- United States

- /

- Aerospace & Defense

- /

- NYSE:KRMN

Top Growth Companies With Strong Insider Ownership In November 2025

Reviewed by Simply Wall St

In the midst of a volatile November 2025, where major U.S. stock indexes have experienced significant swings and tech stocks face scrutiny, investors are keenly observing companies with robust fundamentals. Amidst this backdrop, growth companies with high insider ownership stand out as potentially resilient options due to their alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 14.0% | 50.7% |

| StubHub Holdings (STUB) | 23.3% | 73.5% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| FTC Solar (FTCI) | 22.6% | 78.8% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Cloudflare (NET) | 10.4% | 43.5% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.2% |

| Astera Labs (ALAB) | 11.9% | 29.1% |

| AppLovin (APP) | 27.5% | 26.4% |

Here we highlight a subset of our preferred stocks from the screener.

Amer Sports (AS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Amer Sports, Inc. is involved in the design, manufacture, marketing, distribution, and sale of sports equipment, apparel, footwear, and accessories across various regions including Europe, the Middle East, Africa, the Americas, Mainland China, Hong Kong, Macau, Taiwan and the Asia Pacific with a market cap of $18.89 billion.

Operations: The company's revenue segments include Technical Apparel at $2.60 billion, Outdoor Performance at $2.23 billion, and Ball & Racquet Sports at $1.27 billion.

Insider Ownership: 18%

Earnings Growth Forecast: 27.9% p.a.

Amer Sports, Inc. demonstrates strong growth potential with expected annual earnings growth of 27.95% and recent revenue guidance indicating a 23-24% increase for 2025. Despite an impairment charge of $6.7 million in Q3, net income rose significantly to US$143.1 million from US$55.8 million year-over-year, reflecting robust performance. Insider activity shows more buying than selling recently, suggesting confidence in future prospects despite low forecasted return on equity (13.1%).

- Delve into the full analysis future growth report here for a deeper understanding of Amer Sports.

- Our valuation report unveils the possibility Amer Sports' shares may be trading at a premium.

Estée Lauder Companies (EL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: The Estée Lauder Companies Inc. is a global manufacturer, marketer, and seller of skincare, makeup, fragrance, and hair care products with a market cap of $32.40 billion.

Operations: The company's revenue segments include Skin Care at $7.01 billion, Makeup at $4.20 billion, Fragrance at $2.58 billion, and Hair Care at $555 million.

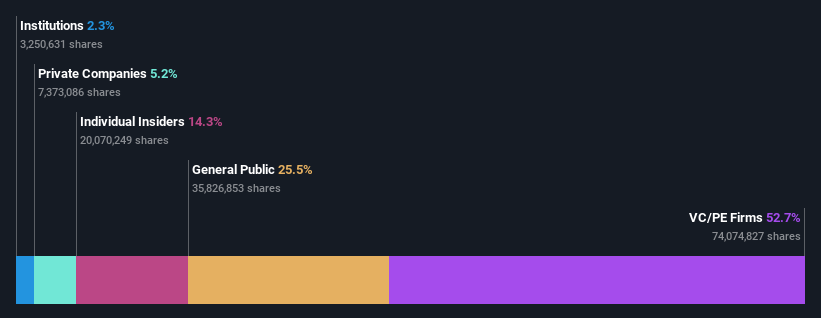

Insider Ownership: 12.7%

Earnings Growth Forecast: 49.2% p.a.

Estée Lauder Companies is poised for growth with expected annual earnings increasing by 49.17% over the next three years, despite revenue growth forecasts of only 3.9% annually, which lags behind the broader US market. Recent strategic initiatives include a partnership with Shopify to enhance digital capabilities and a fragrance expansion in Paris, signaling a focus on innovation and market presence. Insider activity shows more buying than selling, reflecting some confidence amidst financial challenges like high debt levels.

- Click here to discover the nuances of Estée Lauder Companies with our detailed analytical future growth report.

- Our expertly prepared valuation report Estée Lauder Companies implies its share price may be too high.

Karman Holdings (KRMN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Karman Holdings Inc., through its subsidiary, specializes in designing, testing, manufacturing, and selling mission-critical systems in the United States with a market cap of $7.95 billion.

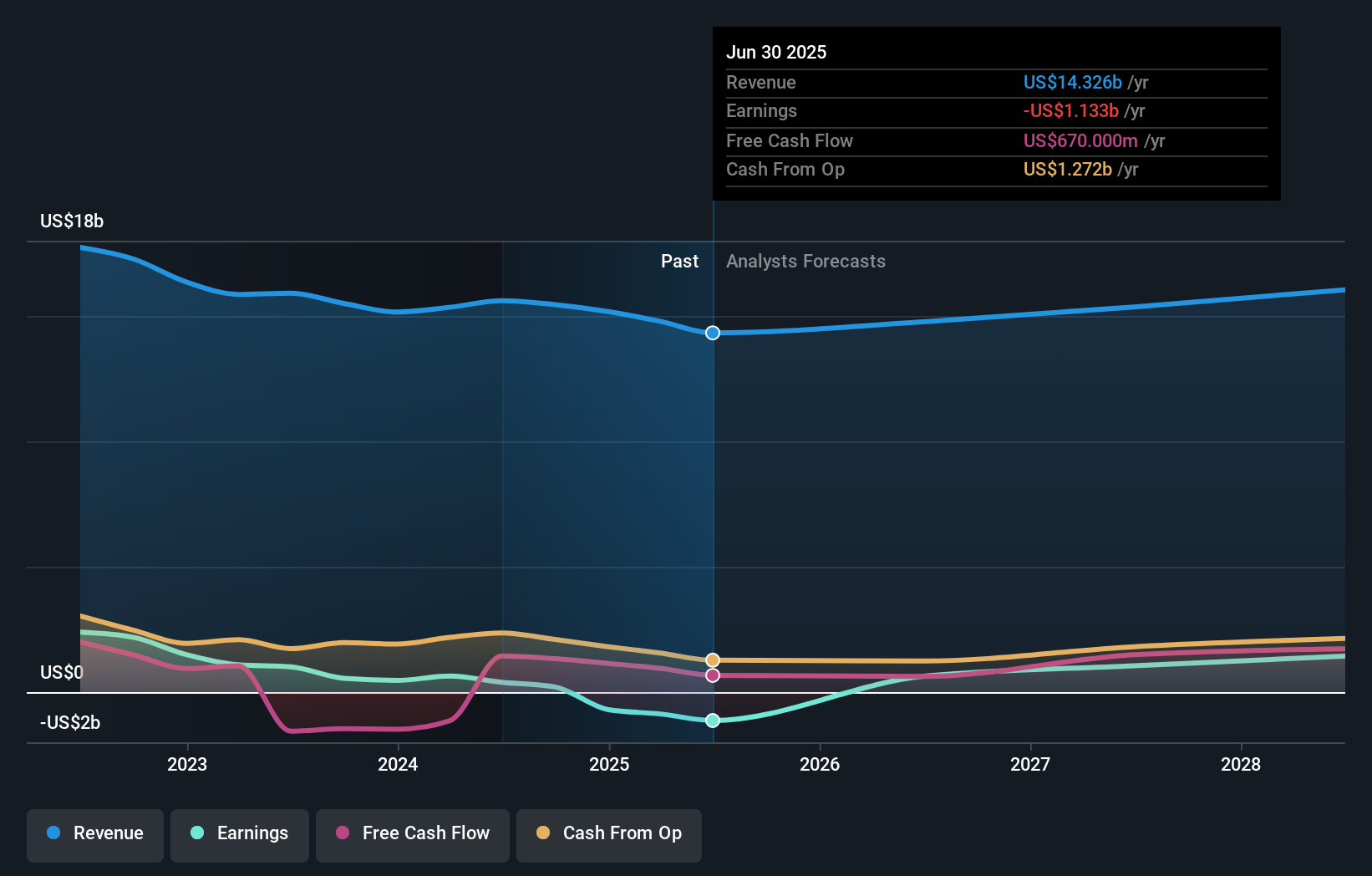

Operations: The company's revenue is primarily derived from the Space and Defense Industry, amounting to $428.25 million.

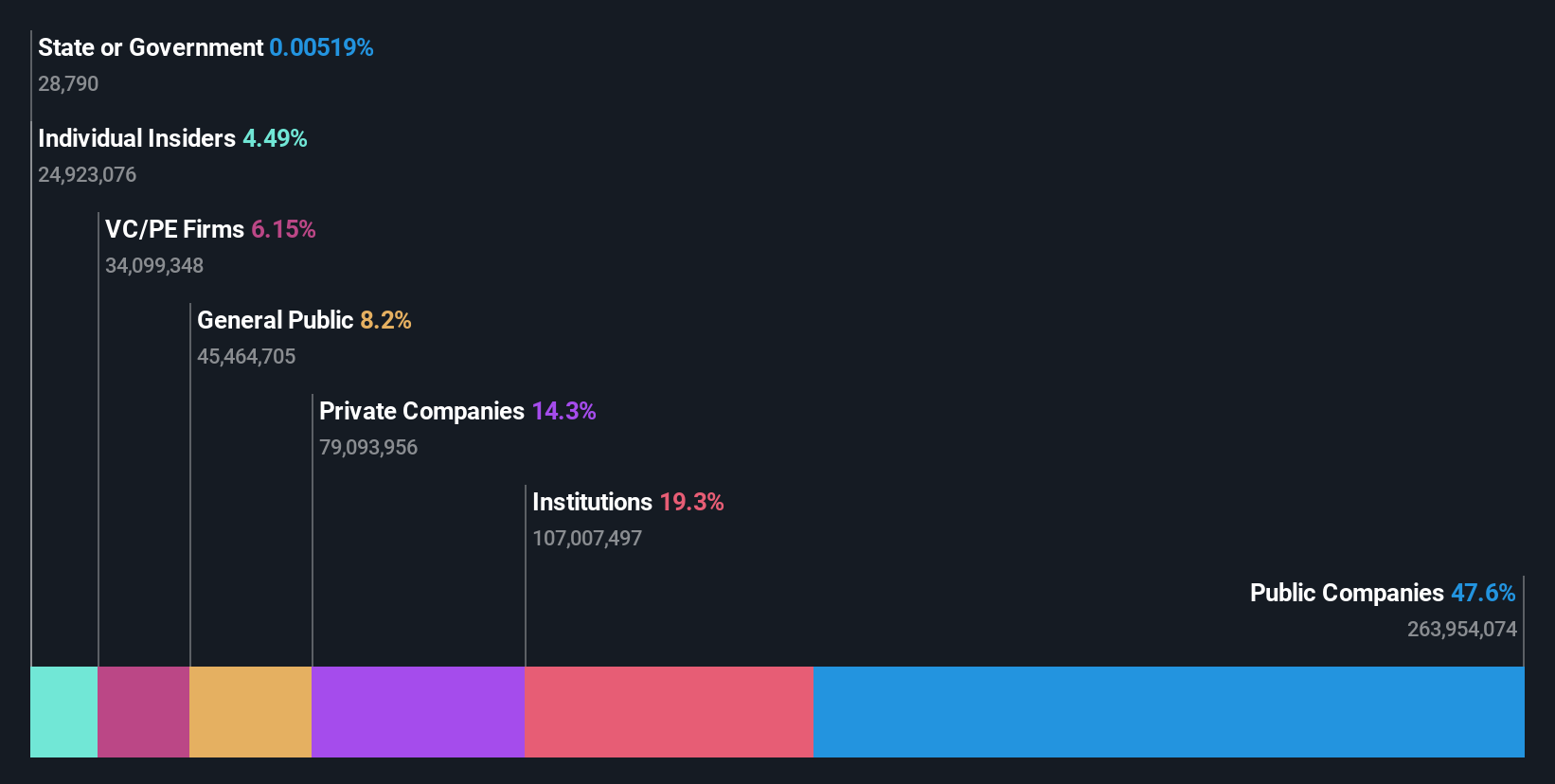

Insider Ownership: 17.5%

Earnings Growth Forecast: 78.5% p.a.

Karman Holdings demonstrates strong growth potential with forecasted annual earnings growth of over 78%, significantly outpacing the US market. Recent insider activity shows more buying than selling, indicating confidence in its future prospects. The company reported a substantial increase in third-quarter sales to US$121.79 million, up from US$85.97 million a year ago, and has raised its revenue guidance for 2025. However, profit margins have declined and interest payments are not well covered by earnings.

- Dive into the specifics of Karman Holdings here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Karman Holdings' current price could be inflated.

Key Takeaways

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 199 more companies for you to explore.Click here to unveil our expertly curated list of 202 Fast Growing US Companies With High Insider Ownership.

- Contemplating Other Strategies? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Karman Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KRMN

Karman Holdings

Through its subsidiary, engages in designing, testing, manufacturing, and sale of mission-critical systems in the United States.

High growth potential with low risk.

Market Insights

Community Narratives