- United States

- /

- Luxury

- /

- NYSE:CRI

Should Income Investors Look At Carter's, Inc. (NYSE:CRI) Before Its Ex-Dividend?

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Carter's, Inc. (NYSE:CRI) is about to trade ex-dividend in the next four days. Typically, the ex-dividend date is one business day before the record date, which is the date on which a company determines the shareholders eligible to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Accordingly, Carter's investors that purchase the stock on or after the 10th of March will not receive the dividend, which will be paid on the 28th of March.

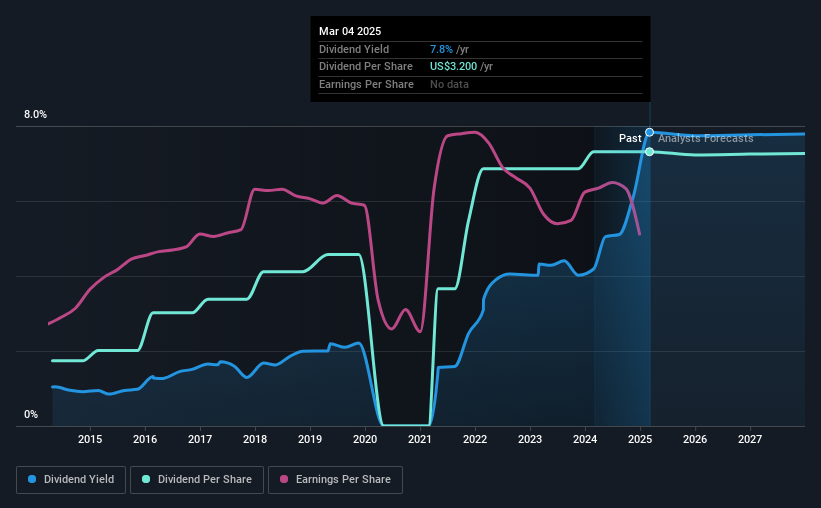

The company's next dividend payment will be US$0.80 per share. Last year, in total, the company distributed US$3.20 to shareholders. Calculating the last year's worth of payments shows that Carter's has a trailing yield of 7.8% on the current share price of US$40.85. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. We need to see whether the dividend is covered by earnings and if it's growing.

View our latest analysis for Carter's

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Carter's paid out more than half (63%) of its earnings last year, which is a regular payout ratio for most companies. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. Fortunately, it paid out only 48% of its free cash flow in the past year.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. So we're not too excited that Carter's's earnings are down 3.0% a year over the past five years.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Carter's has delivered 15% dividend growth per year on average over the past 10 years. That's interesting, but the combination of a growing dividend despite declining earnings can typically only be achieved by paying out more of the company's profits. This can be valuable for shareholders, but it can't go on forever.

To Sum It Up

Is Carter's worth buying for its dividend? The payout ratios are within a reasonable range, implying the dividend may be sustainable. Declining earnings are a serious concern, however, and could pose a threat to the dividend in future. In summary, it's hard to get excited about Carter's from a dividend perspective.

So if you want to do more digging on Carter's, you'll find it worthwhile knowing the risks that this stock faces. To help with this, we've discovered 2 warning signs for Carter's (1 makes us a bit uncomfortable!) that you ought to be aware of before buying the shares.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

If you're looking to trade Carter's, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CRI

Carter's

Designs, sources, and markets branded childrenswear and related products under the Carter's, OshKosh, Skip Hop, Child of Mine, Just One You, Simple Joys, Little Planet, and other brands in the United States and internationally.

Flawless balance sheet established dividend payer.