- United States

- /

- Luxury

- /

- NYSE:DECK

Does HOKA’s Surge Among Affluent Women Mark a New Phase for Deckers Outdoor (DECK)?

Reviewed by Sasha Jovanovic

- Earlier this week, Deckers Outdoor reported first quarter revenues up 16.9% year over year, driven by robust growth from its HOKA and UGG brands that exceeded analyst expectations by 7.2%.

- An intriguing detail from the report is HOKA’s accelerating brand appeal among affluent female consumers, with notable positioning gains in the running sneaker category.

- We'll explore the impact of HOKA’s strong brand performance on Deckers Outdoor's previously established investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Deckers Outdoor Investment Narrative Recap

Being a shareholder in Deckers Outdoor means backing continued demand for its premium brands, especially HOKA and UGG, and trusting in their ability to sustain brand strength amid changing consumer patterns. The latest Q1 results reinforce the importance of HOKA’s rising popularity; however, despite sales beating expectations, a short-term catalyst like brand momentum is not meaningfully changed, nor is the biggest current risk, margin pressure from a more promotional retail environment. Amid strong quarterly earnings growth, the company’s increased buyback authorization in May 2025 stands out. This move follows ongoing share repurchases and communicates confidence in the underlying business, even as the market frets over near-term pressures like discounting and inventory closeouts. Yet, before assuming Deckers is immune, keep in mind that...»

Read the full narrative on Deckers Outdoor (it's free!)

Deckers Outdoor's outlook anticipates $6.5 billion in revenue and $1.1 billion in earnings by 2028. This assumes annual revenue growth of 8.5% and an earnings increase of about $110 million from current earnings of $989.7 million.

Uncover how Deckers Outdoor's forecasts yield a $126.77 fair value, a 27% upside to its current price.

Exploring Other Perspectives

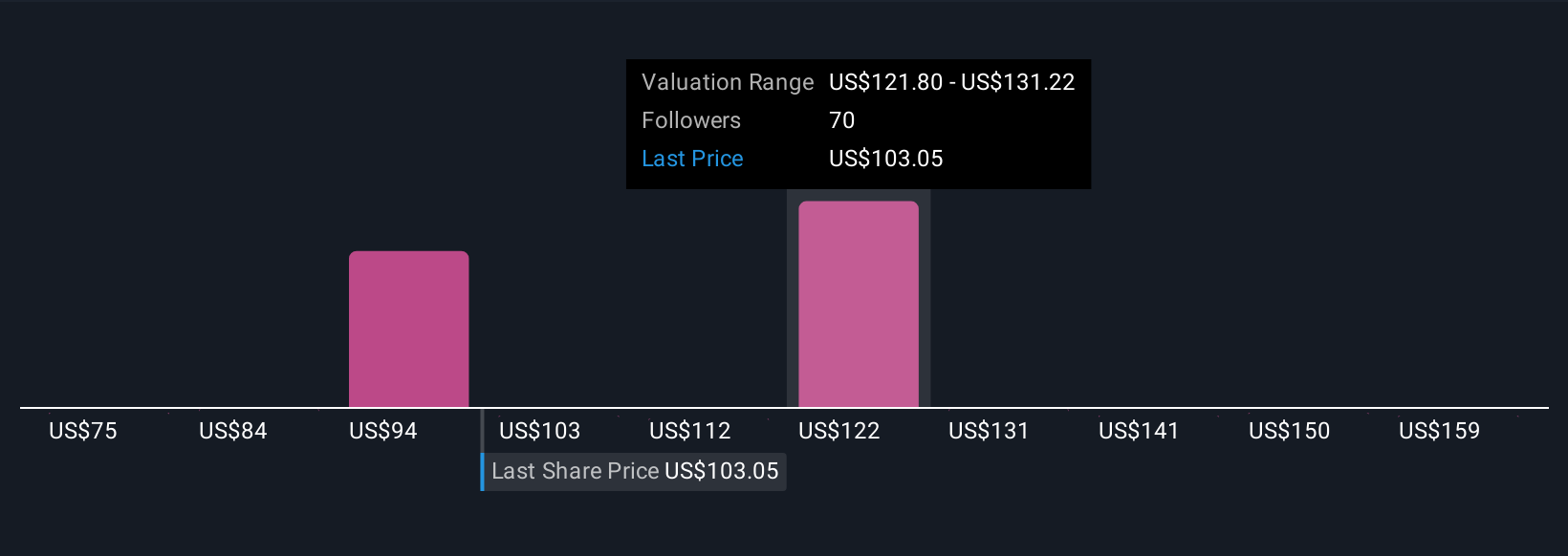

Fair value estimates from 21 Simply Wall St Community members for Deckers Outdoor range widely, from US$74.68 to US$168.91 per share. While many see brand-driven growth potential, others spotlight possible pressure from a rising promotional retail environment, underlining why careful due diligence can shape different outlooks.

Explore 21 other fair value estimates on Deckers Outdoor - why the stock might be worth as much as 69% more than the current price!

Build Your Own Deckers Outdoor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Deckers Outdoor research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Deckers Outdoor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Deckers Outdoor's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DECK

Deckers Outdoor

Designs, markets, and distributes footwear, apparel, and accessories for casual lifestyle use and high-performance activities in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives