- United States

- /

- Luxury

- /

- NYSE:DECK

Analyst Upgrades and Raised Earnings Estimates Could Be a Game Changer for Deckers Outdoor (DECK)

Reviewed by Sasha Jovanovic

- In recent weeks, Deckers Outdoor experienced heavy selling and entered oversold territory, but analyst sentiment has shifted positively, with raised earnings estimates and consensus expectations for another earnings beat.

- This change in analyst outlook comes after Deckers consistently surpassed revenue and earnings expectations over the last four quarters, and as its HOKA and UGG brands continue to benefit from strong global demand and investments in marketing and digital infrastructure.

- We’ll explore how fresh analyst optimism, fueled by upgraded earnings estimates despite recent selling pressure, could influence Deckers Outdoor’s investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Deckers Outdoor Investment Narrative Recap

To own shares of Deckers Outdoor, you need to believe in the strength and broad appeal of the HOKA and UGG brands to keep driving revenue and profit growth, fueled by product innovation and digital expansion. The recent shift in analyst sentiment and raised earnings estimates may encourage short-term optimism, but the biggest risk remains a potentially more promotional environment that could pressure margins if discounting becomes necessary; the news of positive earnings expectations does not materially alter this risk right now.

One of the most relevant recent announcements is the company’s robust Q1 results, which featured a year-over-year revenue increase to US$964.54 million and a sharp earnings per share jump. This performance builds on the positive momentum that analysts are leaning on, highlighting the importance of Deckers’ ability to maintain strong gross margin levels even if consumer demand cools or inventory management requires adjustments.

However, the possibility of increased discounting and closeouts in upcoming quarters is something all investors should be aware of, especially...

Read the full narrative on Deckers Outdoor (it's free!)

Deckers Outdoor's outlook anticipates $6.5 billion in revenue and $1.1 billion in earnings by 2028. This is based on an assumed 8.5% annual revenue growth and an earnings increase of about $110 million from the current earnings of $989.7 million.

Uncover how Deckers Outdoor's forecasts yield a $129.28 fair value, a 25% upside to its current price.

Exploring Other Perspectives

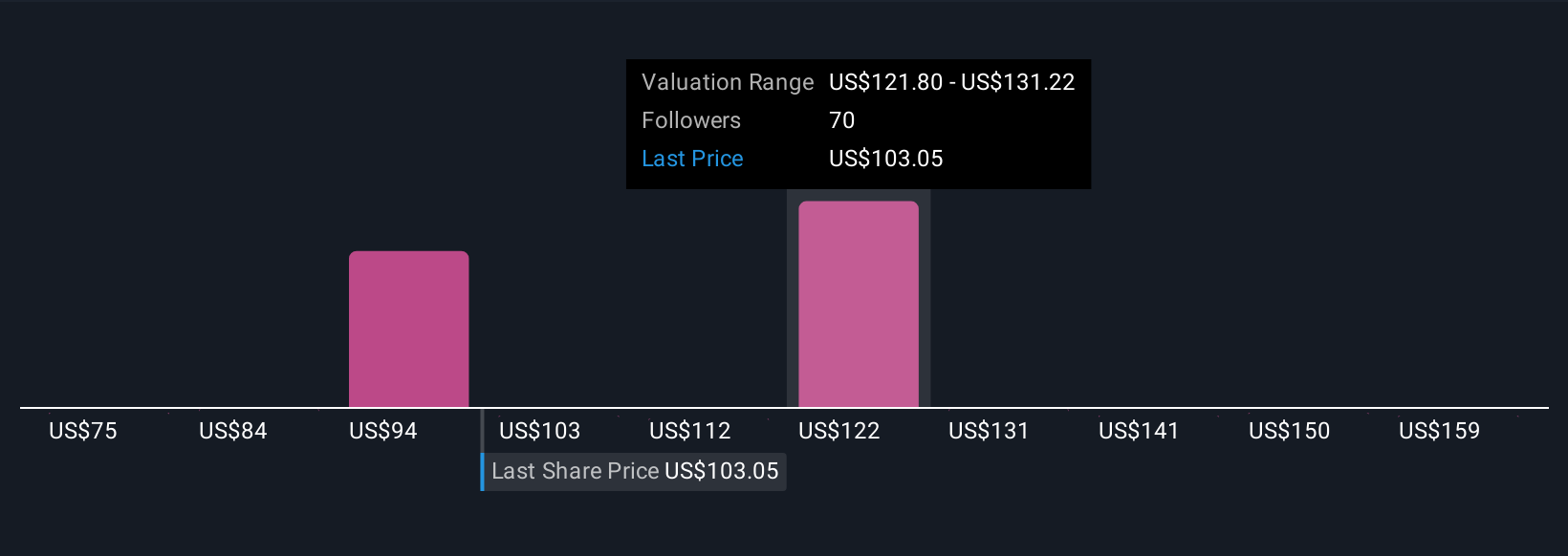

Twenty-two fair value estimates from the Simply Wall St Community span US$74.68 to US$168.91 per share. While opinions differ widely, many participants point to the company’s margin risks, underlining the need to weigh varying viewpoints as you consider Deckers’ growth outlook.

Explore 22 other fair value estimates on Deckers Outdoor - why the stock might be worth 28% less than the current price!

Build Your Own Deckers Outdoor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Deckers Outdoor research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Deckers Outdoor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Deckers Outdoor's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DECK

Deckers Outdoor

Designs, markets, and distributes footwear, apparel, and accessories for casual lifestyle use and high-performance activities in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives