- United States

- /

- Consumer Durables

- /

- NYSE:CCS

Century Communities (CCS): Assessing Valuation Following Latest Expansion Announcements and New Community Launches

Reviewed by Kshitija Bhandaru

Century Communities, a prominent U.S. homebuilder, has rolled out a string of updates, unveiling new developments in Spartanburg, Ocala, and Locust. The company’s pace of expansion into fast-growing areas has caught investor interest.

See our latest analysis for Century Communities.

Century Communities' steady roll-out of new communities in Spartanburg, Ocala, and Locust has been met with cautiously renewed optimism from investors. Despite a challenging start to the year, recent weeks brought a gentle lift to the share price, reflecting some stabilization and a sense that housing market tailwinds could start working in CCS’s favor again. The stock’s one-year total shareholder return sits just below flat, while longer-term holders have still benefited from meaningful gains over the past three and five years. Momentum is building, but the story remains one of patient progress rather than rapid breakout.

If this wave of expansion has you rethinking your next move, now might be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With all this renewed activity and a share price still lagging its highs, the big question is whether investors are overlooking untapped value in Century Communities, or if the current price already reflects the company’s growth prospects.

Most Popular Narrative: 6.9% Overvalued

Century Communities' most widely followed valuation narrative pegs the fair value at $59.50, lower than the recent close of $63.62. This suggests investor optimism outpaces forecast earnings power. This sets the scene for an underlying tension: can operational resilience balance out mounting market headwinds?

Ongoing elevated mortgage rates and affordability constraints are dampening homebuyer demand, forcing Century Communities to increase sales incentives and accept lower average selling prices. This is already putting downward pressure on gross margins and is expected to weigh further on both revenues and earnings in the coming quarters.

Curious which financial levers underpin this outlook? The full narrative reveals how shrinking profit margins, a shift in buyer mix, and long-range earnings projections all factor into the analyst consensus fair value. Want to peek behind the curtain at the boldest assumptions? Take a look and see the numbers shaping this debate.

Result: Fair Value of $59.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong ongoing U.S. housing demand and Century’s record community count could provide lasting support if affordability rebounds quickly.

Find out about the key risks to this Century Communities narrative.

Another View: The Market’s Multiples Paint a Different Picture

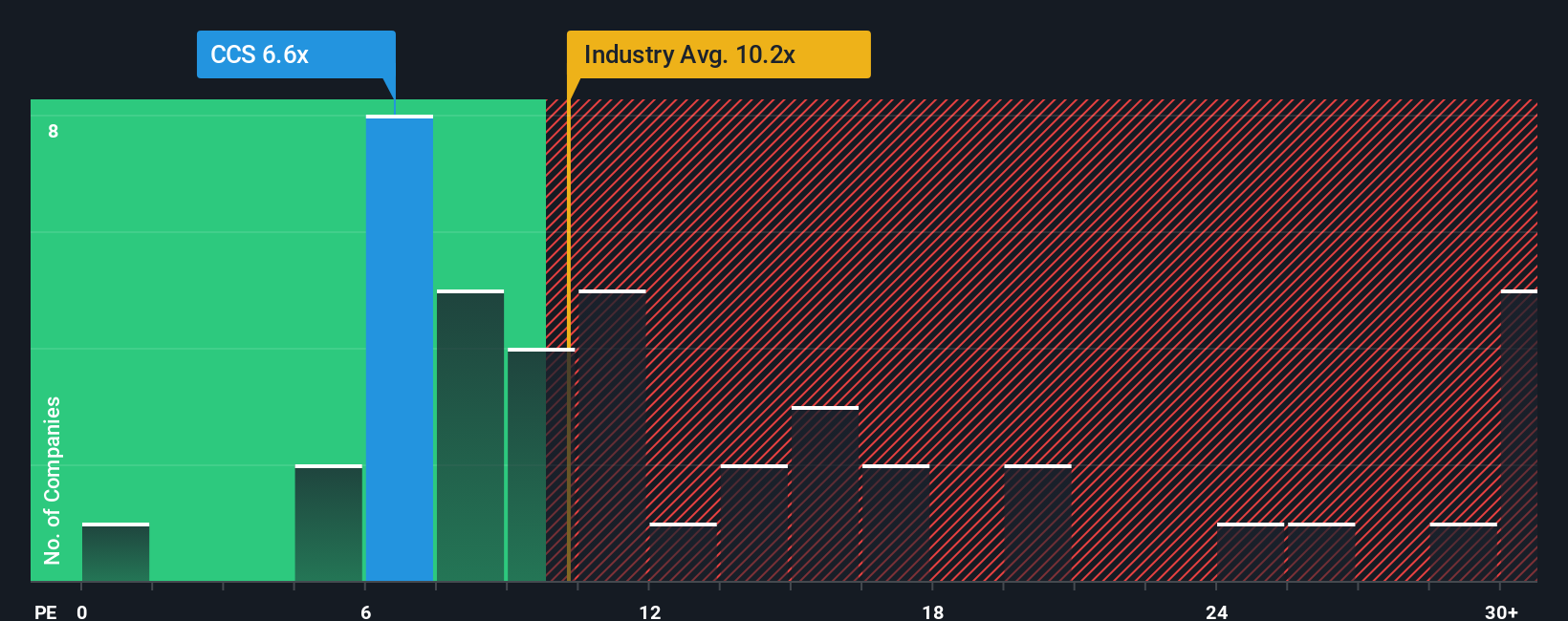

Switching from analyst price targets to market multiples, Century Communities trades at a price-to-earnings ratio of 7.3x. That is markedly lower than its sector peers at 8.8x and well below the Consumer Durables industry average of 11.8x. Our fair ratio suggests a level of 9.1x, so the shares look attractively valued by this measure. Could this gap represent a real opportunity, or is the market seeing risks that others are not?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Century Communities Narrative

If you see the numbers differently, or are keen to dig into the details for yourself, you can shape your own story in just a few minutes with Do it your way.

A great starting point for your Century Communities research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Upgrade your portfolio with handpicked stocks in sizzling sectors. These screeners spotlight trends that could put you ahead while others are still catching up.

- Capture the next wave of healthcare breakthroughs as you examine the opportunities among these 31 healthcare AI stocks making strides in life sciences and artificial intelligence.

- Lock in steady income streams by searching for these 19 dividend stocks with yields > 3% delivering reliable yields to help you meet your financial goals.

- Shape your tech strategy and get ahead of tomorrow’s computing by investigating these 26 quantum computing stocks leading quantum innovation in today’s market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCS

Century Communities

Engages in the design, development, construction, marketing, and sale of single-family attached and detached homes.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives