- United States

- /

- Luxury

- /

- NYSE:BIRK

Birkenstock Holding And 2 Other Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As global markets reach new highs, driven by a robust start to the earnings season and despite some economic headwinds, investors are keenly observing opportunities that may be trading below their estimated value. With inflationary pressures and shifting interest rate expectations adding complexity to investment decisions, identifying undervalued stocks becomes crucial for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| MidWestOne Financial Group (NasdaqGS:MOFG) | US$28.59 | US$57.11 | 49.9% |

| VersaBank (TSX:VBNK) | CA$20.69 | CA$41.31 | 49.9% |

| Management SolutionsLtd (TSE:7033) | ¥1885.00 | ¥3763.79 | 49.9% |

| Nolato (OM:NOLA B) | SEK51.65 | SEK103.13 | 49.9% |

| Medley (TSE:4480) | ¥3955.00 | ¥7897.30 | 49.9% |

| Trisura Group (TSX:TSU) | CA$43.92 | CA$87.82 | 50% |

| Sejin Heavy Industries (KOSE:A075580) | ₩7390.00 | ₩14743.96 | 49.9% |

| SysGroup (AIM:SYS) | £0.325 | £0.65 | 50% |

| Cytek Biosciences (NasdaqGS:CTKB) | US$5.32 | US$10.63 | 49.9% |

| Distribuidora Internacional de Alimentación (BME:DIA) | €0.0128 | €0.026 | 50% |

Underneath we present a selection of stocks filtered out by our screen.

Birkenstock Holding (NYSE:BIRK)

Overview: Birkenstock Holding plc is a company that manufactures and sells footwear products, with a market capitalization of approximately $9.40 billion.

Operations: The company's revenue segments are Europe (€616.54 million), Americas (€905.60 million), and APMA (Asia Pacific, Middle East, Africa) (€196.26 million).

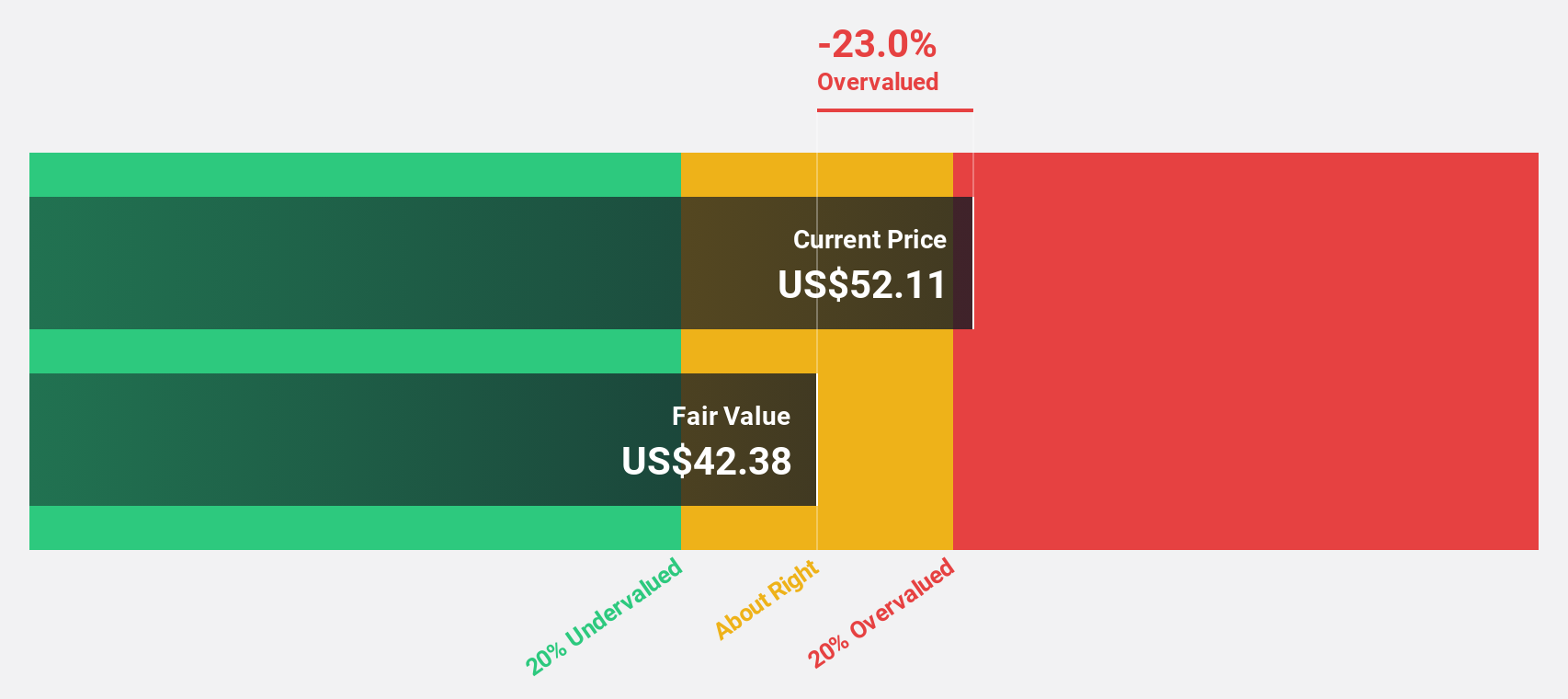

Estimated Discount To Fair Value: 17.3%

Birkenstock Holding is trading at US$51.77, which is 17.3% below its estimated fair value of US$62.58, indicating potential undervaluation based on discounted cash flow analysis. Despite a decline in profit margins from 11.2% to 6.4%, the company reported strong revenue growth of 19.8% over the past year and forecasts earnings to grow significantly by over 51% annually, outpacing the broader US market's expected growth rate.

- The analysis detailed in our Birkenstock Holding growth report hints at robust future financial performance.

- Dive into the specifics of Birkenstock Holding here with our thorough financial health report.

Molina Healthcare (NYSE:MOH)

Overview: Molina Healthcare, Inc. offers managed healthcare services primarily to low-income families and individuals through Medicaid, Medicare, and state insurance marketplaces, with a market cap of approximately $19.35 billion.

Operations: The company's revenue is primarily derived from Medicaid ($30.03 billion), Medicare ($5.03 billion), and Marketplace ($2.26 billion) segments.

Estimated Discount To Fair Value: 48.3%

Molina Healthcare is trading at US$340.12, significantly below its estimated fair value of US$657.44, highlighting potential undervaluation based on discounted cash flow analysis. Despite recent insider selling and slight declines in net income, the company reported robust revenue growth from US$8.33 billion to US$9.88 billion year-over-year for Q2 2024 and maintains strong earnings forecasts, expected to grow faster than the broader U.S. market at 16.5% annually.

- Upon reviewing our latest growth report, Molina Healthcare's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Molina Healthcare.

Asia Vital Components (TWSE:3017)

Overview: Asia Vital Components Co., Ltd. is a company that provides thermal solutions globally, with a market cap of NT$248 billion.

Operations: The company's revenue is primarily derived from its Overseas Operating Department, which contributes NT$66.65 billion, and its Integrated Management Division, which adds NT$48.87 billion.

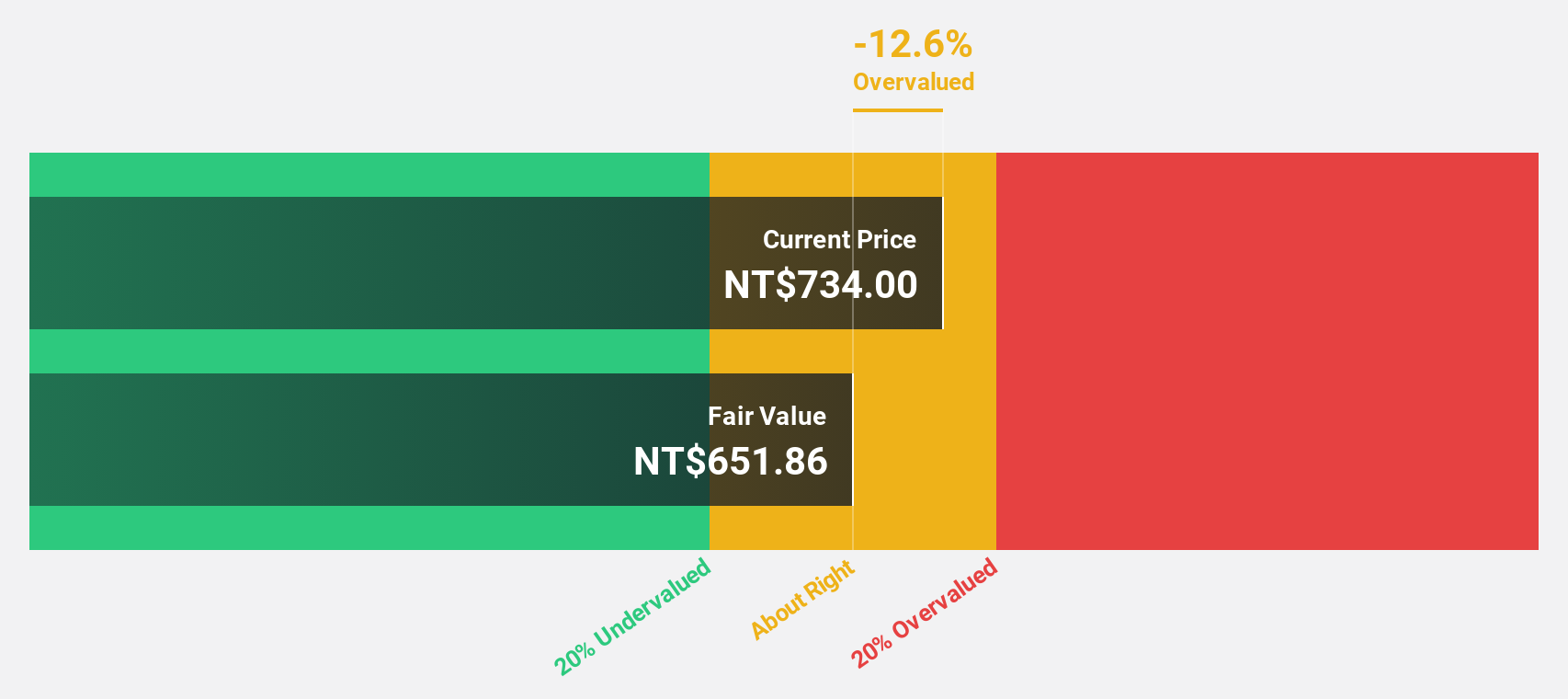

Estimated Discount To Fair Value: 10.9%

Asia Vital Components is trading at NT$677, below its estimated fair value of NT$759.82, suggesting potential undervaluation based on cash flows. The company reported strong earnings growth for Q2 2024, with net income rising from TWD 1,201.43 million to TWD 1,947.26 million year-over-year. Revenue and earnings are forecast to grow significantly above market averages at 23.8% and 29.9% annually, respectively, despite recent share price volatility and a new USD 150 million syndicated loan agreement to bolster finances.

- Our expertly prepared growth report on Asia Vital Components implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Asia Vital Components' balance sheet health report.

Next Steps

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 968 more companies for you to explore.Click here to unveil our expertly curated list of 971 Undervalued Stocks Based On Cash Flows.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Birkenstock Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BIRK

Birkenstock Holding

Engages in the manufacture and sale of footwear products.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives