- United States

- /

- Luxury

- /

- NasdaqGS:LULU

Does Lululemon’s Slump After 52% Slide in 2024 Offer a Fresh Opportunity?

Reviewed by Bailey Pemberton

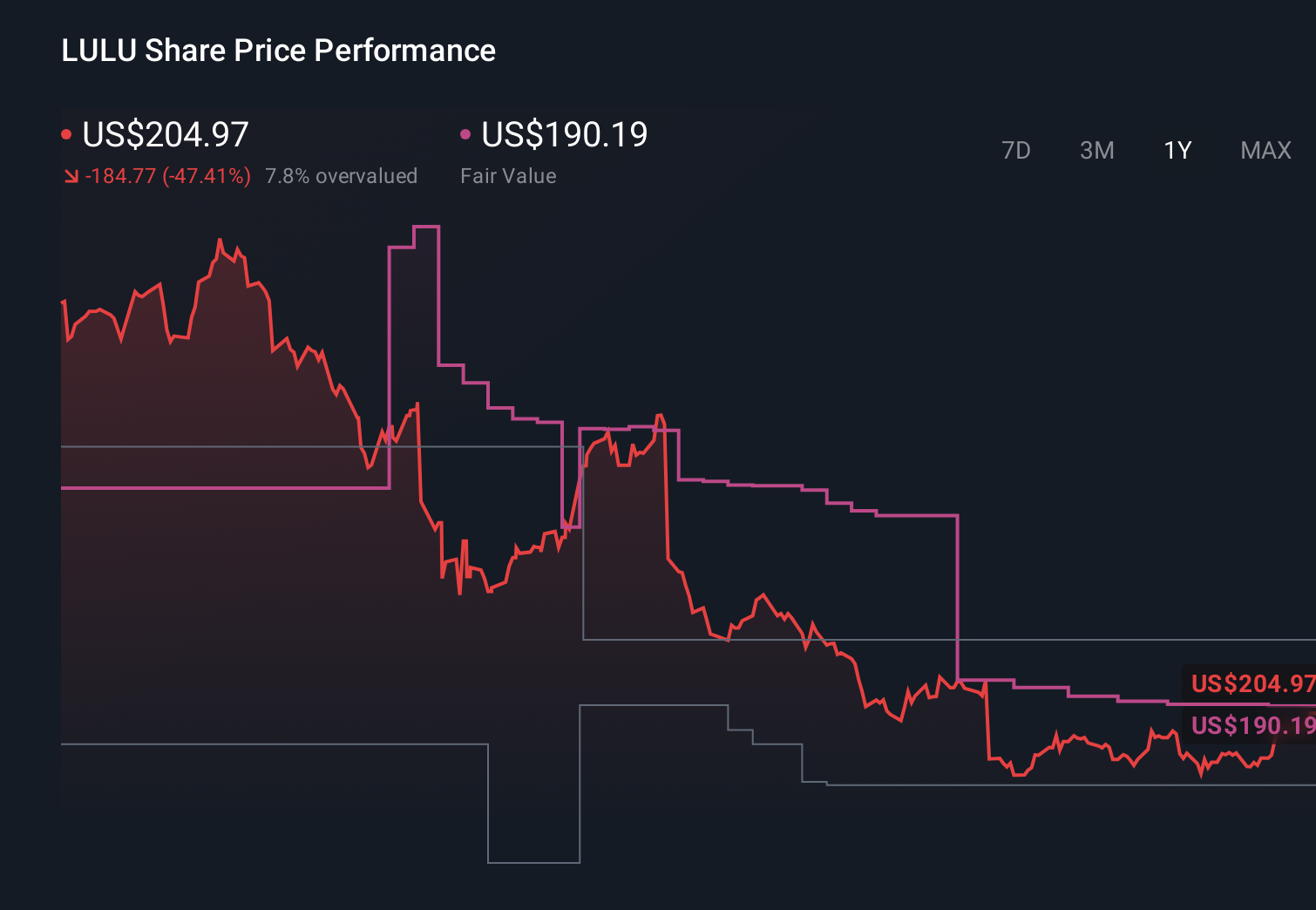

- Wondering whether lululemon athletica is a bargain or a value trap at around $187 a share? You are not alone in trying to make sense of where this stock really belongs.

- Despite a tough run with shares still down 49.8% year to date and 52.0% over the last year, the stock has shown tentative signs of life with a 1.9% gain over the past week and 10.1% over the last month.

- Recent headlines have focused on shifting consumer spending toward experiences and lower price-point athleisure, putting pressure on premium brands like Lululemon and raising questions about how sustainable its growth story really is. At the same time, commentary around competition from newer performance and lifestyle brands has added another layer of uncertainty, which helps explain the stock's volatile path.

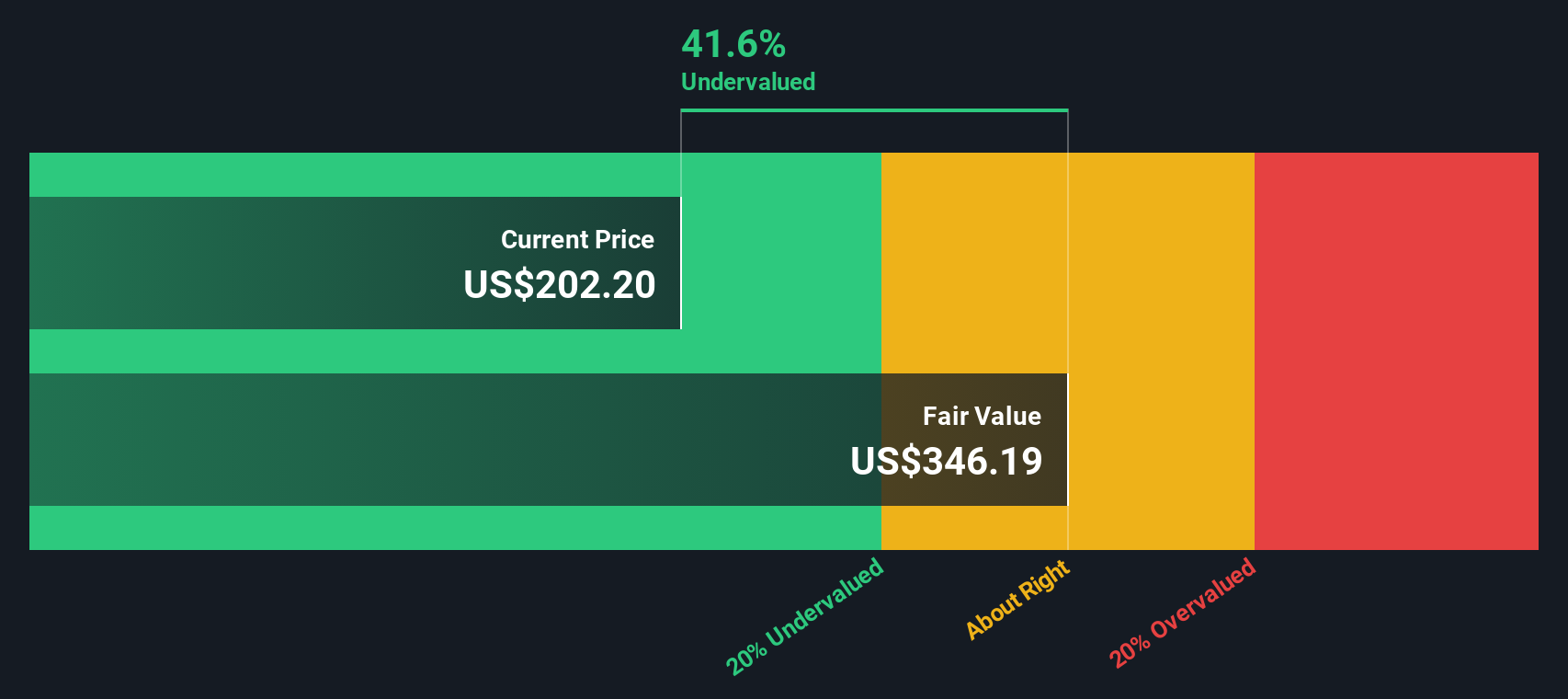

- On our framework, lululemon athletica scores a solid 5/6 valuation score. This suggests it screens as undervalued on most of the checks we run. In the sections ahead, we will break down what that means across different valuation approaches, before exploring a more nuanced way to think about what the market might be missing.

Find out why lululemon athletica's -52.0% return over the last year is lagging behind its peers.

Approach 1: lululemon athletica Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a stock is worth by projecting the company’s future cash flows and then discounting them back into today’s dollars. For lululemon athletica, the model used is a 2 Stage Free Cash Flow to Equity approach, based on cash flows reported and forecast in $.

The company generated trailing twelve month free cash flow of about $1.16 billion, and analysts expect this to rise to roughly $1.60 billion by 2030. The detailed schedule combines analyst forecasts for the next few years with longer term projections extrapolated by Simply Wall St, and reflects a gradual moderation in growth as the business matures.

When these projected cash flows are discounted back, the model arrives at an estimated intrinsic value of about $256.48 per share. Versus the current share price near $187, this implies the stock is roughly 27.1% undervalued, and indicates a potential margin of safety if the cash flow outlook proves accurate.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests lululemon athletica is undervalued by 27.1%. Track this in your watchlist or portfolio, or discover 904 more undervalued stocks based on cash flows.

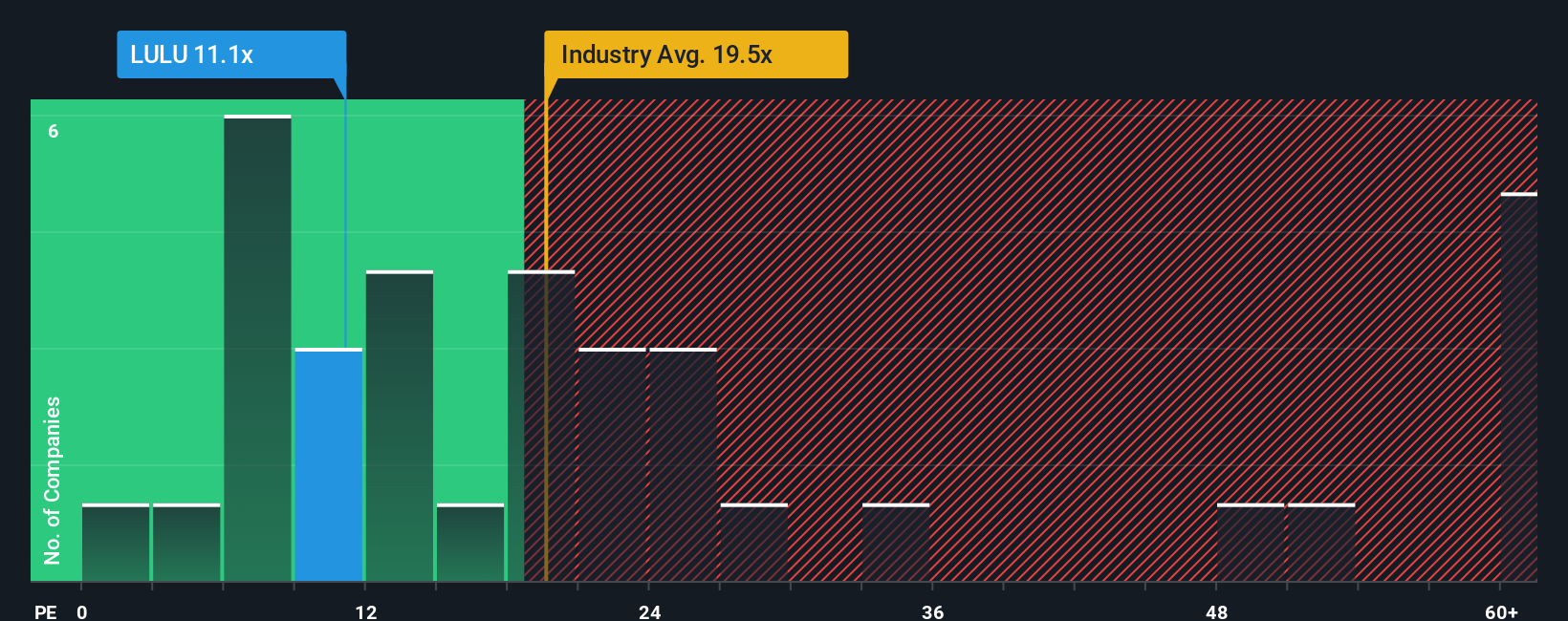

Approach 2: lululemon athletica Price vs Earnings

For profitable businesses like lululemon athletica, the price to earnings, or PE, ratio is a useful way to gauge how much investors are willing to pay today for each dollar of current earnings. In general, companies with stronger, more reliable growth and lower perceived risk can justify higher PE ratios, while slower growing or riskier businesses typically deserve lower ones.

lululemon currently trades on a PE of about 12.4x. That is far below both the broader Luxury industry average of roughly 22.3x and the peer group average near 51.4x, which on the surface makes the stock look inexpensive. However, simply comparing to peers can be misleading, because it does not fully account for differences in growth, margins, size or risk.

To address this, Simply Wall St uses a proprietary Fair Ratio, which estimates the PE a company should trade on once you factor in its earnings growth outlook, industry, profit margins, market capitalization and key risks. For lululemon, the Fair Ratio is 17.3x, meaning the shares trade at a discount to where they might reasonably sit based on those fundamentals. With the actual PE of 12.4x below the 17.3x Fair Ratio, the stock screens as undervalued on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your lululemon athletica Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of lululemon athletica’s story with the numbers behind its future revenue, earnings, margins and, ultimately, its fair value. A Narrative on Simply Wall St’s Community page lets you spell out what you think will actually happen to the business, turns that into a transparent financial forecast, and then compares the resulting Fair Value to today’s Price so you can decide whether to buy, hold or sell. Because Narratives update dynamically when new information like earnings, guidance or news hits the market, they stay aligned with the latest facts instead of going stale. For example, one lululemon Narrative currently assumes a fair value near $225 per share with stronger growth and a lower discount rate. In contrast, a more cautious Narrative puts fair value closer to $190 with slower growth and higher risk, illustrating how different but well argued perspectives can coexist and help you choose which story you believe.

Do you think there's more to the story for lululemon athletica? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if lululemon athletica might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LULU

lululemon athletica

Designs, distributes, and retails technical athletic apparel, footwear, and accessories for women and men under the lululemon brand in the United States, Canada, Mexico, China Mainland, Hong Kong, Taiwan, Macau, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion