touch could influence its long-term investment outlook.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Garmin Investment Narrative Recap

To be a shareholder in Garmin, you need to believe in the company’s ability to drive steady growth through product innovation, robust subscription services, and a presence in outdoor, aviation, fitness, and marine technology. The recent launch of the eTrex Touch handheld GPS targets outdoor enthusiasts and strengthens Garmin’s profile in premium, rugged devices, but it does not meaningfully change the most important near-term catalyst, growing recurring, high-margin service revenues, or alter the current primary risk of economic uncertainty affecting demand in its Outdoor segment.

Of the recent announcements, Garmin’s partnership with Meta is most relevant, highlighting its ambition to connect devices for enhanced training experiences and new service revenue streams. This aligns closely with Garmin’s focus on premium subscriptions and supporting future revenue growth, especially as hardware launches like the eTrex Touch aim to attract adventurers who could be long-term subscribers.

However, it’s important to keep in mind that, in contrast, investors should be aware of mounting operating expenses and...

Read the full narrative on Garmin (it's free!)

Garmin's narrative projects $8.5 billion revenue and $1.8 billion earnings by 2028. This requires 7.9% yearly revenue growth and a $0.2 billion earnings increase from $1.6 billion today.

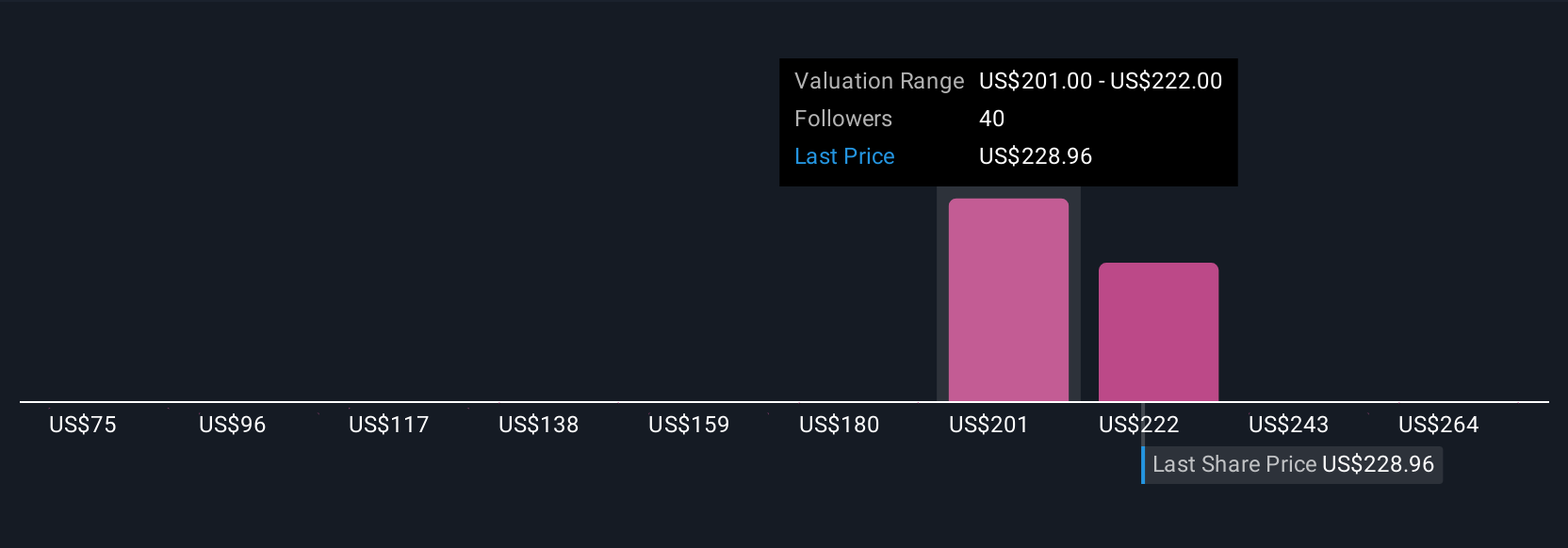

Uncover how Garmin's forecasts yield a $218.33 fair value, a 12% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community contributors estimated Garmin’s fair value between US$119 and US$285 (across nine perspectives), highlighting significant differences in outlook. With economic uncertainty and Outdoor segment demand at risk, many readers may want to review these community estimates for alternative viewpoints on Garmin’s prospects.

Explore 9 other fair value estimates on Garmin - why the stock might be worth as much as 15% more than the current price!

Build Your Own Garmin Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Garmin research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Garmin research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Garmin's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GRMN

Garmin

Designs, develops, manufactures, markets, and distributes a range of wireless devices worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives