- United States

- /

- Consumer Durables

- /

- NasdaqGS:LGIH

Is Increased Scrutiny of Sales Practices Shifting the Investment Narrative for LGI Homes (LGIH)?

Reviewed by Sasha Jovanovic

- In recent weeks, LGI Homes reported September and third-quarter 2025 home closings while also responding to critical media coverage alleging deceptive sales tactics and higher foreclosure rates among its buyers.

- New floor plans and community expansions have been announced, but operational updates and negative media reports on business practices have sharpened investor focus on the company's sales quality and affordability claims.

- We'll explore how the combination of sales reporting and scrutiny over lending practices may alter LGI Homes' investment outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

LGI Homes Investment Narrative Recap

To view LGI Homes as an investment, you need confidence in the return of affordable entry-level housing demand, supported by younger buyers and market stabilization. The recent news about negative media reports surrounding LGI’s marketing and foreclosures intensifies the spotlight on sales quality, potentially creating near-term share price volatility, but the main catalyst remains the company’s ability to sustain home closings despite affordability headwinds; the biggest risk is any further erosion of buyer trust or tightening in mortgage standards impacting absorption and margins.

Against this backdrop, LGI’s September announcement of new floor plans at Lago Mar directly addresses affordability, with homes starting at US$289,900 including upgrades once seen as extras. While this broadens LGI’s reach and could reinforce its core thesis of attracting entry-level buyers, persistent scrutiny may continue to influence perceptions just as new sales activity picks up into the year-end catalyst.

Yet, beneath headline expansion, investors should watch for signals that point to...

Read the full narrative on LGI Homes (it's free!)

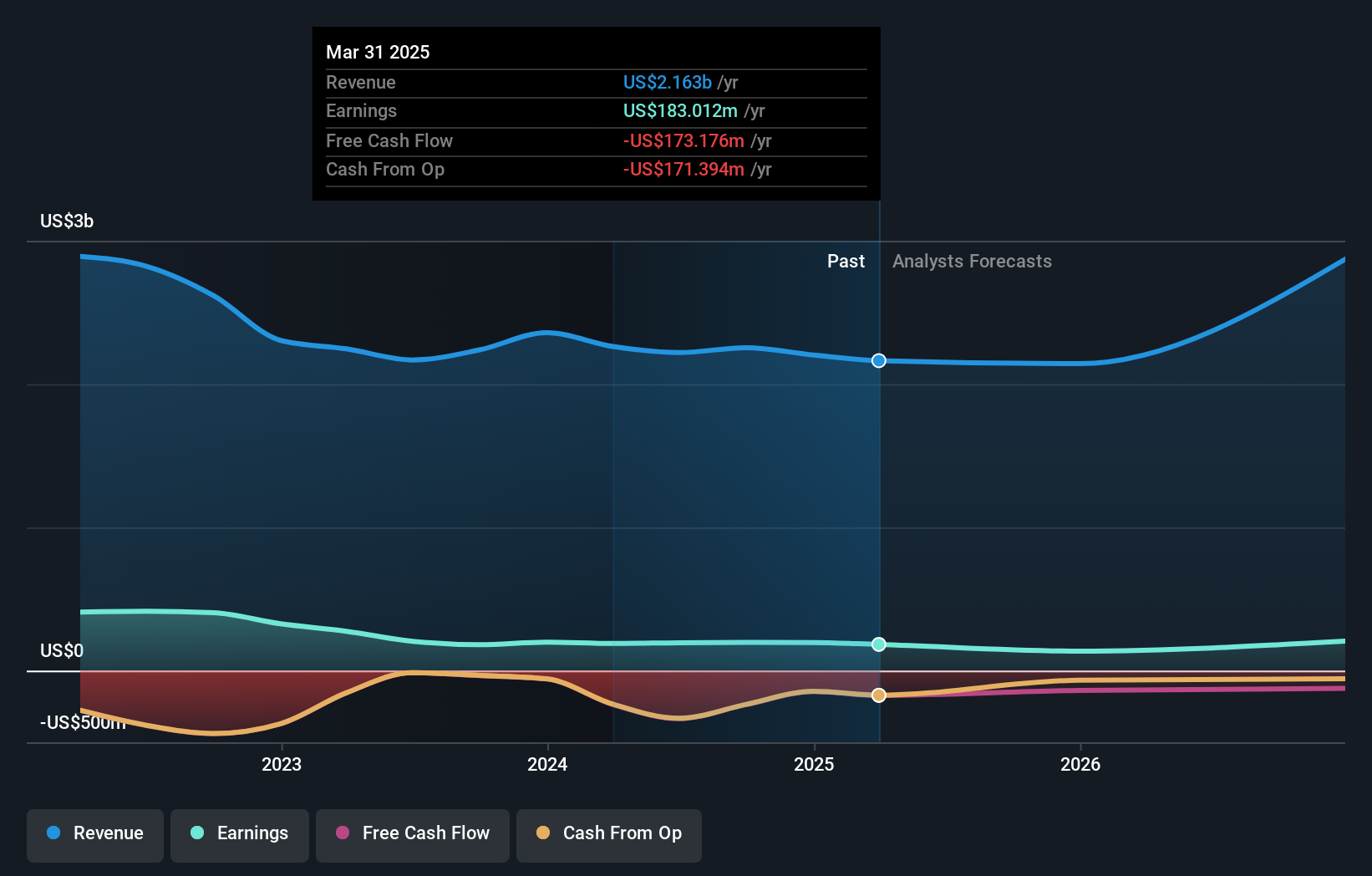

LGI Homes' outlook anticipates $2.8 billion in revenue and $178.8 million in earnings by 2028. This scenario assumes a 10.5% annual revenue growth rate and an earnings increase of $22.8 million from current earnings of $156.0 million.

Uncover how LGI Homes' forecasts yield a $75.67 fair value, a 42% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members pegged LGI Homes’ fair value at US$75.67, but only one estimate was submitted. With ongoing scrutiny of LGI’s affordability claims, you’ll find sharply different opinions on the company’s future in the market and among your peers.

Explore another fair value estimate on LGI Homes - why the stock might be worth as much as 42% more than the current price!

Build Your Own LGI Homes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LGI Homes research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free LGI Homes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LGI Homes' overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LGIH

LGI Homes

Engages in the design, construction, and sale of homes in the United States.

Fair value with limited growth.

Similar Companies

Market Insights

Community Narratives