- United States

- /

- Consumer Durables

- /

- NasdaqCM:LSEA

Investors Give Landsea Homes Corporation (NASDAQ:LSEA) Shares A 25% Hiding

Landsea Homes Corporation (NASDAQ:LSEA) shares have had a horrible month, losing 25% after a relatively good period beforehand. Looking at the bigger picture, even after this poor month the stock is up 65% in the last year.

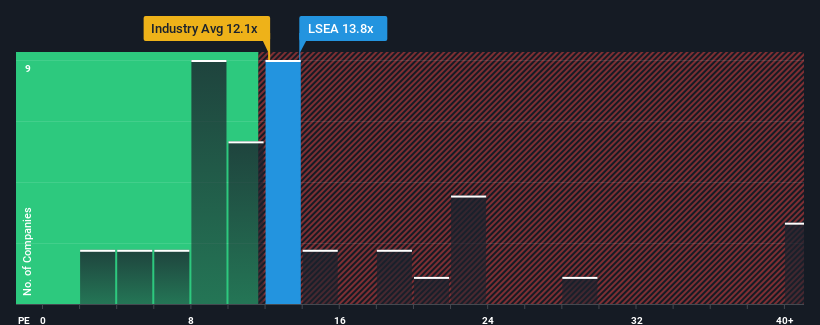

Although its price has dipped substantially, Landsea Homes may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 13.8x, since almost half of all companies in the United States have P/E ratios greater than 18x and even P/E's higher than 32x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Landsea Homes has been struggling lately as its earnings have declined faster than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Landsea Homes

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Landsea Homes would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 55%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to climb by 54% during the coming year according to the three analysts following the company. That's shaping up to be materially higher than the 12% growth forecast for the broader market.

With this information, we find it odd that Landsea Homes is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Landsea Homes' P/E has taken a tumble along with its share price. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Landsea Homes' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Landsea Homes (at least 1 which is a bit unpleasant), and understanding them should be part of your investment process.

Of course, you might also be able to find a better stock than Landsea Homes. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LSEA

Landsea Homes

Engages in the design, construction, marketing, and sale of suburban and urban single-family detached and attached homes in Arizona, California, Colorado, Florida, Texas, and Metro New York.

Slight with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives