- United States

- /

- Consumer Durables

- /

- NasdaqGS:LGIH

What LGI Homes (LGIH)'s Nationwide Community Rollout Means For Shareholders

Reviewed by Sasha Jovanovic

- In recent days, LGI Homes announced the unveiling of new floor plans and the opening of multiple new communities across Utah, Minnesota, Florida, Tennessee, and Washington, highlighting its focus on geographic and product expansion.

- These launches reflect LGI Homes’ push to broaden its reach nationally with a mix of townhomes, luxury, and affordable single-family options tailored to distinct regional markets.

- We'll review how this nationwide rollout of new communities and home designs could reshape LGI Homes’ investment narrative going forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

LGI Homes Investment Narrative Recap

To be a shareholder in LGI Homes, you typically need to believe in a recovery of entry-level housing demand, supported by demographic trends and a persistent need for affordable new homes. While the recent wave of new community launches and upgraded home designs shows LGI's commitment to broadening its product mix and geographical footprint, these actions have not yet shifted the company's most pressing short-term catalyst, the pace of absorption among first-time buyers as affordability remains under pressure. The biggest risk continues to be softening sales velocity if high rates and home costs keep many potential customers on the sidelines.

Among the recent developments, the unveiling of four new floor plans at Oquirrh Mountain Ranch in Utah stands out. This announcement is particularly relevant, as it highlights LGI’s approach to adaptability: offering layouts with a mix of sizes and features, including the CompleteHome™ package, at a time when buyers are prioritizing both value and flexibility. By addressing a broader range of needs within the entry-level and move-up market, LGI may have a better chance of maintaining absorption rates, which is key for earnings stability.

But while expansion into new regions and products aims to offset headwinds, investors should be aware that the company’s recent cancellation rates and slower community absorption could still...

Read the full narrative on LGI Homes (it's free!)

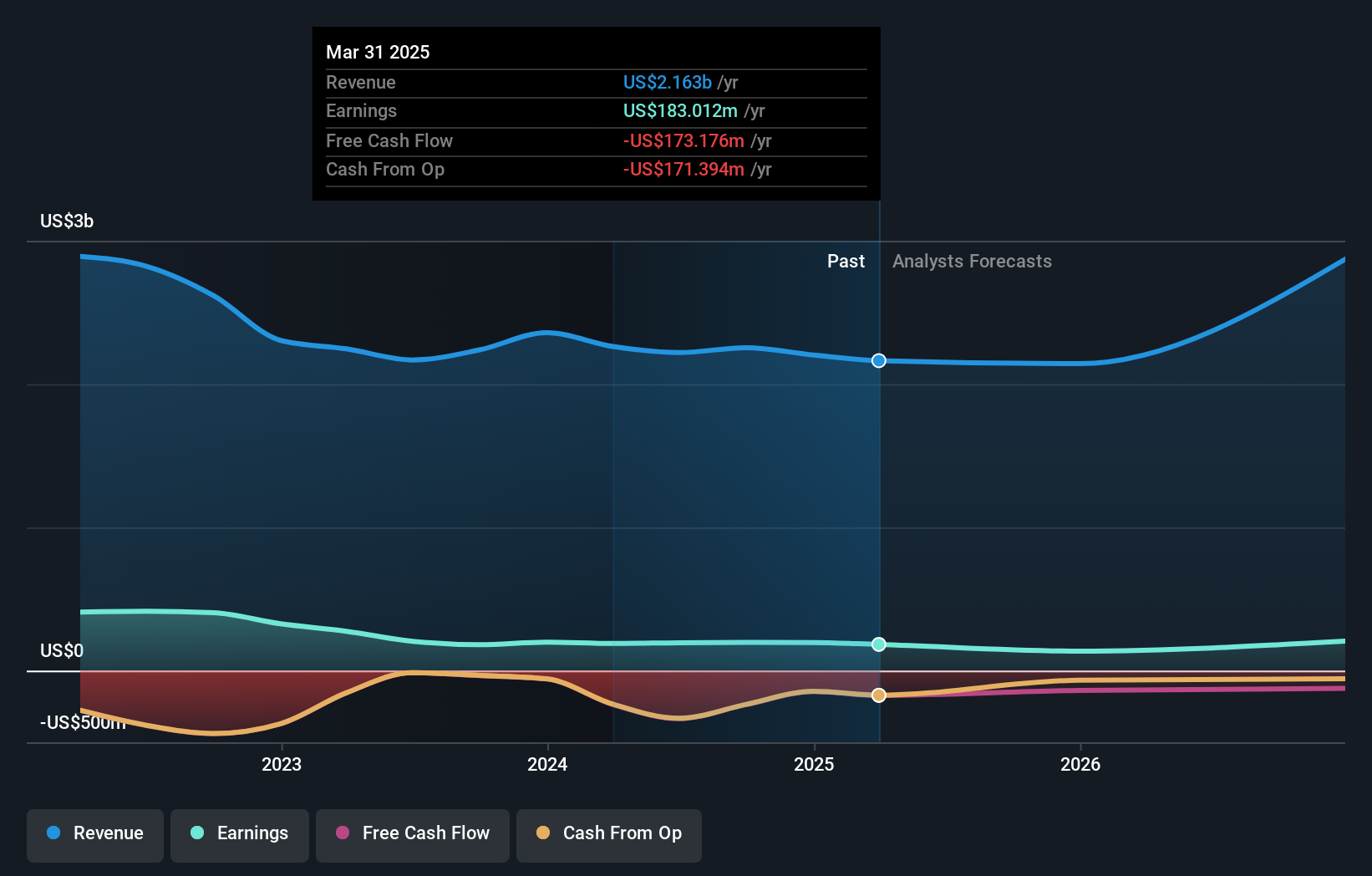

LGI Homes is projected to reach $2.8 billion in revenue and $178.8 million in earnings by 2028. This reflects a 10.5% annual revenue growth rate and a $22.8 million earnings increase from the current $156.0 million.

Uncover how LGI Homes' forecasts yield a $75.67 fair value, a 66% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community submitted one fair value estimate for LGI Homes, clustering strongly at US$75.67. Keep in mind, ongoing affordability pressures still challenge the pace of home sales, explore how other investors view the road ahead.

Explore another fair value estimate on LGI Homes - why the stock might be worth as much as 66% more than the current price!

Build Your Own LGI Homes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LGI Homes research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free LGI Homes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LGI Homes' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LGIH

LGI Homes

Engages in the design, construction, and sale of homes in the United States.

Fair value with limited growth.

Similar Companies

Market Insights

Community Narratives