- United States

- /

- Luxury

- /

- NYSE:CRI

Carter’s (CRI): Does Q2 Sales Growth and Otter Avenue Launch Change the Valuation Narrative?

Reviewed by Kshitija Bhandaru

Carter's (CRI) reported a 4% increase in fiscal Q2 2025 sales, drawing attention to both its ongoing performance and the strategic launch of Otter Avenue, a toddler-focused brand designed to navigate a shifting retail environment.

See our latest analysis for Carter's.

Despite Carter's efforts to innovate with its Otter Avenue launch and a modest 4% sales bump, the stock has faced persistent downward momentum. The share price has slipped 49% year-to-date and posted a steep 55% decline in total return over the past year. These drops reflect ongoing questions around long-term demand and shifting investor appetite, even as management leans into new brand strategies.

If you’re looking for fresh ideas beyond Carter’s recent moves, broaden your search and see what’s happening among fast growing stocks with high insider ownership.

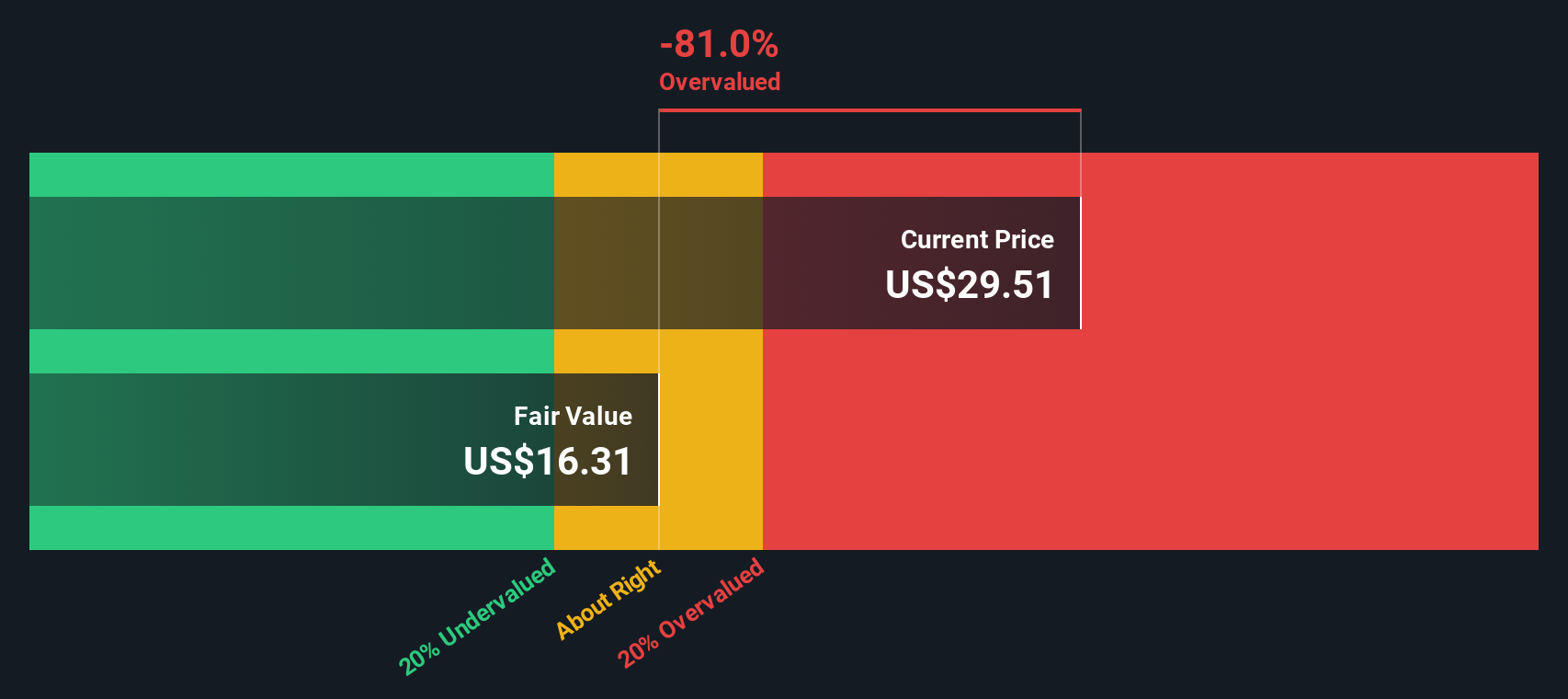

With the stock trading near multi-year lows and analysts divided over its outlook, the big question remains: is Carter’s undervalued at current levels, or is the market already factoring in its long-term challenges and growth prospects?

Most Popular Narrative: 12% Overvalued

Carter’s last close was $27.46, while the most popular analyst narrative sets fair value at $24.60. This poses a challenge for those betting on a rebound, especially with analysts projecting persistent headwinds for future earnings and revenue.

Persistent declines in U.S. and developed market birth rates present structural headwinds to Carter's future revenue growth, as its core customer base shrinks and limits long-term addressable demand. The accelerating shift to e-commerce and proliferation of direct-to-consumer, digitally native competitors is expected to intensify pricing pressure and erode Carter's gross and net margins through increased price transparency and customer acquisition costs.

What number-crunching drives this cautious stance? The narrative’s bold downgrade relies on analyst models forecasting deep cuts to Carter’s profits, squeezed margins, and growth well below sector peers. Find out which surprising assumptions and rapid-fire projections sealed this verdict. See why the valuation story does not follow the market’s past or present optimism.

Result: Fair Value of $24.60 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Carter's international growth in markets with higher birth rates and strong momentum in its core baby segment could challenge the consensus view.

Find out about the key risks to this Carter's narrative.

Another View: What Does the DCF Suggest?

Looking at Carter’s through the lens of the SWS DCF model, a different picture emerges. The model estimates fair value at just $15.78 per share, which is well below its current market price. This raises the question of whether the market is too optimistic or if the DCF model misses potential upside.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Carter's Narrative

If you see things differently or want to dig into the numbers yourself, it takes just a few minutes to craft your own view, your way. Do it your way.

A great starting point for your Carter's research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors look beyond one opportunity. Tap into unique markets and trends to position your portfolio for standout growth using the latest tools from Simply Wall Street.

- Tap into tech’s smartest disruptors by checking out these 24 AI penny stocks shaking up artificial intelligence across every industry.

- Lock in the potential for steady income by browsing these 19 dividend stocks with yields > 3% that consistently offer yields above 3% even during volatile markets.

- Position yourself at the forefront of finance’s biggest shift by exploring these 79 cryptocurrency and blockchain stocks shaping the landscape with blockchain-powered innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRI

Carter's

Designs, sources, and markets branded childrenswear and related products under the Carter's, OshKosh, Skip Hop, Child of Mine, Just One You, Simple Joys, Little Planet, and other brands in the United States and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives