- United States

- /

- Luxury

- /

- NYSE:CPRI

Can Renewed Value Interest in Capri Holdings (CPRI) Offset Brand Fatigue Concerns?

Reviewed by Sasha Jovanovic

- Capri Holdings has recently attracted renewed interest from value-focused investors after extended share price weakness, with many highlighting the company's undervaluation compared to industry peers.

- Despite ongoing business risks, including disappointing earnings and brand fatigue, some investors see opportunities for brand revitalization and recovery, driving fresh sentiment towards the stock.

- We’ll explore how the recent investor focus on Capri Holdings' valuation shapes the company’s investment narrative going forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Capri Holdings Investment Narrative Recap

To take a long-term view on Capri Holdings today, a shareholder needs to believe in management’s ability to revitalize its brands and restore profitable growth, despite recent share price volatility and a history of disappointing financials. The latest news of a short-term share price gain is not material enough to shift the core short-term catalyst, which remains a sustained turnaround in full-price sales and improved brand engagement. The biggest risk, weakness in core brand performance and ongoing revenue declines, remains central to the story.

Of the recent news, the company’s Q1 earnings rebound, modest net income following a year of losses, stands out as particularly relevant. This quarterly improvement may boost confidence in Capri Holdings’ efforts to slow its earnings decline, but with full-year guidance still projecting sales and margin constraints, the catalyst for recovery is still tied to successful brand revitalization and sustainable sales gains.

Yet even after the recent rally, the looming challenge of continued softness in both Michael Kors and Jimmy Choo’s revenues is something investors should be mindful of...

Read the full narrative on Capri Holdings (it's free!)

Capri Holdings' outlook projects $3.7 billion in revenue and $351.8 million in earnings by 2028. This reflects a 5.7% annual revenue decline and a $1.45 billion increase in earnings from the current loss of $-1.1 billion.

Uncover how Capri Holdings' forecasts yield a $25.25 fair value, a 32% upside to its current price.

Exploring Other Perspectives

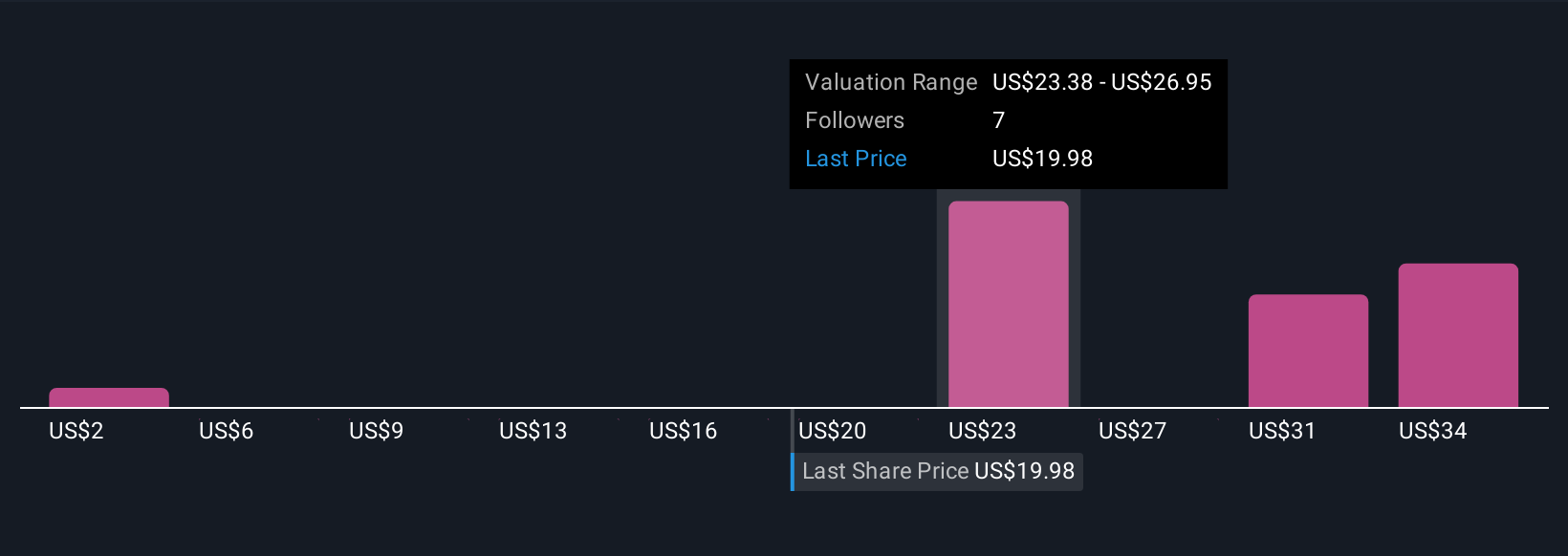

Simply Wall St Community members assigned Capri fair values ranging from US$2 to US$37.64, based on four independent analyses. While views vary, many caution that persistent sales declines and brand fatigue could continue to weigh on performance, showing just how differently investors size up the opportunity in this stock.

Explore 4 other fair value estimates on Capri Holdings - why the stock might be worth less than half the current price!

Build Your Own Capri Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Capri Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Capri Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Capri Holdings' overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPRI

Capri Holdings

Engages in the design, marketing, distribution, and retail of branded women’s and men’s apparel, footwear, and accessories in the United States, Canada, Latin America, Europe, the Middle East, Africa, Asia, and the Oceania.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives