- United States

- /

- Consumer Durables

- /

- NasdaqGS:LCUT

Alto Ingredients And 2 Other Penny Stocks With Promising Potential

Reviewed by Simply Wall St

As the U.S. stock market experiences mixed movements, with tech stocks pushing indices higher and Treasury yields sliding on soft jobs data, investors are keenly observing potential opportunities across various sectors. Penny stocks, often representing smaller or newer companies, continue to capture attention due to their potential for significant returns despite their somewhat outdated label. In this article, we explore three penny stocks that combine financial resilience with promising growth prospects, offering investors a chance to uncover hidden value in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.12 | $441.47M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.76 | $622.06M | ✅ 4 ⚠️ 0 View Analysis > |

| VTEX (VTEX) | $4.03 | $742.41M | ✅ 3 ⚠️ 1 View Analysis > |

| WM Technology (MAPS) | $1.14 | $212.07M | ✅ 4 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $1.83 | $23.5M | ✅ 4 ⚠️ 2 View Analysis > |

| Table Trac (TBTC) | $4.892 | $22.5M | ✅ 2 ⚠️ 2 View Analysis > |

| Riverview Bancorp (RVSB) | $4.93 | $106M | ✅ 2 ⚠️ 1 View Analysis > |

| BAB (BABB) | $0.9595 | $6.9M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.20 | $89.5M | ✅ 3 ⚠️ 3 View Analysis > |

| TETRA Technologies (TTI) | $4.76 | $626.41M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 375 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Alto Ingredients (ALTO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Alto Ingredients, Inc. is involved in the production, distribution, and marketing of specialty alcohols, renewable fuel, and essential ingredients in the United States with a market cap of approximately $87.46 million.

Operations: The company's revenue is primarily derived from Pekin Campus Production at $576.59 million, Western Production at $150.51 million, and Marketing and Distribution activities contributing $209.62 million.

Market Cap: $87.46M

Alto Ingredients faces challenges typical of penny stocks, with recent earnings showing a net loss of US$11 million for Q2 2025 and increased losses over the past five years. Despite this, the company maintains a strong liquidity position, as its short-term assets exceed both short- and long-term liabilities. The board has seen recent changes, potentially bringing fresh strategic perspectives. While management is relatively new with an average tenure of 2.1 years, their experience could help navigate profitability issues. The company's debt-to-equity ratio has improved significantly over five years, indicating progress in financial management despite ongoing unprofitability concerns.

- Unlock comprehensive insights into our analysis of Alto Ingredients stock in this financial health report.

- Examine Alto Ingredients' earnings growth report to understand how analysts expect it to perform.

Lifetime Brands (LCUT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Lifetime Brands, Inc. designs, sources, and sells branded kitchenware and tableware for home use both in the United States and internationally, with a market cap of $89.50 million.

Operations: The company's revenue is primarily derived from the U.S. market, including retail direct sales, totaling $614.04 million, with an additional $56.95 million generated internationally.

Market Cap: $89.5M

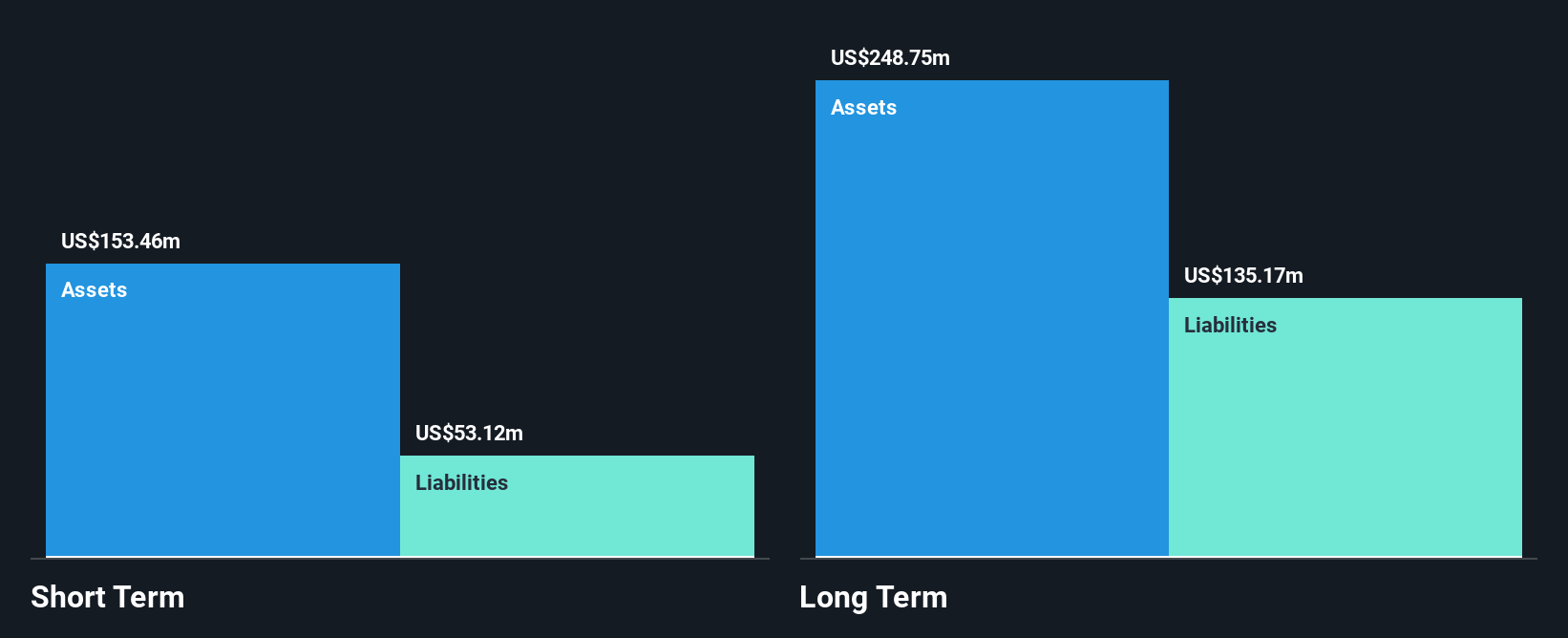

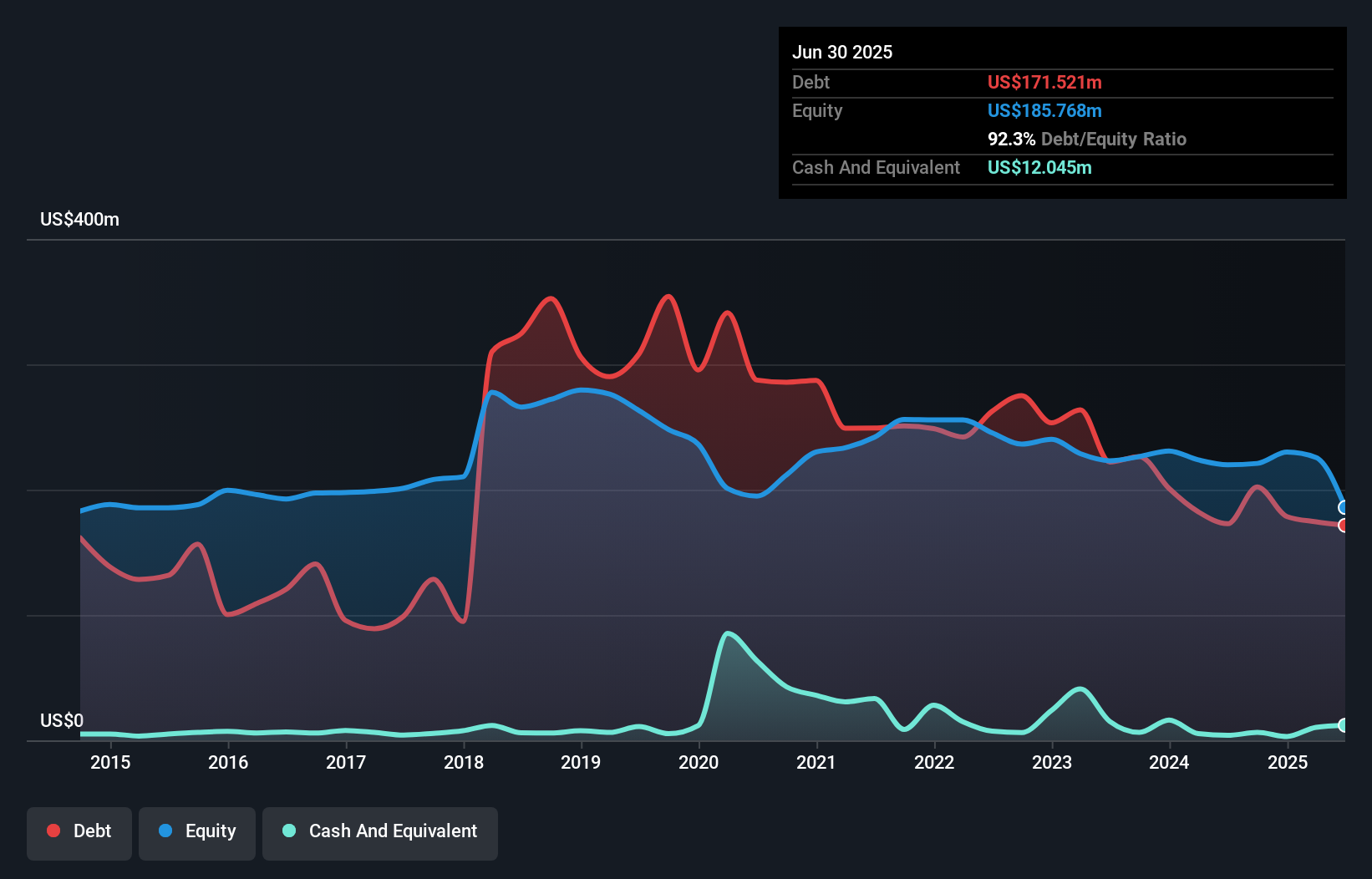

Lifetime Brands, Inc. is navigating the complexities of penny stocks with its market cap at US$89.50 million and a focus on U.S.-derived revenue of US$614.04 million. Despite trading at a value 42.3% below estimated fair value, the company remains unprofitable, with increased net losses reported in recent earnings results for Q2 2025. The company's high net debt to equity ratio of 85.8% raises financial concerns, though it has improved over five years from 147.5%. Lifetime Brands maintains a cash runway exceeding three years and continues to pay quarterly dividends despite being dropped from several Russell indices recently.

- Jump into the full analysis health report here for a deeper understanding of Lifetime Brands.

- Assess Lifetime Brands' future earnings estimates with our detailed growth reports.

FDCTech (FDCT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: FDCTech, Inc. is a technology provider and software developer focused on digital assets, with a market capitalization of $38.03 million.

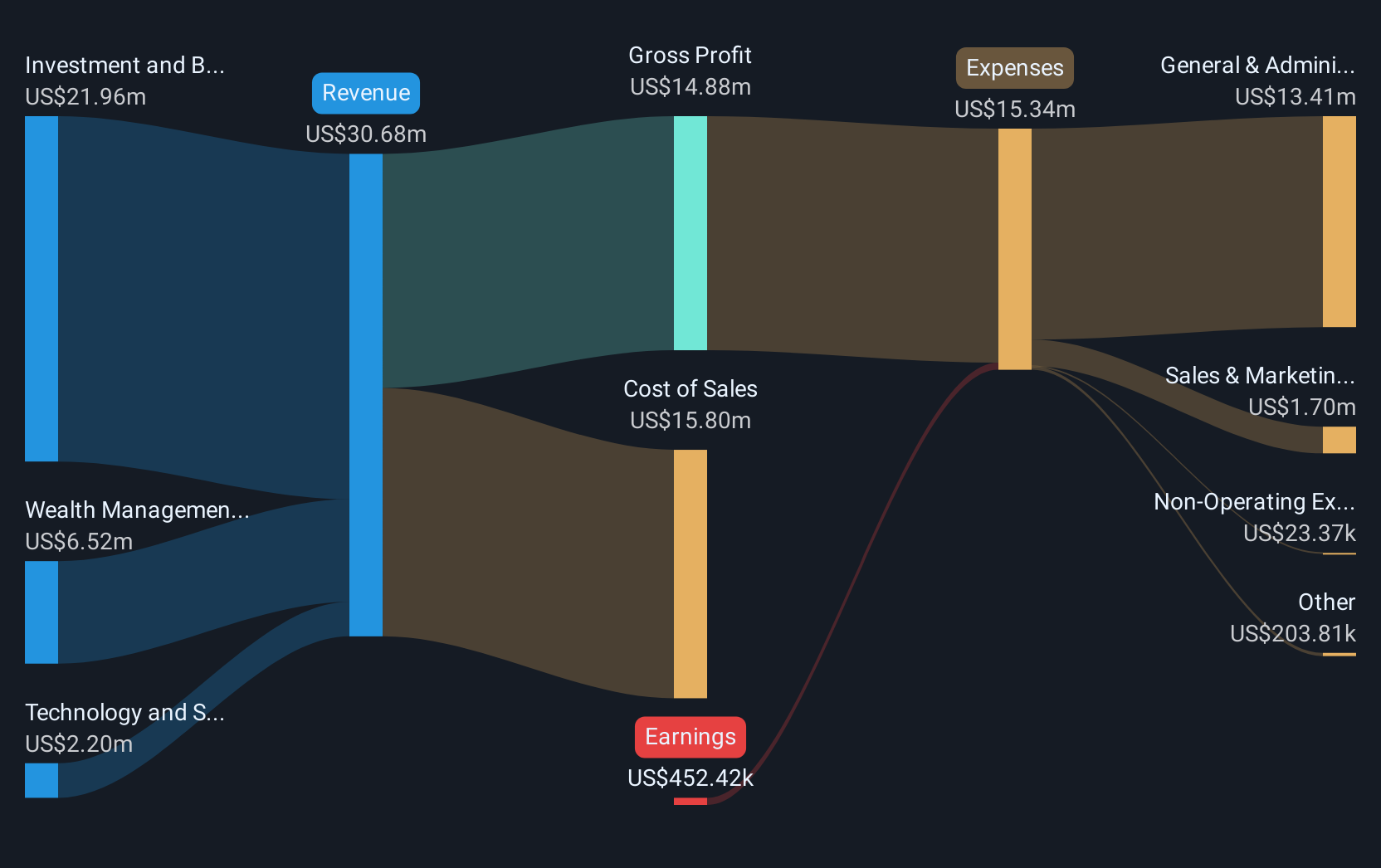

Operations: FDCT's revenue is derived from three main segments: Wealth Management ($6.43 million), Investment and Brokerage ($16.32 million), and Technology and Software Development ($3.09 million).

Market Cap: $38.03M

FDCTech, Inc. operates in the volatile penny stock space with a market cap of US$38.03 million and recent sales of US$11.41 million for the first half of 2025, down from the previous year. Despite being unprofitable, it has reduced losses significantly over five years and has more cash than total debt, indicating financial prudence. The company recently expanded its global reach by establishing a subsidiary in Mauritius to enhance international operations, aligning with its strategic growth objectives across Asia, the Middle East, and Africa. However, FDCTech's share price remains highly volatile despite reduced weekly volatility over the past year.

- Click here and access our complete financial health analysis report to understand the dynamics of FDCTech.

- Gain insights into FDCTech's historical outcomes by reviewing our past performance report.

Seize The Opportunity

- Explore the 375 names from our US Penny Stocks screener here.

- Want To Explore Some Alternatives? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LCUT

Lifetime Brands

Designs, sources, and sells branded kitchenware, tableware, and other products for use in the home in the United States and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives