- United States

- /

- Consumer Durables

- /

- NasdaqCM:LSEA

A Piece Of The Puzzle Missing From Landsea Homes Corporation's (NASDAQ:LSEA) 40% Share Price Climb

Landsea Homes Corporation (NASDAQ:LSEA) shareholders would be excited to see that the share price has had a great month, posting a 40% gain and recovering from prior weakness. Notwithstanding the latest gain, the annual share price return of 9.6% isn't as impressive.

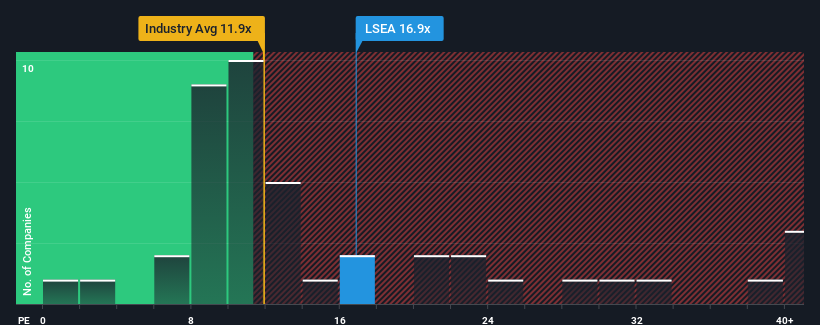

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Landsea Homes' P/E ratio of 16.9x, since the median price-to-earnings (or "P/E") ratio in the United States is also close to 18x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times haven't been advantageous for Landsea Homes as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Landsea Homes

How Is Landsea Homes' Growth Trending?

The only time you'd be comfortable seeing a P/E like Landsea Homes' is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 55%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 55% as estimated by the four analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 14%, which is noticeably less attractive.

With this information, we find it interesting that Landsea Homes is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Landsea Homes appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Landsea Homes' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you take the next step, you should know about the 4 warning signs for Landsea Homes (1 can't be ignored!) that we have uncovered.

Of course, you might also be able to find a better stock than Landsea Homes. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LSEA

Landsea Homes

Engages in the design, construction, marketing, and sale of suburban and urban single-family detached and attached homes in Arizona, California, Colorado, Florida, Texas, and Metro New York.

Slight with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives