- United States

- /

- Consumer Durables

- /

- NasdaqGS:SONO

Sonos (SONO): Examining Valuation After 20% 12-Month Share Price Rise

Reviewed by Kshitija Bhandaru

Sonos (SONO) has been quietly moving higher, with the stock returning over 20% for investors in the past twelve months. There hasn’t been a single headline-grabbing event to explain this upward drift. However, the gains might be catching the eye of anyone who has considered jumping in. With fewer external catalysts to pin down the reason for recent momentum, now could be an interesting time for investors to pause and ask what’s driving this run and whether it is sustainable.

The recent climb adds to a year of choppy but ultimately positive performance for Sonos. After a sluggish start to the year, the company’s shares have pushed up 44% across the past three months. This hints that sentiment might be shifting. This comes against a mixed backdrop that includes annual revenue growth of around 5% and a much bigger swing on net income, which has leapt more than 80% compared to last year.

The real question now is whether markets are truly pricing in Sonos’ future growth or if there is still meaningful value left for buyers willing to look past the surface gains.

Most Popular Narrative: 14% Overvalued

The most widely followed analysis sees Sonos as overvalued compared to its fair value, with limited upside based on current assumptions. The price target is built on several ambitious financial projections and business expansion scenarios.

Sonos's ongoing platform evolution, where new hardware products compound in value via frequent software enhancements, particularly with integration of AI capabilities, positions the brand for higher household penetration and stickier, more valuable customer relationships. This supports long-term revenue growth and increased gross margins.

Curious what numbers power this bullish long-term vision? The entire thesis hangs on profit margins reversing course and sustained top-line growth that outpaces industry cycles. Is Sonos really set to transform its business model and leap past rivals? There is only one way to see the detailed assumptions analysts are betting on for Sonos’s future fair value.

Result: Fair Value of $13.63 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, near-term headwinds such as tariff-driven cost pressures and delayed hardware releases could hinder Sonos’s growth path and challenge bullish forecasts.

Find out about the key risks to this Sonos narrative.Another View: What Does Our DCF Model Say?

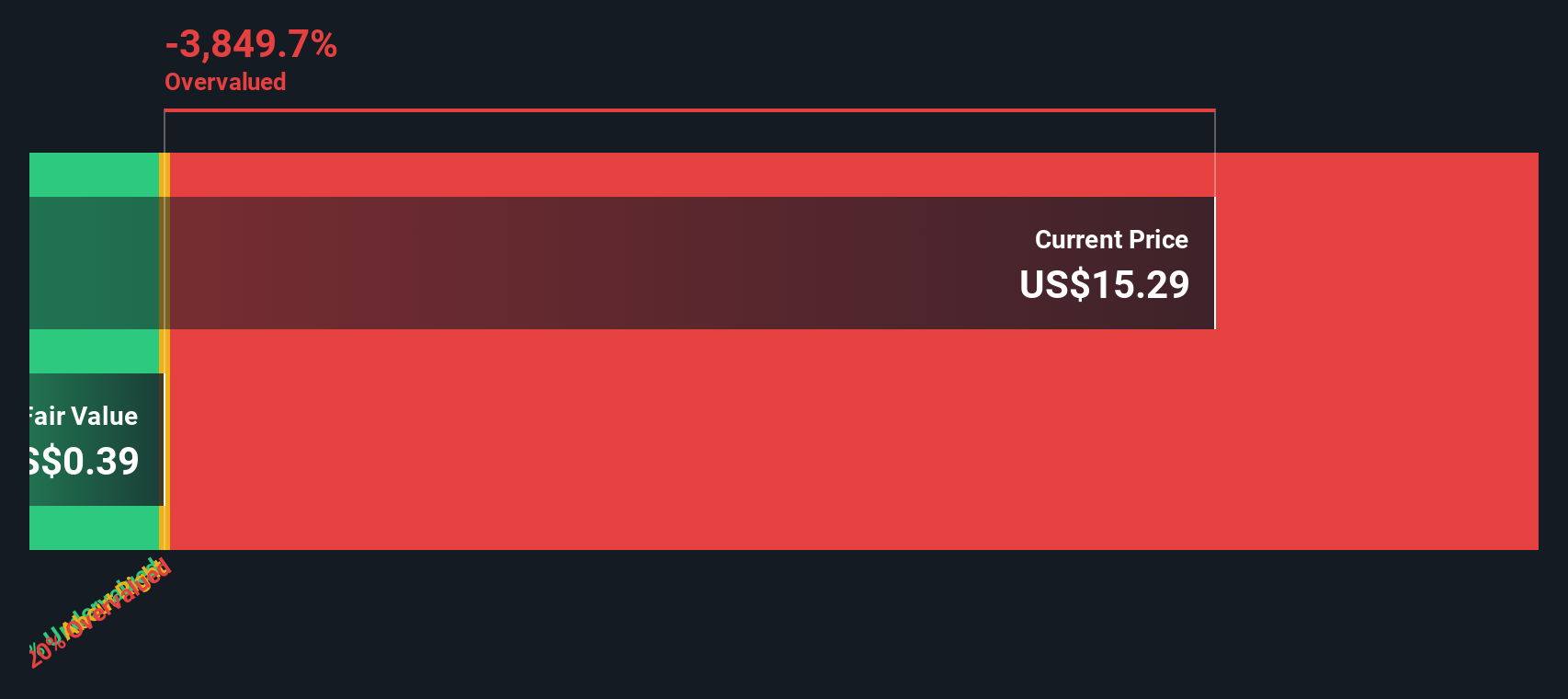

While analyst price targets use ambitious growth and margin assumptions, our DCF model offers a different perspective. It suggests the current price exceeds fair value, raising questions about whether expectations have moved too far ahead. Which view highlights the real opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sonos for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sonos Narrative

If you see things differently or want to dig deeper into the data yourself, you can shape your own view in just a few minutes. Do it your way

Prefer to form your own view? Our platform makes it easy to explore a stock's fundamentals and create your own narrative in minutes.

Looking for More Investment Ideas?

Let’s make sure you don’t miss out on smart opportunities beyond Sonos. Use these unique shortlists to fuel your next investment move. There is a world of innovation and strong returns waiting for you.

- Capture the upside in rapidly growing industries by targeting AI penny stocks, which are making big waves in artificial intelligence and reshaping how the world works.

- Grow your passive income by evaluating top companies offering dividend stocks with yields > 3% that reward shareholders with reliable, impressive dividend yields.

- Predict the next breakthrough phase in technology by searching for quantum computing stocks on the frontier of quantum computing and futuristic tech breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SONO

Sonos

Designs, develops, manufactures, and sells audio products and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives