- United States

- /

- Luxury

- /

- NYSE:FIGS

Can FIGS (FIGS) Global Campaign Deepen Its Brand Loyalty and Drive Sustainable International Growth?

Reviewed by Simply Wall St

- FIGS recently launched its 'Where Do You Wear FIGS' global campaign, spotlighting real healthcare professionals in Tokyo, London, Mexico City, and Los Angeles to celebrate their rituals and human connections across cultures.

- This campaign underscores FIGS’ commitment to empowering healthcare providers worldwide and highlights its efforts to strengthen brand recognition in international markets.

- We'll assess how the campaign’s emphasis on global healthcare communities may influence FIGS' long-term international growth prospects.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

FIGS Investment Narrative Recap

To own FIGS stock, you need confidence in the company’s ability to grow its premium medical apparel brand, expand internationally, and efficiently execute its direct-to-consumer strategy amid risks such as global tariff headwinds, competition, and execution around inventory and new markets. The newly launched 'Where Do You Wear FIGS' global campaign appears aligned with international expansion efforts, but its immediate impact on topline revenue or margin risk is likely immaterial for now, given existing tariff and competition challenges are more pressing as short-term catalysts and risks.

Among FIGS’ recent updates, the expansion of its Community Hubs, physical retail locations designed for healthcare professionals, stands out. This complements the focus of the global campaign by deepening brand relevance in key cities, potentially supporting international customer acquisition, yet the backdrop of measured growth and competitive pressures remains a bigger influence on near-term performance.

In contrast, the risk from persistent tariff pressures, impacting much of FIGS’ cost of goods sold, remains a concern that investors should be aware of as...

Read the full narrative on FIGS (it's free!)

FIGS' narrative projects $656.8 million revenue and $37.0 million earnings by 2028. This requires 4.9% yearly revenue growth and a $29.8 million earnings increase from $7.2 million today.

Uncover how FIGS' forecasts yield a $6.42 fair value, a 7% downside to its current price.

Exploring Other Perspectives

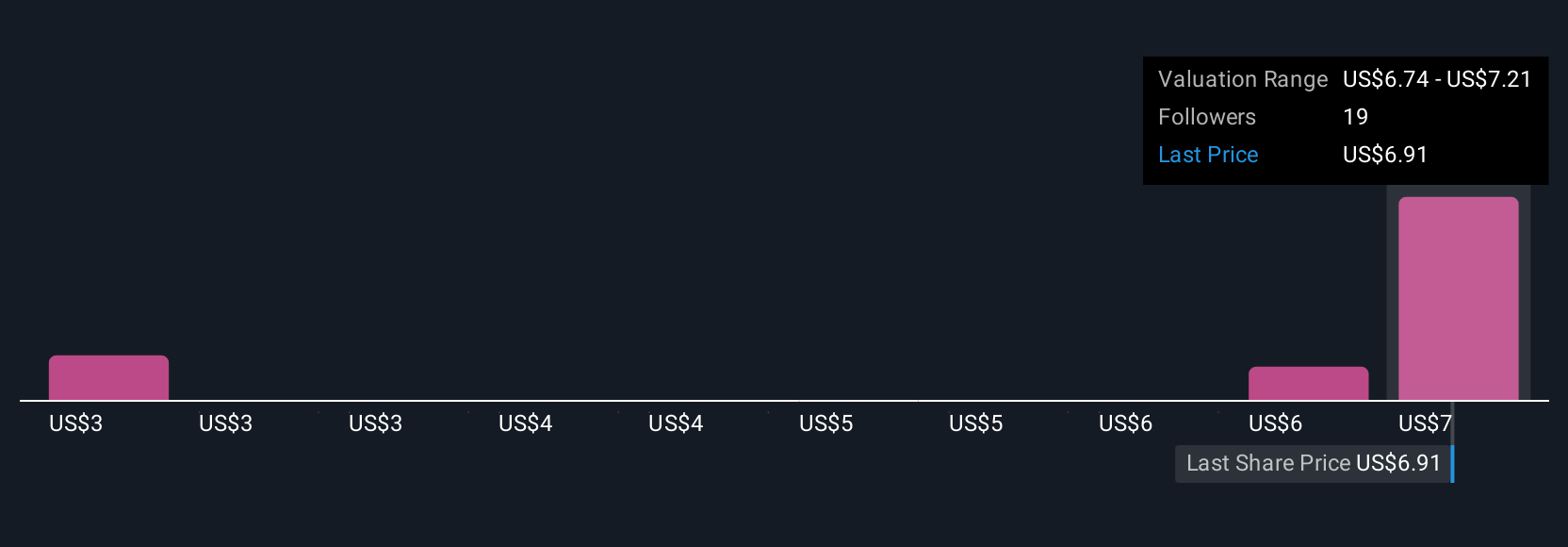

Simply Wall St Community members submitted four fair value estimates for FIGS ranging from US$2.51 to US$7.21 per share. These diverse views underscore how persistent tariff headwinds and intense sector competition can lead to very different expectations for the company’s future performance.

Explore 4 other fair value estimates on FIGS - why the stock might be worth as much as $7.21!

Build Your Own FIGS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FIGS research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free FIGS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FIGS' overall financial health at a glance.

No Opportunity In FIGS?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIGS

FIGS

Together with its subsidiary, FIGS Canada, Inc., operates as a direct-to-consumer healthcare apparel and lifestyle company in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives