- United States

- /

- Luxury

- /

- NYSE:DECK

Does Deckers Outdoor's (DECK) Aggressive Buyback Reflect Long-Term Confidence or Mask Competitive Pressures?

Reviewed by Sasha Jovanovic

- Deckers Outdoor recently completed the repurchase of nearly 1.87 million shares, covering more than a quarter of its ongoing buyback program, amid revised analyst valuations and continued debates about sales momentum and rising competitive risks.

- This buyback activity signals management's confidence in the company’s long-term value even as some analysts voice concerns about slowing growth for key brands and intensified industry rivalry.

- We'll explore how recent share buybacks, reflecting management's optimism, might influence Deckers Outdoor's global growth-focused investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Deckers Outdoor Investment Narrative Recap

To be a shareholder in Deckers Outdoor, you need to be comfortable with the company’s reliance on the ongoing momentum of its HOKA and UGG brands, international expansion, and direct-to-consumer growth. The recent sizable share buybacks reinforce management’s confidence, but do not materially impact the most important short-term catalyst: quarterly earnings from core brand sales; the biggest near-term risk remains intensifying competition, especially within the athletic footwear segment.

The most relevant recent announcement is the buyback of nearly 1.87 million shares for US$203.98 million, a move that reflects Deckers Outdoor’s commitment to capital allocation amid changing market valuations. While this financial action sends a positive signal, it does not mitigate ongoing competitive risk, which could weigh on sales momentum for flagship brands in future quarters.

Yet, despite share buybacks and management optimism, investors should be aware that...

Read the full narrative on Deckers Outdoor (it's free!)

Deckers Outdoor's narrative projects $6.5 billion revenue and $1.1 billion earnings by 2028. This requires 8.5% yearly revenue growth and a $110 million earnings increase from $989.7 million.

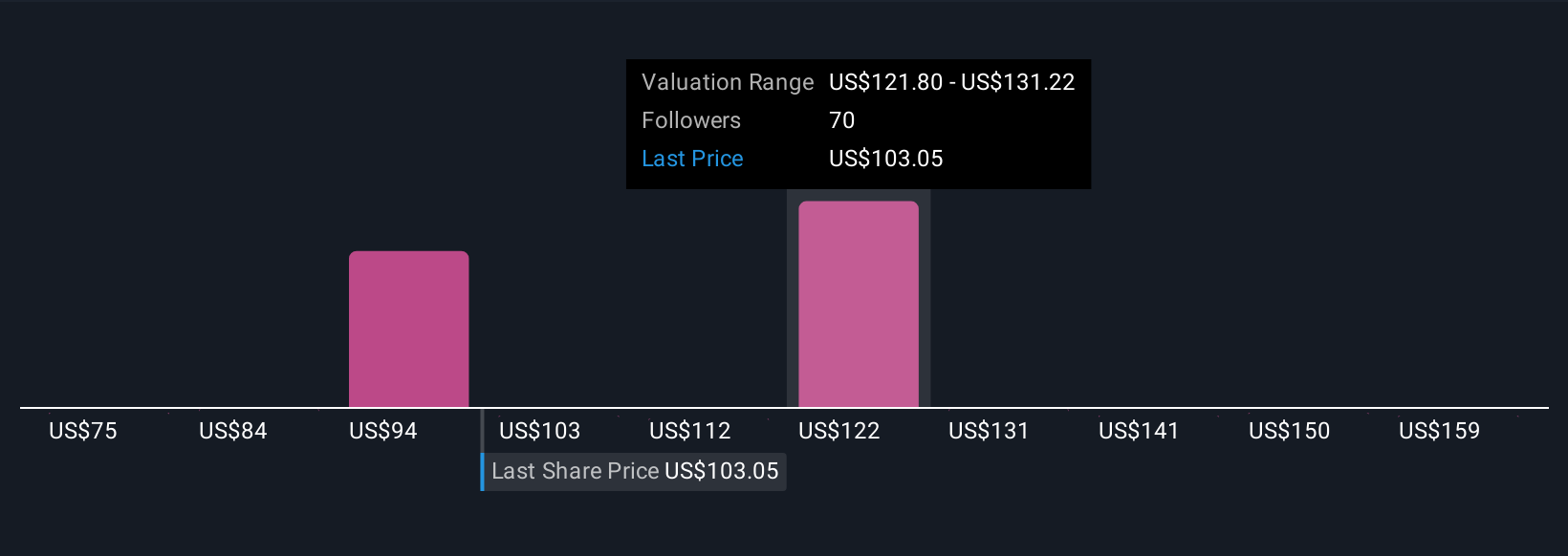

Uncover how Deckers Outdoor's forecasts yield a $126.77 fair value, a 33% upside to its current price.

Exploring Other Perspectives

Fair value estimates from 21 Simply Wall St Community contributors span US$74.68 to US$168.91 per share. Although optimism about new product launches prevails among many, growing competitive risks could shift expectations, consider these diverse views before making up your mind.

Explore 21 other fair value estimates on Deckers Outdoor - why the stock might be worth 21% less than the current price!

Build Your Own Deckers Outdoor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Deckers Outdoor research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Deckers Outdoor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Deckers Outdoor's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DECK

Deckers Outdoor

Designs, markets, and distributes footwear, apparel, and accessories for casual lifestyle use and high-performance activities in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives