- United States

- /

- Luxury

- /

- NYSE:CRI

Carter's (CRI): Assessing Valuation After Mixed Earnings Beat and Cautious Outlook

Reviewed by Kshitija Bhandaru

Quarterly Results Put Carter's Back in the Spotlight

If you are wondering whether to make a move on Carter’s (NYSE:CRI) after its recent earnings announcement, you are not alone. The company just posted quarterly revenue growth of 3.7% year on year, coming in above what analysts had expected. CEO Douglas C. Palladini emphasized stabilization and new momentum in Carter’s direct-to-consumer segment, particularly across the U.S., Canada, and Mexico. Yet, the report was not entirely upbeat, as adjusted operating income missed expectations and the company’s outlook for next quarter came in softer than some had hoped. These mixed signals have investors weighing Carter’s growth potential against its profitability hiccups.

Looking beyond this latest report, Carter’s share price tells a story of ups and downs. Over the past month, the stock has risen about 19%, suggesting growing confidence or perhaps a rebound in sentiment. Still, momentum has stalled over longer periods, and Carter’s shares have lost more than half their value in the past year alone. Despite some stabilization and growth in its core businesses, investor sentiment appears to reflect ongoing skepticism about the company’s ability to sustain stronger results, at least for now.

After such a dramatic fall and this recent bounce, it is worth asking whether Carter’s now offers a genuine bargain for value-seeking investors, or if the market is simply bracing for tougher times ahead.

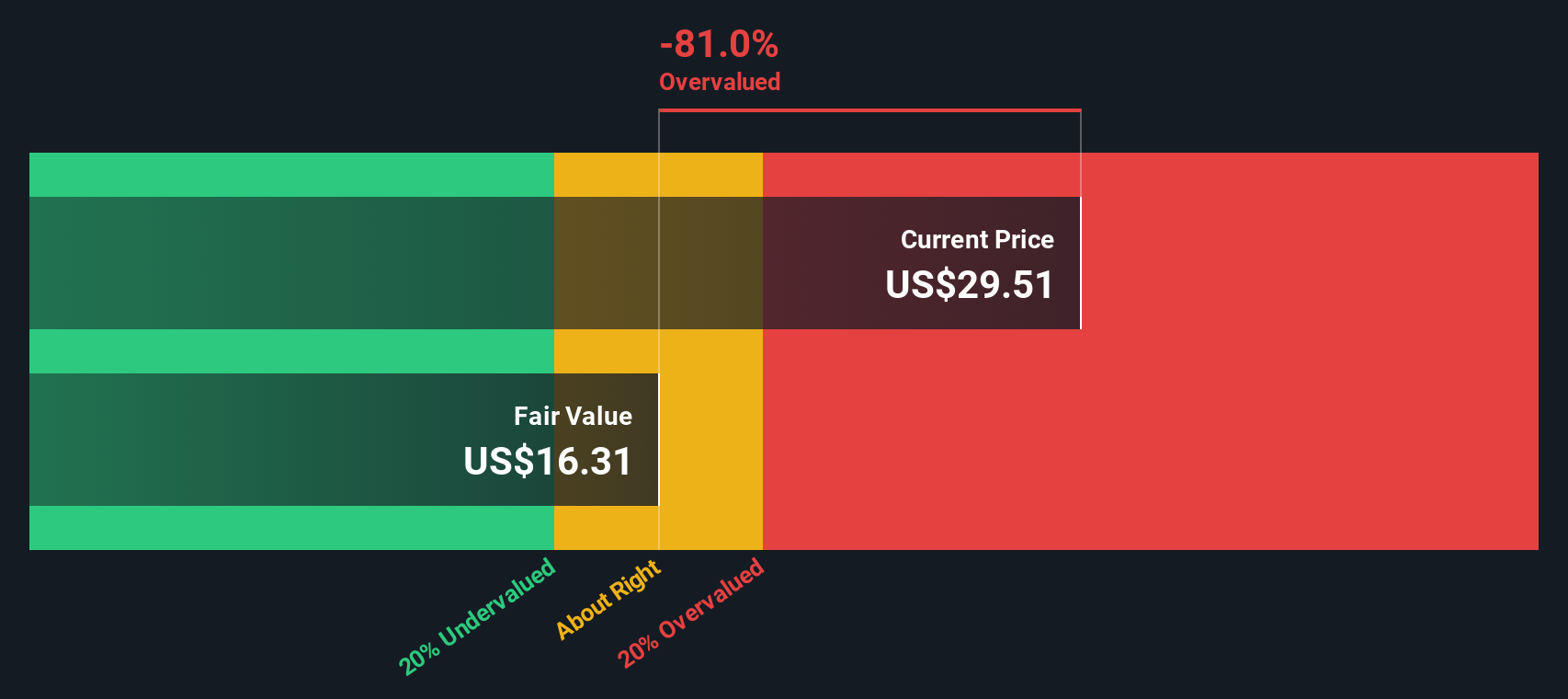

Most Popular Narrative: 27% Overvalued

The prevailing narrative views Carter's as significantly overvalued at its current price, drawing from consensus analyst assumptions and forecasts.

"Persistent declines in U.S. and developed market birth rates present structural headwinds to Carter's future revenue growth. As its core customer base shrinks, this limits long-term addressable demand. The accelerating shift to e-commerce and proliferation of direct-to-consumer, digitally native competitors is expected to intensify pricing pressure and erode Carter's gross and net margins through increased price transparency and customer acquisition costs."

Curious why so many analysts are waving red flags at Carter’s valuation? The real tension is in their underlying numbers. Just one key assumption about shrinking profits could make or break the bull case. Hungry to know the controversial figure behind that bold price target? The narrative’s hidden formula awaits those seeking a deeper dive into Carter’s future trajectory.

Result: Fair Value of $24.60 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, Carter’s growing success in international markets and product innovation, such as new brand launches, could challenge the prevailing bearish outlook.

Find out about the key risks to this Carter's narrative.Another View: Challenging the Consensus

While most analysts rely on future earnings and price targets to judge Carter’s value, our SWS DCF model offers a different perspective. This approach evaluates long-term cash flows and points to overvaluation, raising fresh doubts. Should investors trust market forecasts or look deeper?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Carter's Narrative

If you are the type who likes to look beyond the numbers or challenge the prevailing view, you can analyze the latest metrics and build your own investment story in just a few minutes. Do it your way

A great starting point for your Carter's research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

There is a world of stocks beyond Carter’s that could match your investing ambitions. Take control and use these tailored screeners to uncover big potential you will not want to miss out on:

- Uncover tech pioneers shaping the future of artificial intelligence by tapping into AI penny stocks.

- Build a portfolio of income powerhouses with reliable yields through dividend stocks with yields > 3%.

- Spot hidden value among companies trading under their fair worth using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRI

Carter's

Designs, sources, and markets branded childrenswear and related products under the Carter's, OshKosh, Skip Hop, Child of Mine, Just One You, Simple Joys, Little Planet, and other brands in the United States and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives