- United States

- /

- Leisure

- /

- NasdaqGS:PTON

Does Peloton's (PTON) AI Push and Wellness Focus Mark a New Era for Brand Differentiation?

Reviewed by Sasha Jovanovic

- Earlier this month, Peloton Interactive revealed its largest-ever product overhaul, introducing a new AI-powered coaching system called Peloton IQ and launching advanced commercial-grade fitness equipment, including the Cross Training Series and the Pro Series, across North America and select international markets.

- The company also announced a partnership with Respin Health to develop scientifically validated menopause-focused wellness content and research studies, marking Peloton’s first direct investment in women’s health and an expansion into underrepresented demographics.

- We’ll explore how Peloton’s shift to AI-driven personalization and holistic wellness solutions could influence its long-term investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Peloton Interactive Investment Narrative Recap

To own shares in Peloton Interactive, investors need confidence in its ability to drive sustained subscriber engagement and revenue growth by transitioning from a hardware-focused model to a holistic, AI-driven wellness platform. The recent product and AI announcements, while substantial, do not fundamentally change the near-term focus: Peloton must address ongoing hardware and subscription declines, the most pressing catalyst and risk. These news updates provide fresh content and differentiation, but are not expected to materially offset subscription headwinds in the short term.

The newly announced partnership with Respin Health stands out, as it expands Peloton’s reach with menopause-focused wellness programming and research. This move directly targets underserved demographics and aligns well with Peloton’s drive to deepen engagement beyond its core customer base, offering a potential spark for new membership growth, though early impacts remain to be seen in subscriber or revenue figures. But while these targeted expansions are timely, the biggest investor consideration remains...

Read the full narrative on Peloton Interactive (it's free!)

Peloton Interactive is projected to reach $2.5 billion in revenue and $113.2 million in earnings by 2028. This scenario assumes a 0.4% annual revenue decline and a $232.1 million increase in earnings from the current level of -$118.9 million.

Uncover how Peloton Interactive's forecasts yield a $10.18 fair value, a 46% upside to its current price.

Exploring Other Perspectives

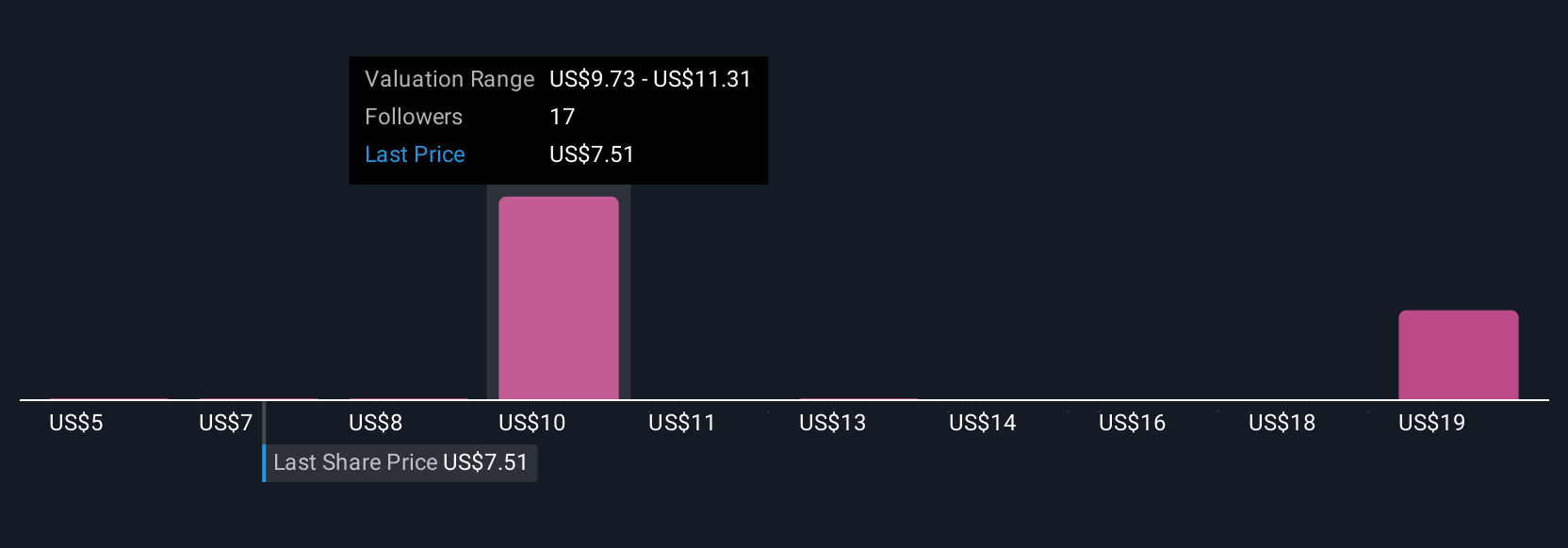

Six private investors in the Simply Wall St Community have set fair value estimates for Peloton between US$5.00 and US$17.80 per share. Meanwhile, competition from low-cost fitness providers could further pressure both pricing and subscriber retention, underlining why opinions on Peloton’s future vary so widely.

Explore 6 other fair value estimates on Peloton Interactive - why the stock might be worth 28% less than the current price!

Build Your Own Peloton Interactive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Peloton Interactive research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Peloton Interactive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Peloton Interactive's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTON

Peloton Interactive

Provides fitness and wellness products and services in North America and internationally.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives