- United States

- /

- Consumer Durables

- /

- NYSE:DHI

D.R. Horton (DHI): Assessing Value After Strong Earnings Beat and Upgraded Full-Year Guidance

Reviewed by Simply Wall St

Anyone watching D.R. Horton (DHI) lately has probably noticed the stock catching a strong updraft after the company’s most recent earnings release. D.R. Horton not only beat expectations for revenue, operating income, and EPS, it also raised its full-year guidance. This combination tends to attract significant attention. Investors saw management demonstrate its confidence by returning $1.3 billion to shareholders through buybacks and dividends, all while navigating the challenges in today’s housing market.

The stock has certainly benefited from these developments, climbing nearly 24% since the earnings announcement and continuing a rally that has extended over the past few months. That said, the ride has not been perfectly smooth. There has been some hesitance in the broader market as traders anticipate signals from the Federal Reserve and analyze updates on the housing industry. Still, D.R. Horton’s ongoing share repurchases, along with improved financial results and liquidity, send a confident message that is difficult to overlook.

With all of this considered, the question now is whether D.R. Horton’s impressive performance still leaves room for value, or if the recent momentum indicates the market is already accounting for future growth.

Most Popular Narrative: 7.4% Overvalued

According to the community narrative, D.R. Horton is considered slightly overvalued relative to its fair value calculation. The analysis weighs both strong operating trends and sector headwinds to arrive at this assessment, blending current financials with forecasts.

Vertically integrated operations, including strong relationships with lot development partners like Forestar, internal mortgage financing, and a focus on operational efficiencies, allow D.R. Horton to control costs, improve inventory turnover, and protect or enhance gross and net margins compared to less integrated competitors.

Want to know why analysts think D.R. Horton's future profits might not fully justify the current price? This narrative packs in surprising sector forecasts with a twist on projected earnings and margin moves. The full story behind these numbers could change your outlook on what comes next for D.R. Horton.

Result: Fair Value of $158.93 (OVERVALUE)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising sales incentives and ongoing affordability pressures could weigh on margins and challenge D.R. Horton's ability to maintain recent performance.

Find out about the key risks to this D.R. Horton narrative.Another View: DCF Suggests a Different Story

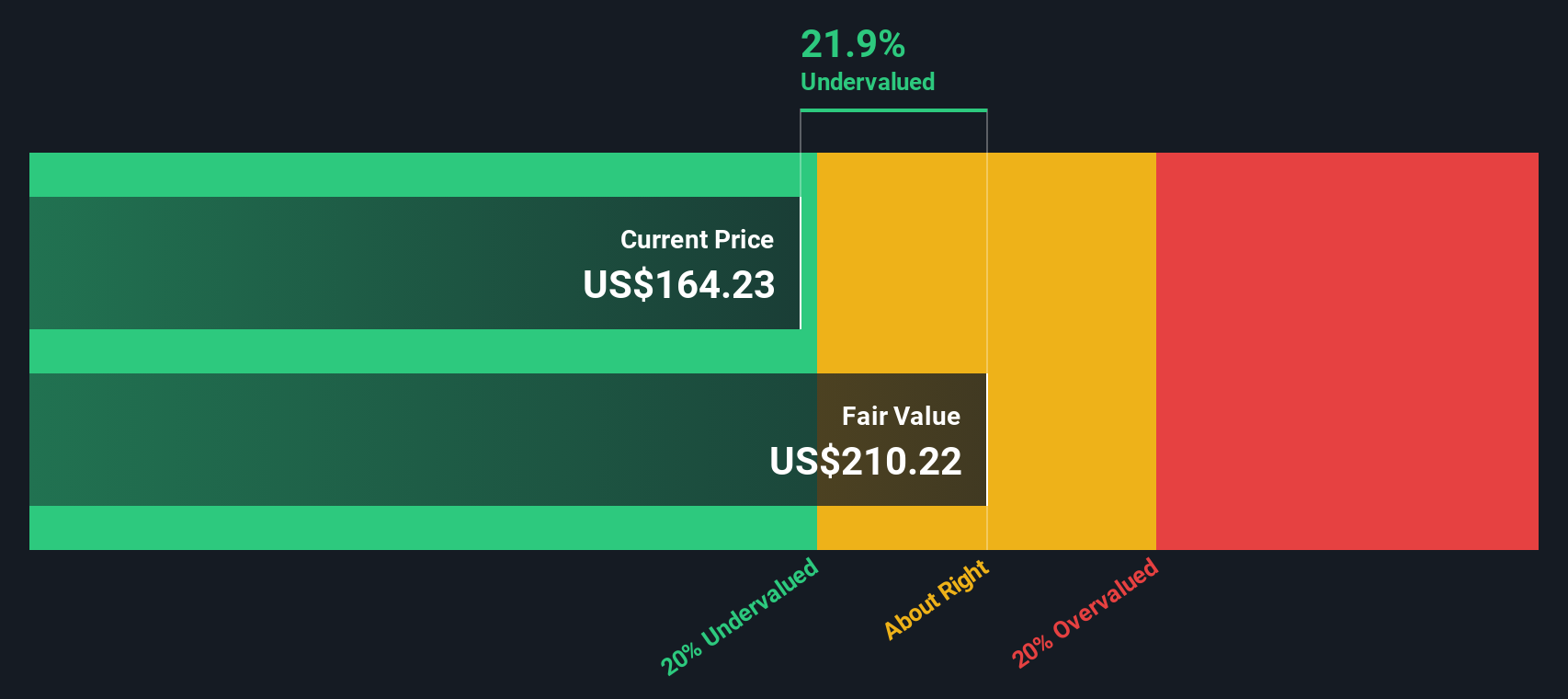

While traditional valuation points to D.R. Horton being a bit expensive right now, the SWS DCF model offers a starkly different take. This model indicates the stock may actually be undervalued. So, which method deserves more weight?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own D.R. Horton Narrative

If you want to dig into the numbers yourself and reach your own conclusions, it's easy to explore and develop a unique perspective in just a few minutes. So why not do it your way?

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding D.R. Horton.

Looking for More Compelling Investment Ideas?

Smart investors never settle for just one opportunity. There are plenty of game-changing stocks available, and the right strategy can help you stay ahead of the market. Make the most of your next move by exploring these stand-out investment screens, which could serve as your shortcut to confident decisions and greater rewards:

- Unlock the potential of breakthrough medical tech with healthcare AI stocks, which connects you to healthcare innovators using artificial intelligence to transform patient care and diagnostics.

- Get ahead of the next tech wave by checking out quantum computing stocks, where trailblazing companies are tackling quantum computing projects that could redefine entire industries.

- Strengthen your portfolio with dividend stocks with yields > 3%, providing access to stocks delivering yields over 3 percent and a solid record of rewarding shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DHI

D.R. Horton

Operates as a homebuilding company in East, North, Southeast, South Central, Southwest, and Northwest regions in the United States.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives