- United States

- /

- Consumer Durables

- /

- NYSE:CCS

Is Century Communities Stock Attractive After Recent Housing Market Resilience?

Reviewed by Bailey Pemberton

- If you are wondering whether Century Communities is a bargain or a value trap at today’s price, you are not alone. This article unpacks what the market might be missing.

- The stock last closed at $66.14, with a 1.3% gain over the past week and a 13.2% rise over the last month, even though it is still down 9.0% year to date and 23.6% over the past year. That combination hints at shifting sentiment after a rough stretch.

- Recent news flow has focused on the housing market staying tighter than many expected and on builders like Century Communities continuing to benefit from limited existing home supply and incentives that keep buyers engaged. At the same time, analysts have highlighted how resilient homebuilder order trends and pricing power could be if mortgage rates stabilize. That context helps explain some of the recent share price recovery.

- On our framework, Century Communities scores a 3/6 valuation score, meaning it screens as undervalued on half of our checks. Next, we will walk through the main valuation approaches, then finish by looking at a way to tie those numbers into one clear story.

Find out why Century Communities's -23.6% return over the last year is lagging behind its peers.

Approach 1: Century Communities Dividend Discount Model (DDM) Analysis

The Dividend Discount Model estimates what a stock is worth by projecting all future dividend payments and discounting them back into today’s dollars. It is most useful when a company pays a regular, sustainable dividend that is expected to grow over time.

Century Communities currently pays an annual dividend per share of $1.16. Based on a return on equity of about 13.3% and a very low payout ratio of roughly 9.9%, the dividend appears well covered by current earnings. However, to keep the model conservative, the long term dividend growth rate is capped at 3.26%. This is lower than the broader business earnings growth rate assumption of around 12.0% a year.

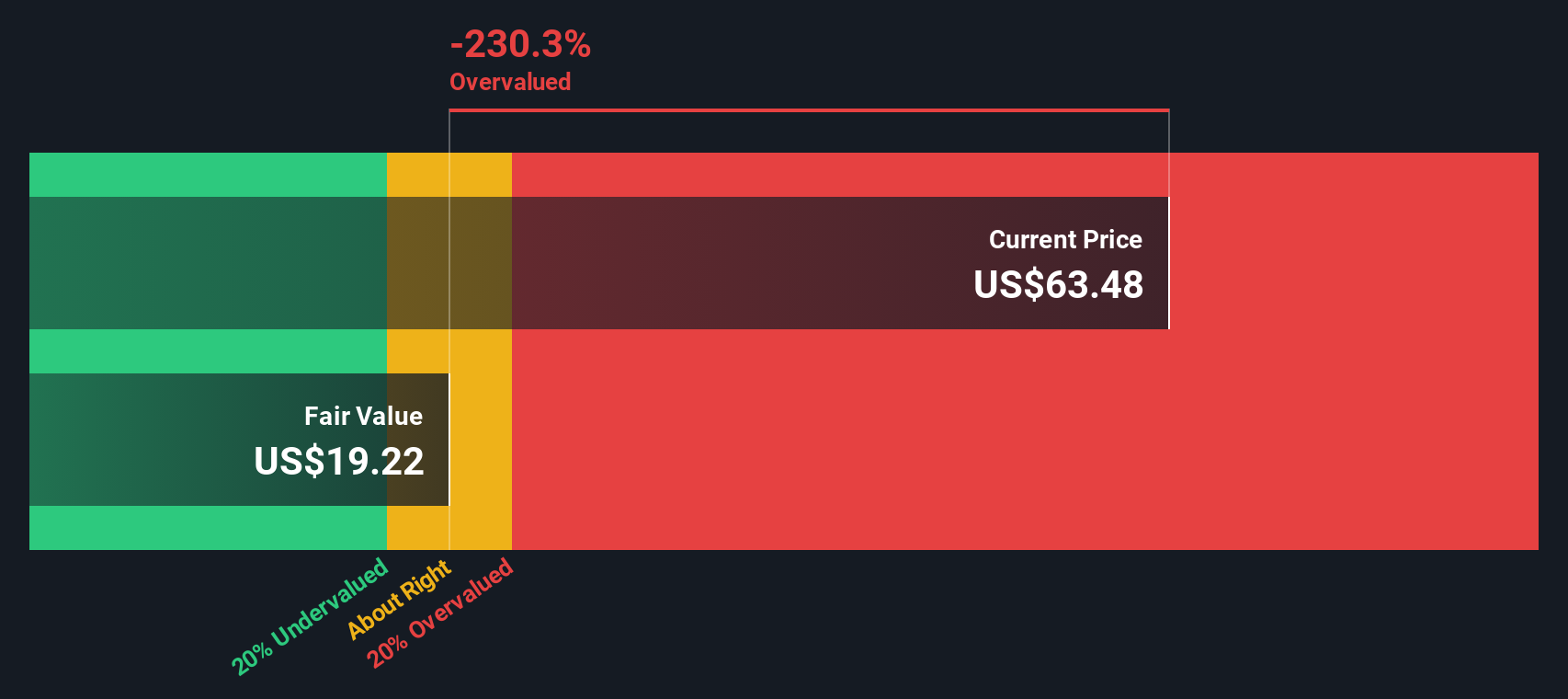

Using these assumptions in the DDM produces an intrinsic value estimate of about $18.76 per share. Compared with the recent share price of $66.14, the model implies the stock is roughly 252.6% overvalued on a pure dividend basis. In this framework, buyers today are paying more than the dividend stream alone can justify.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Century Communities may be overvalued by 252.6%. Discover 919 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Century Communities Price vs Earnings

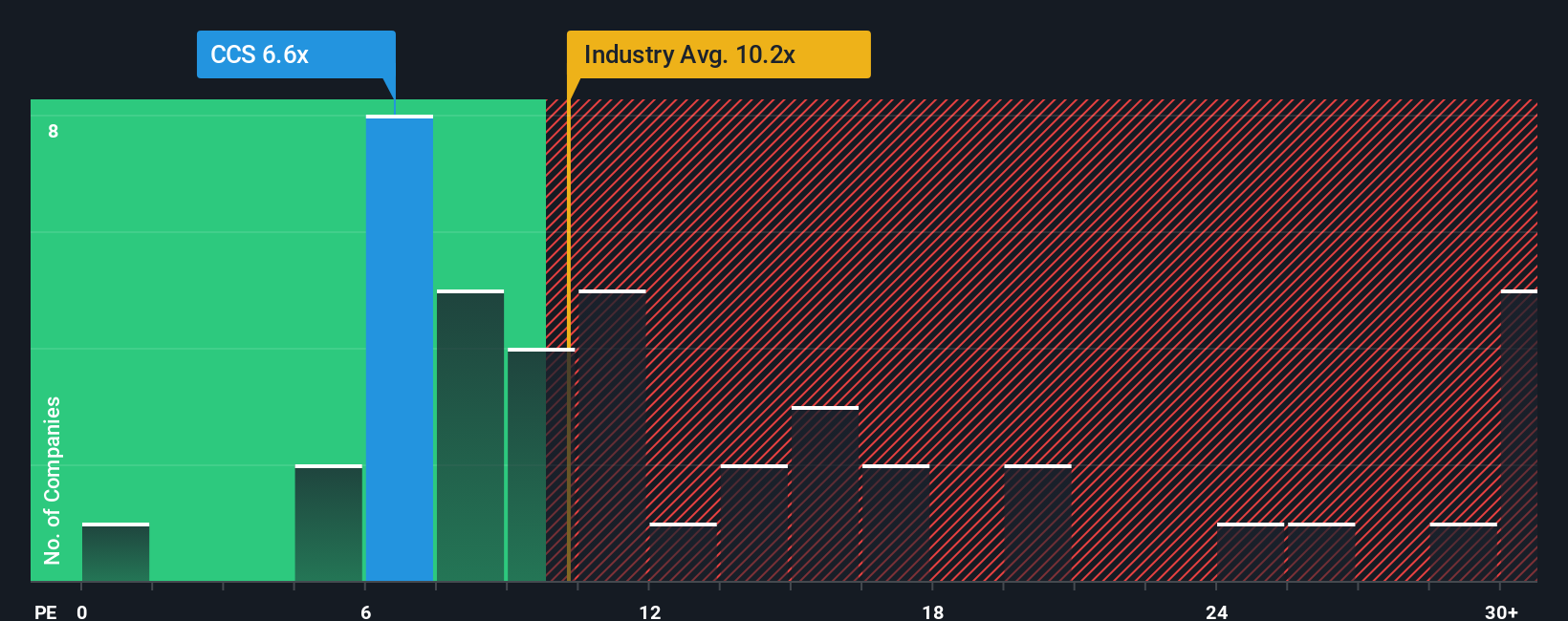

For profitable companies like Century Communities, the price to earnings, or PE, ratio is a useful way to see how much investors are willing to pay for each dollar of current earnings. In general, higher growth and lower perceived risk justify a higher PE, while slower growth or higher risk usually mean the stock should trade on a lower multiple.

Century Communities currently trades on a PE of about 9.1x. That is very similar to the direct peer average of 9.1x and sits below the broader Consumer Durables industry average of around 12.1x, suggesting the market is applying a modest discount to the stock relative to typical sector valuations.

Simply Wall St’s Fair Ratio framework estimates that, given Century Communities earnings growth profile, industry, profit margins, market cap and risk factors, a more appropriate PE would be closer to 12.8x. Because this Fair Ratio is tailored to the company rather than just comparing it with peers or the industry, it can better capture where the multiple should sit. With the shares trading at 9.1x versus a Fair Ratio of 12.8x, the stock appears attractively priced on an earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Century Communities Narrative

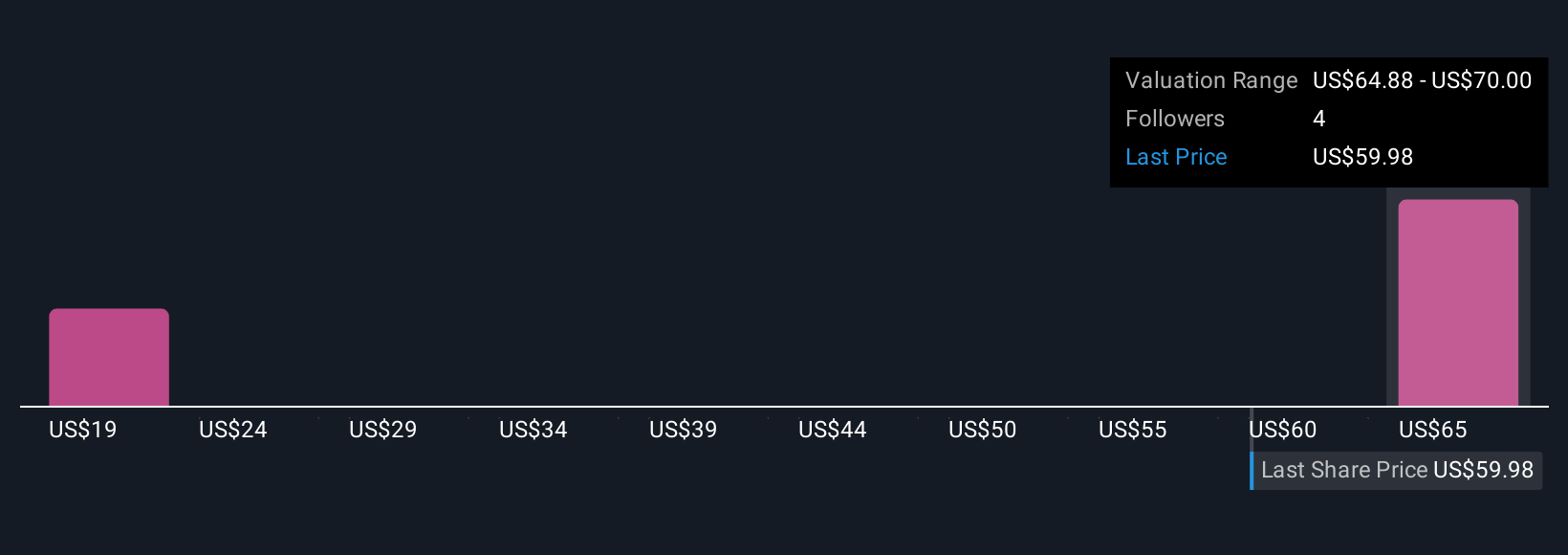

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply your story about a company, translated into a set of assumptions for its future revenue, earnings, margins and, ultimately, fair value. A Narrative on Simply Wall St connects three pieces: what you believe is happening in the business, how that shapes a forward financial forecast, and the fair value that drops out of those numbers so you can easily compare it to the current share price to decide whether to buy, hold, or sell. Narratives live inside the Community page on the Simply Wall St platform, making them an accessible, guided tool that millions of investors can use and update as new earnings, news, or guidance come through, with the fair value recalculating dynamically. For Century Communities, for example, a cautious investor might side with a lower fair value near 49 dollars if they think demand and margins will keep sliding, while a more optimistic investor could justify something closer to 70 dollars if they expect the company’s buybacks, community expansions, and operational efficiencies to support better than expected growth and profitability.

Do you think there's more to the story for Century Communities? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCS

Century Communities

Engages in the design, development, construction, marketing, and sale of single-family attached and detached homes.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026