- United States

- /

- Consumer Durables

- /

- NYSE:ETD

Top Dividend Stocks To Consider In December 2025

Reviewed by Simply Wall St

As the U.S. stock markets conclude a robust week, with major indexes like the S&P 500 and Dow Jones Industrial Average extending their winning streaks, investors continue to navigate an evolving landscape marked by fluctuating tech performances and strong retail gains. Amidst this backdrop, dividend stocks stand out as a compelling option for those seeking steady income streams, particularly in times of market volatility when consistent returns can provide a measure of stability.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 5.01% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.53% | ★★★★★★ |

| PCB Bancorp (PCB) | 3.68% | ★★★★★☆ |

| OTC Markets Group (OTCM) | 4.77% | ★★★★★★ |

| Heritage Commerce (HTBK) | 4.78% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.72% | ★★★★★★ |

| Farmers National Banc (FMNB) | 5.00% | ★★★★★★ |

| Ennis (EBF) | 5.73% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.19% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.56% | ★★★★★★ |

Click here to see the full list of 124 stocks from our Top US Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

First Community Bankshares (FCBC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: First Community Bankshares, Inc. serves as the financial holding company for First Community Bank, offering a range of banking products and services with a market cap of $612.08 million.

Operations: First Community Bankshares, Inc. generates revenue primarily through its Community Banking segment, which accounts for $164.26 million.

Dividend Yield: 3.7%

First Community Bankshares offers a stable dividend profile with a payout ratio of 46%, ensuring dividends are well covered by earnings. The company has consistently increased its dividends over the past decade, although its yield of 3.71% is below the top tier in the US market. Recent earnings showed slight declines, but dividends remain reliable and supported by ongoing profitability. The stock trades at a discount to estimated fair value, potentially offering good value for investors seeking steady income.

- Click here and access our complete dividend analysis report to understand the dynamics of First Community Bankshares.

- Our valuation report here indicates First Community Bankshares may be overvalued.

Ethan Allen Interiors (ETD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ethan Allen Interiors Inc. is an interior design company that manufactures and retails home furnishings both in the United States and internationally, with a market cap of $601.55 million.

Operations: Ethan Allen Interiors Inc.'s revenue is derived from its Retail segment, which generated $518.95 million, and its Wholesale segment, contributing $359.96 million.

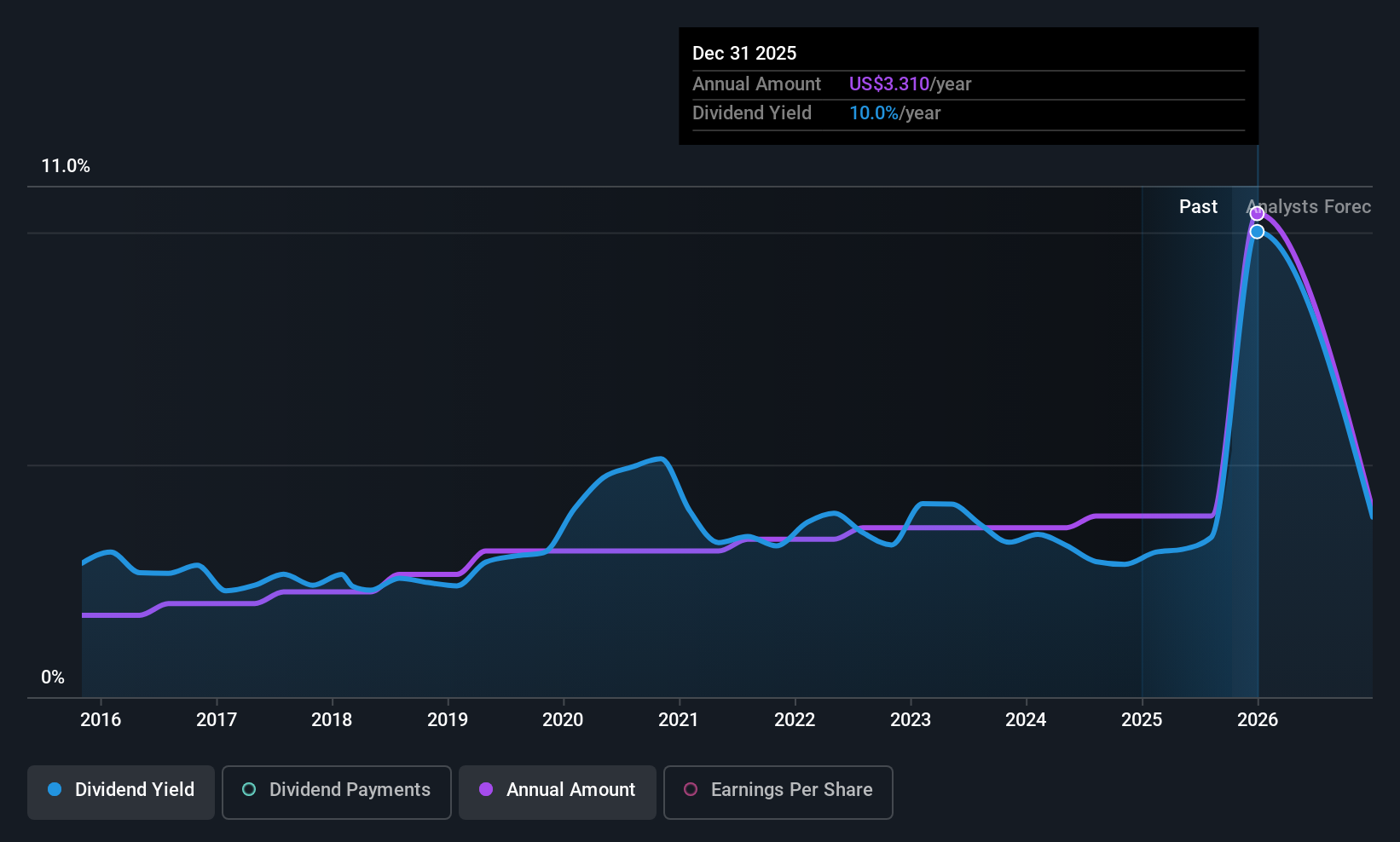

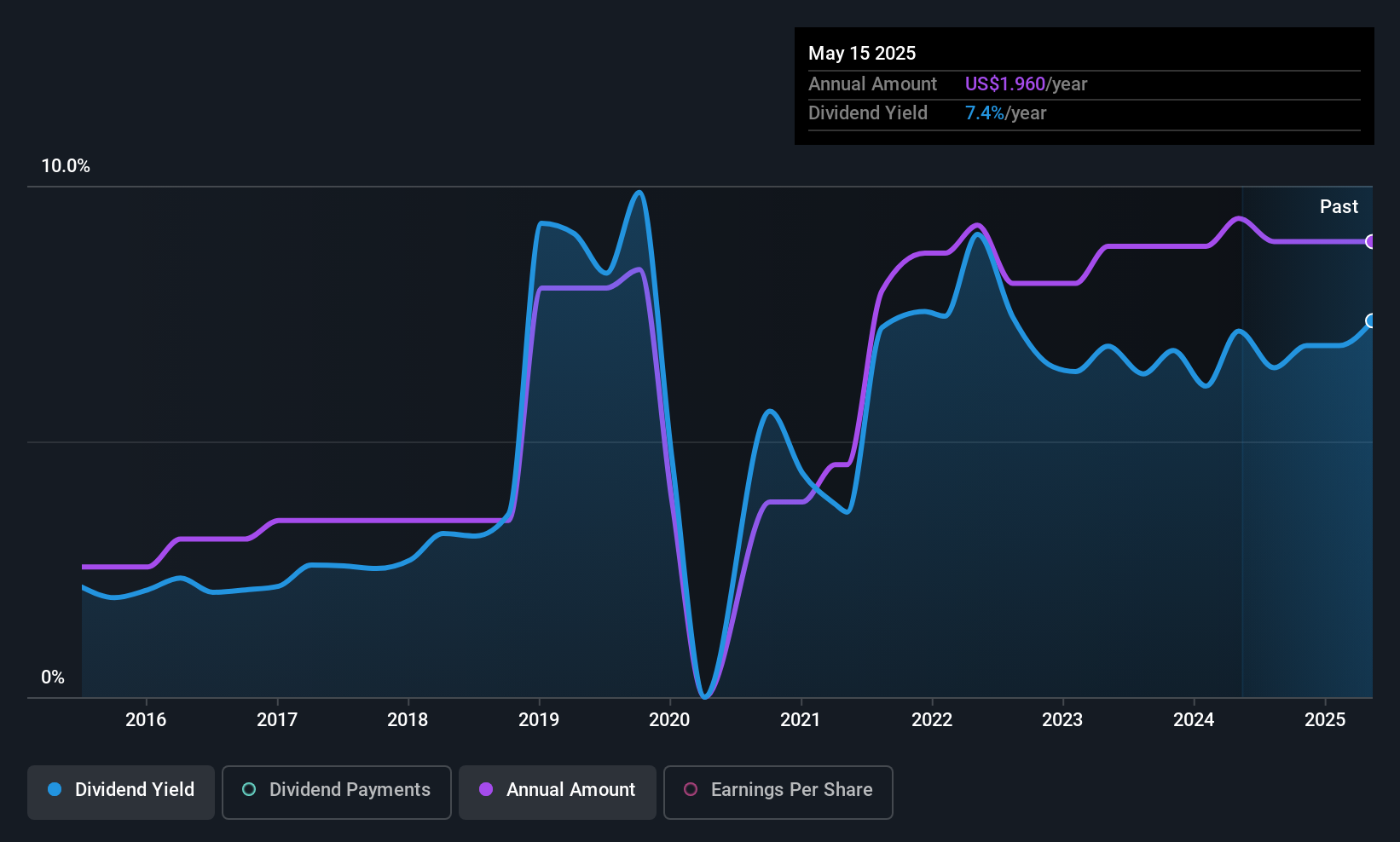

Dividend Yield: 7.7%

Ethan Allen Interiors declared a US$0.39 quarterly dividend, reflecting its high yield in the top 25% of U.S. dividend payers. While dividends have grown over the past decade, their stability has been volatile and unreliable. The payout is covered by earnings and cash flows, with respective ratios at 84.2% and 86.3%. Recent earnings showed declines with sales at US$146.98 million and net income at US$10.45 million, highlighting potential challenges in sustaining dividends long-term without growth improvements.

- Navigate through the intricacies of Ethan Allen Interiors with our comprehensive dividend report here.

- Our expertly prepared valuation report Ethan Allen Interiors implies its share price may be too high.

Watsco (WSO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Watsco, Inc. distributes air conditioning, heating, and refrigeration equipment along with related parts and supplies across the United States, Canada, Latin America, and the Caribbean with a market cap of $13.17 billion.

Operations: Watsco's revenue segment includes wholesale electronics, generating $7.41 billion.

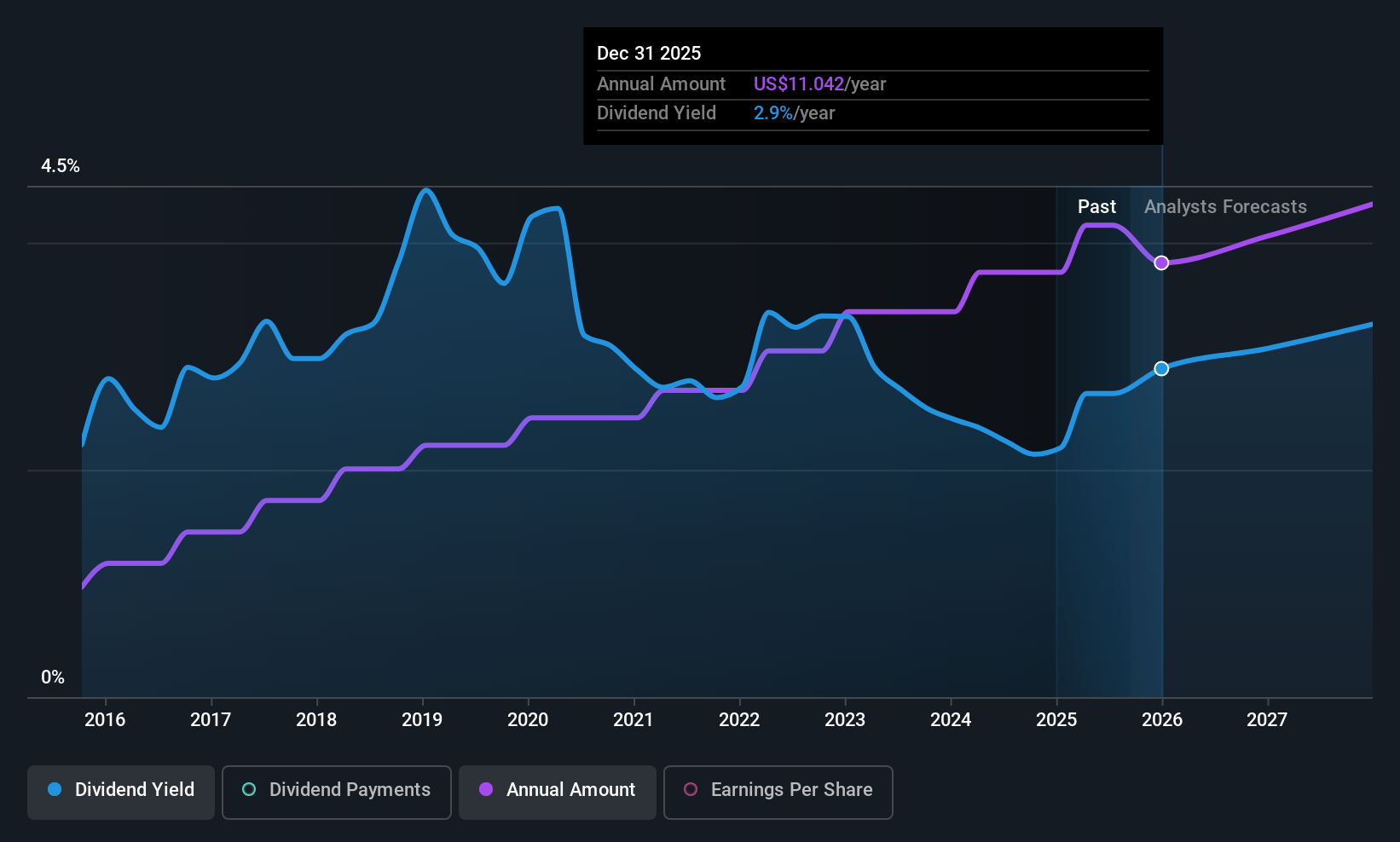

Dividend Yield: 3.5%

Watsco's dividend, yielding 3.46%, is reliable and has grown steadily over the past decade, though it remains below the top 25% of U.S. payers. The payout ratio stands at 88.4%, covered by earnings and cash flows, indicating sustainability despite recent declines in sales and net income for Q3 2025 to US$2.07 billion and US$161.58 million respectively. Earnings are projected to grow annually by 7.93%, supporting future dividend stability and growth potential.

- Click to explore a detailed breakdown of our findings in Watsco's dividend report.

- Our comprehensive valuation report raises the possibility that Watsco is priced higher than what may be justified by its financials.

Key Takeaways

- Navigate through the entire inventory of 124 Top US Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ethan Allen Interiors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETD

Ethan Allen Interiors

Operates as an interior design company, and manufacturer and retailer of home furnishings in the United States and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026