- United States

- /

- Leisure

- /

- NasdaqGS:PTON

The Bull Case For Peloton (PTON) Could Change Following AI-Powered Product Overhaul and Price Hikes – Learn Why

Reviewed by Sasha Jovanovic

- On October 1, 2025, Peloton Interactive launched a comprehensive overhaul of its connected fitness portfolio, unveiling the AI-powered Peloton IQ system and debuting the Cross Training Series with updated bikes, treadmills, and rowing equipment, alongside significant price increases for both hardware and membership fees.

- This extensive refresh signals Peloton's attempt to reposition itself as a wellness technology leader, highlighting a shift into commercial fitness markets and the integration of advanced AI for personalized coaching across all devices.

- We will assess how Peloton’s push for AI-driven personalization and expanded hardware lineup may influence its investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Peloton Interactive Investment Narrative Recap

To be a Peloton shareholder right now is to believe the company can reignite growth and defend its subscription base by repositioning as a tech-driven wellness brand, while overcoming weakness in hardware demand and competitive threats. The October AI-powered portfolio overhaul and significant price hikes are the latest big bet; their near-term impact will be closely watched, as Peloton’s most important short-term catalyst remains its ability to drive sustained member engagement and slow hardware demand declines. However, the immediate market reaction suggests skepticism about whether these measures can offset the biggest risk: persistent subscription and unit sales pressure.

Among the recent updates, the launch of Peloton IQ and the complete overhaul of the Cross Training Series stand out. Equipped with advanced AI-guided coaching and new cross-training hardware, this move seeks to directly address engagement challenges by deepening personalization for current members, a critical piece as Peloton balances price increases with the need to demonstrate improved customer value.

Yet, despite these efforts, investors should keep in mind that if hardware and subscription declines continue...

Read the full narrative on Peloton Interactive (it's free!)

Peloton Interactive's outlook anticipates $2.5 billion in revenue and $113.2 million in earnings by 2028. This scenario involves a 0.4% annual revenue decline and a $232.1 million earnings increase from current earnings of -$118.9 million.

Uncover how Peloton Interactive's forecasts yield a $9.84 fair value, a 13% upside to its current price.

Exploring Other Perspectives

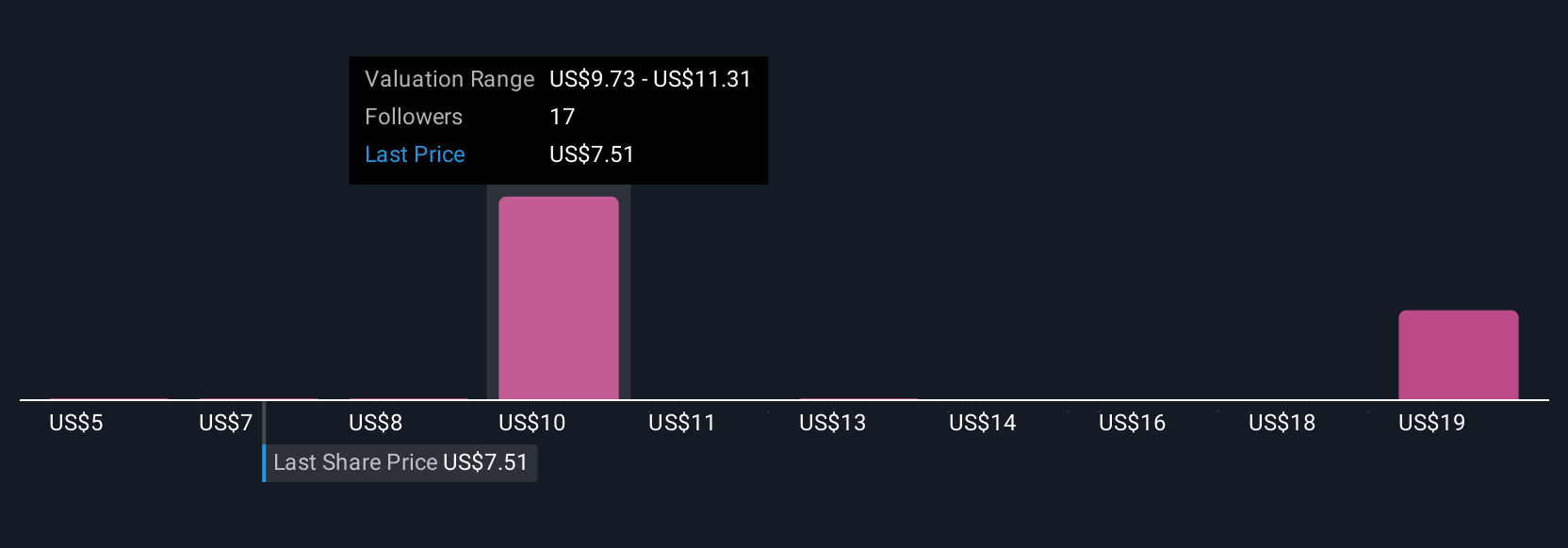

Simply Wall St Community members estimate Peloton’s fair value anywhere from US$5 to US$18.40, reflecting a spread of opinions across six analyses. Against this backdrop, questions about hardware sales resilience remain central to the company’s outlook, be sure to consider a range of viewpoints before making your own assessment.

Explore 6 other fair value estimates on Peloton Interactive - why the stock might be worth 42% less than the current price!

Build Your Own Peloton Interactive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Peloton Interactive research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Peloton Interactive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Peloton Interactive's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTON

Peloton Interactive

Provides fitness and wellness products and services in North America and internationally.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives