- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:SPTN

Top US Dividend Stocks For January 2025

Reviewed by Simply Wall St

As January 2025 unfolds, the U.S. stock market has been marked by a broad-based rally, with major indices like the Dow Jones Industrial Average and S&P 500 posting gains as investors digest a wave of earnings reports amidst ongoing economic evaluations. In this dynamic environment, dividend stocks continue to attract attention for their potential to provide steady income streams, making them appealing choices for those looking to balance growth with income amid fluctuating market conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.14% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.60% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.91% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.58% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.52% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Farmers National Banc (NasdaqCM:FMNB) | 4.86% | ★★★★★★ |

| CompX International (NYSEAM:CIX) | 4.68% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.61% | ★★★★★★ |

| Ennis (NYSE:EBF) | 4.83% | ★★★★★★ |

Click here to see the full list of 132 stocks from our Top US Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

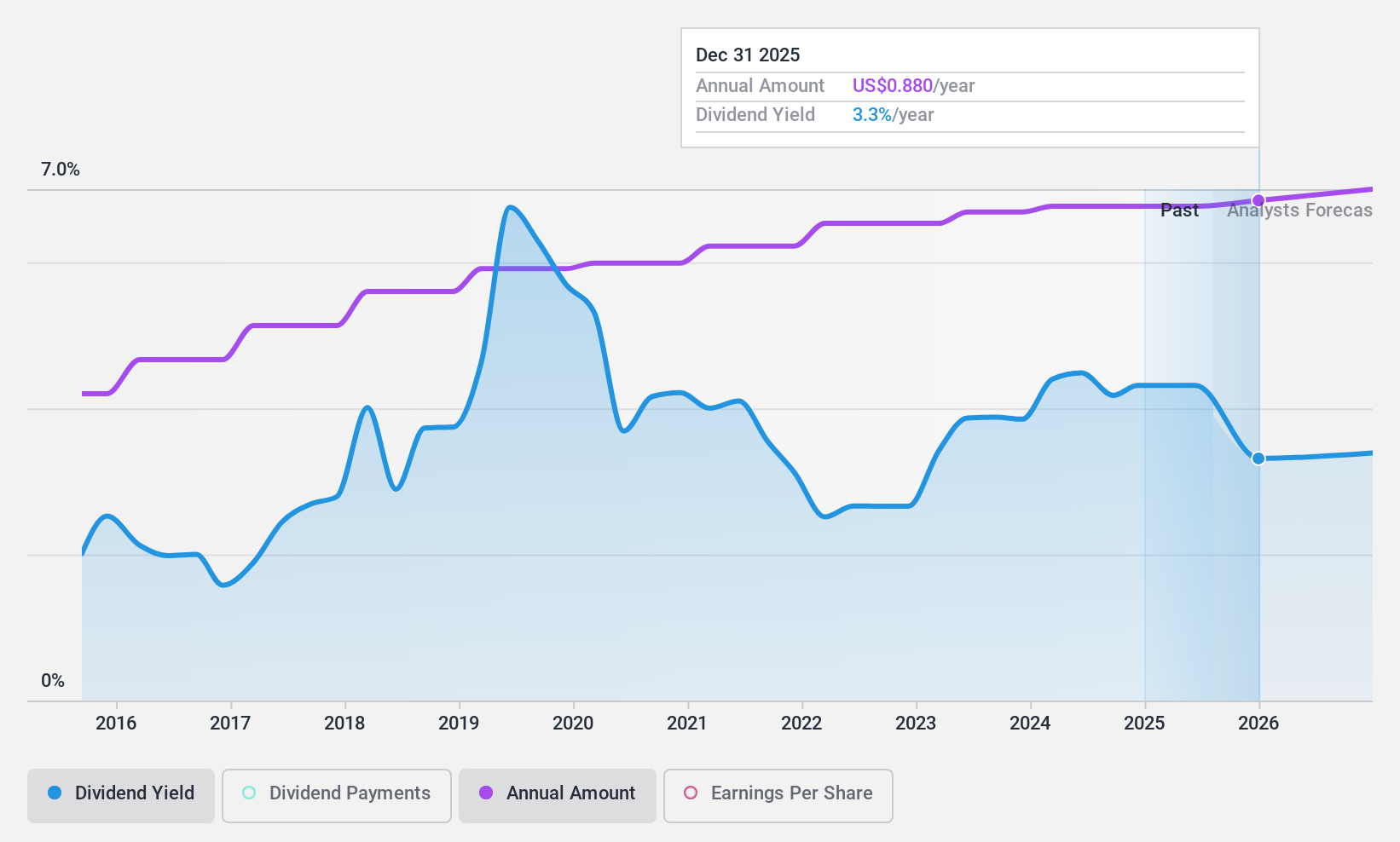

SpartanNash (NasdaqGS:SPTN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SpartanNash Company distributes and retails grocery products in the United States, with a market cap of approximately $623.11 million.

Operations: SpartanNash generates revenue through its Retail segment, which accounts for $2.79 billion, and its Wholesale segment, contributing $7.93 billion.

Dividend Yield: 4.7%

SpartanNash has maintained stable and reliable dividends over the past decade, with recent affirmations of a quarterly dividend of US$0.2175 per share. Its dividend yield ranks in the top 25% among U.S. payers but is not fully covered by free cash flows, raising sustainability concerns. Despite trading below estimated fair value, its financial position shows debt coverage issues by operating cash flow. Recent leadership changes may impact future strategic direction and performance.

- Delve into the full analysis dividend report here for a deeper understanding of SpartanNash.

- Our expertly prepared valuation report SpartanNash implies its share price may be lower than expected.

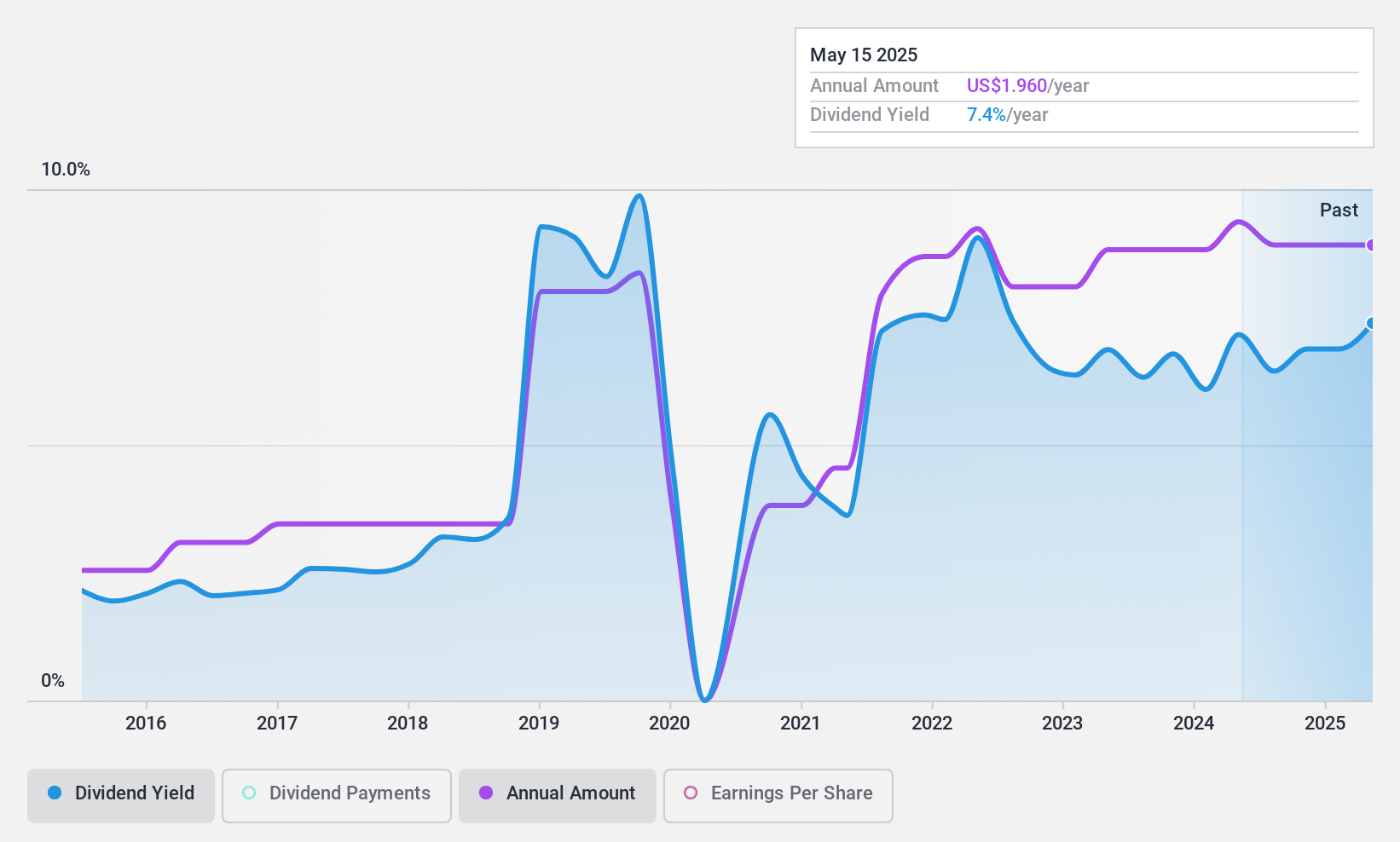

Ethan Allen Interiors (NYSE:ETD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ethan Allen Interiors Inc. is an interior design company that manufactures and retails home furnishings both in the United States and internationally, with a market cap of approximately $726.53 million.

Operations: Ethan Allen Interiors Inc. generates revenue through its operations as a manufacturer and retailer of home furnishings, providing interior design services in both domestic and international markets.

Dividend Yield: 6.2%

Ethan Allen Interiors offers a dividend yield in the top 25% of U.S. payers, supported by earnings with a payout ratio of 61.4%. However, its dividend history has been volatile over the past decade. Recent earnings showed decreased sales and net income compared to last year, but dividends remain covered by cash flows with a cash payout ratio of 76.8%. The company recently declared a quarterly dividend of US$0.39 per share, affirming its commitment to shareholder returns despite mixed financial performance.

- Take a closer look at Ethan Allen Interiors' potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Ethan Allen Interiors is priced lower than what may be justified by its financials.

Coca-Cola FEMSA. de (NYSE:KOF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Coca-Cola FEMSA, S.A.B. de C.V., a franchise bottler, operates by producing, marketing, selling, and distributing Coca-Cola trademark beverages across several Latin American countries including Mexico and Brazil with a market cap of approximately $16.59 billion.

Operations: Coca-Cola FEMSA's revenue primarily comes from its Non-Alcoholic Beverages segment, which generated MX$267.59 billion.

Dividend Yield: 3.7%

Coca-Cola FEMSA's dividend yield of 3.7% is lower than the top 25% in the U.S., yet it maintains reliability with stable and growing dividends over the past decade. The payout ratio of 58.7% indicates earnings coverage, while a cash payout ratio of 65.9% shows sustainability through cash flows. Trading at significant value below estimated fair value, KOF's stock price has potential upside according to analysts' consensus expectations for growth.

- Unlock comprehensive insights into our analysis of Coca-Cola FEMSA. de stock in this dividend report.

- The analysis detailed in our Coca-Cola FEMSA. de valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Get an in-depth perspective on all 132 Top US Dividend Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SPTN

SpartanNash

A food solutions company, engages in the distribution and retail sale of grocery products in the United States of America.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives