- United States

- /

- Consumer Durables

- /

- NasdaqGS:LGIH

Why LGI Homes (LGIH) Is Down 6.1% After Launching New Atherstone Floor Plans and Incentives

Reviewed by Simply Wall St

- LGI Homes recently celebrated the grand opening of a new phase at its Atherstone community in Angier, North Carolina, unveiling six upgraded floor plans along with limited-time incentives and enhanced amenities for homebuyers.

- This launch highlights LGI Homes' ongoing focus on expanding offerings with premium features at accessible price points, targeting buyers in growth markets with community-focused investments.

- We'll examine how the introduction of six new floor plans at Atherstone fits into LGI Homes' longer-term growth strategy and investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

LGI Homes Investment Narrative Recap

To be a shareholder in LGI Homes, you need confidence in the long-term demand for entry-level homes and the company’s ability to grow community count despite margin and revenue headwinds. The newly launched Atherstone phase with six upgraded floor plans in Angier, NC, signals ongoing commitment to new community openings, a key short-term catalyst, but does not materially shift the biggest current risk: persistent margin pressure from sales incentives and market uncertainty.

Among recent news, the launch of three new floor plans at The Valley in Elgin, SC closely echoes the Atherstone announcement, both emphasizing LGI Homes’ expansion into growth markets with upgraded, move-in-ready offerings. These incremental community and product launches are important for replenishing LGI Homes’ sales pipeline while tackling margin and execution challenges that remain front of mind for investors.

However, while new communities could help drive revenue, investors should also be mindful that larger sales incentives to attract buyers can continue to erode earnings...

Read the full narrative on LGI Homes (it's free!)

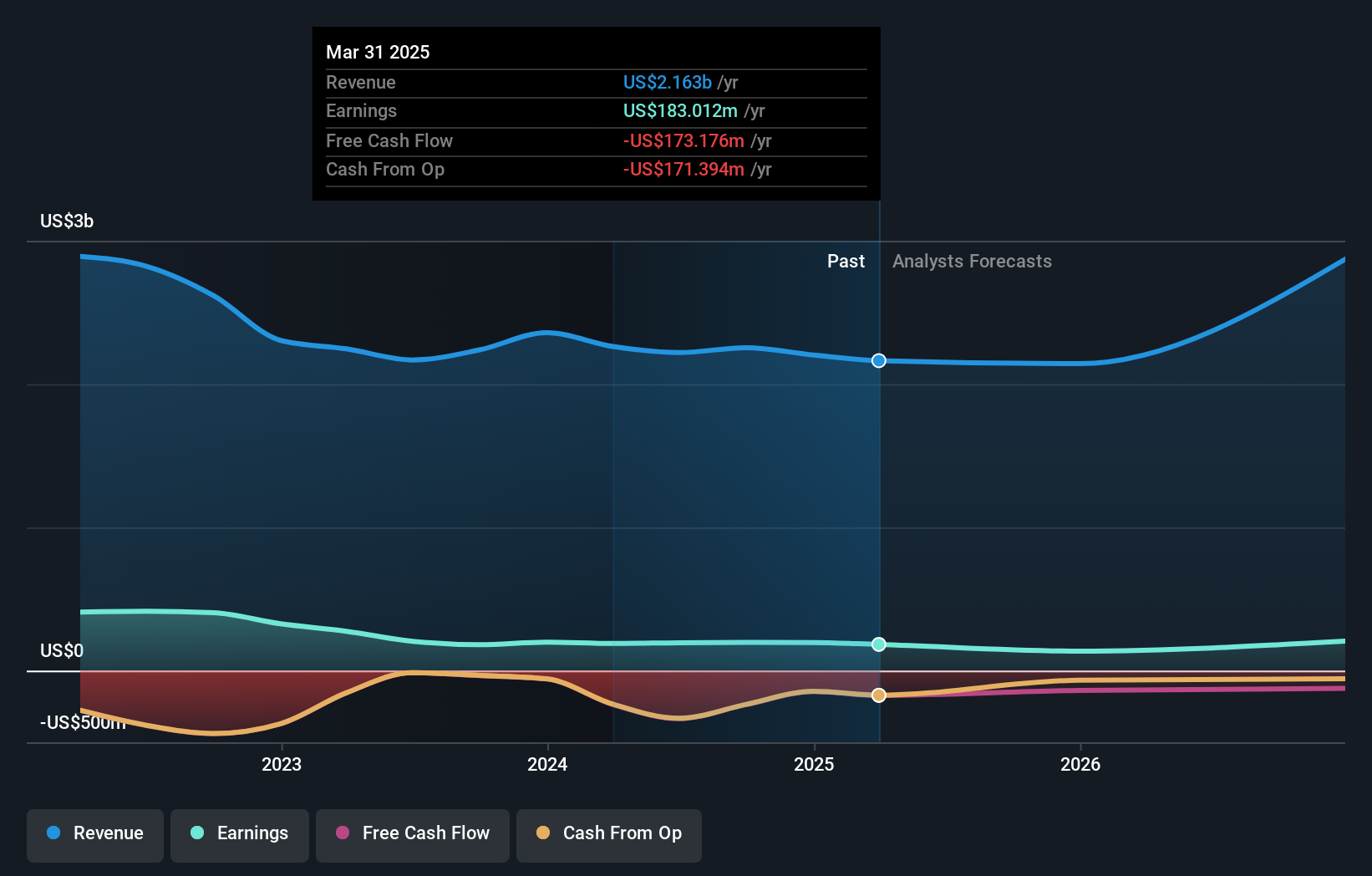

LGI Homes' outlook anticipates $3.4 billion in revenue and $247.7 million in earnings by 2028. This is based on a 16.2% annual revenue growth rate and a $64.7 million increase in earnings from the current $183.0 million.

Uncover how LGI Homes' forecasts yield a $102.37 fair value, a 100% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 1 fair value estimate for LGI Homes at US$102.37, reflecting a single perspective. Ongoing margin risks, particularly from increased sales incentives, could impact future company performance, review more community viewpoints to form your own opinion.

Explore another fair value estimate on LGI Homes - why the stock might be worth just $102.37!

Build Your Own LGI Homes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LGI Homes research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free LGI Homes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LGI Homes' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LGIH

LGI Homes

Engages in the design, construction, and sale of homes in the United States.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives