- United States

- /

- Consumer Durables

- /

- NasdaqGS:HELE

Helen of Troy (HELE): Evaluating Valuation After Earnings Cut and 2026 Margin Warnings

Reviewed by Kshitija Bhandaru

Helen of Troy (HELE) issued new guidance signaling declines in both quarterly and full-year earnings and sales. Management warned that ongoing cost pressures and tariff disruptions will continue to challenge results across fiscal 2026.

See our latest analysis for Helen of Troy.

Helen of Troy’s share price has been on a steep slide this year, with a 7-day share price return of -22.09% following the recent earnings warning and a year-to-date return of -65.4%. Strategic moves, such as bringing in a new CEO and efforts to stabilize operations, have yet to win back investor confidence. This is reflected in the 1-year total shareholder return of -71.2%. Momentum remains weak, and challenges around margins, sales, and cost pressures continue to shape the longer-term picture.

If you’re looking for stocks with more upbeat momentum, it could be a great time to broaden your search and discover fast growing stocks with high insider ownership

The market has reacted swiftly to Helen of Troy's guidance cut and profitability warnings. With the share price down sharply, is the worst already reflected in the valuation, or is there a genuine opportunity for patient investors?

Most Popular Narrative: 46.3% Undervalued

With the narrative assigning fair value well above Helen of Troy’s latest closing price, the potential upside is hard to ignore, especially as the market digests recent turmoil. The estimates reflect both cost-saving strategies and expectations for a future profit rebound, setting the stage for a deep dive into the narrative’s main catalysts.

"Helen of Troy's ongoing supply chain diversification efforts, particularly moving production out of China, are expected to mitigate tariff impacts and help stabilize costs, which should positively affect net margins. The company's focus on re-evaluated SKU prioritization and promotional pricing plans, in partnership with retailers, aims to enhance profitability by emphasizing high-margin, high-demand products, potentially improving net margins."

Want to know the secret sauce behind this bullish price? The narrative banks on a radical turnaround, powered by margin uplift and bold efficiency gains. Are the financial projections fueling this optimism as achievable as they sound? Peek inside to catch the strategy fueling this attention-grabbing value call.

Result: Fair Value of $38.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing supply chain disruptions and mounting operational costs could quickly undermine the upbeat outlook if these risks escalate further.

Find out about the key risks to this Helen of Troy narrative.

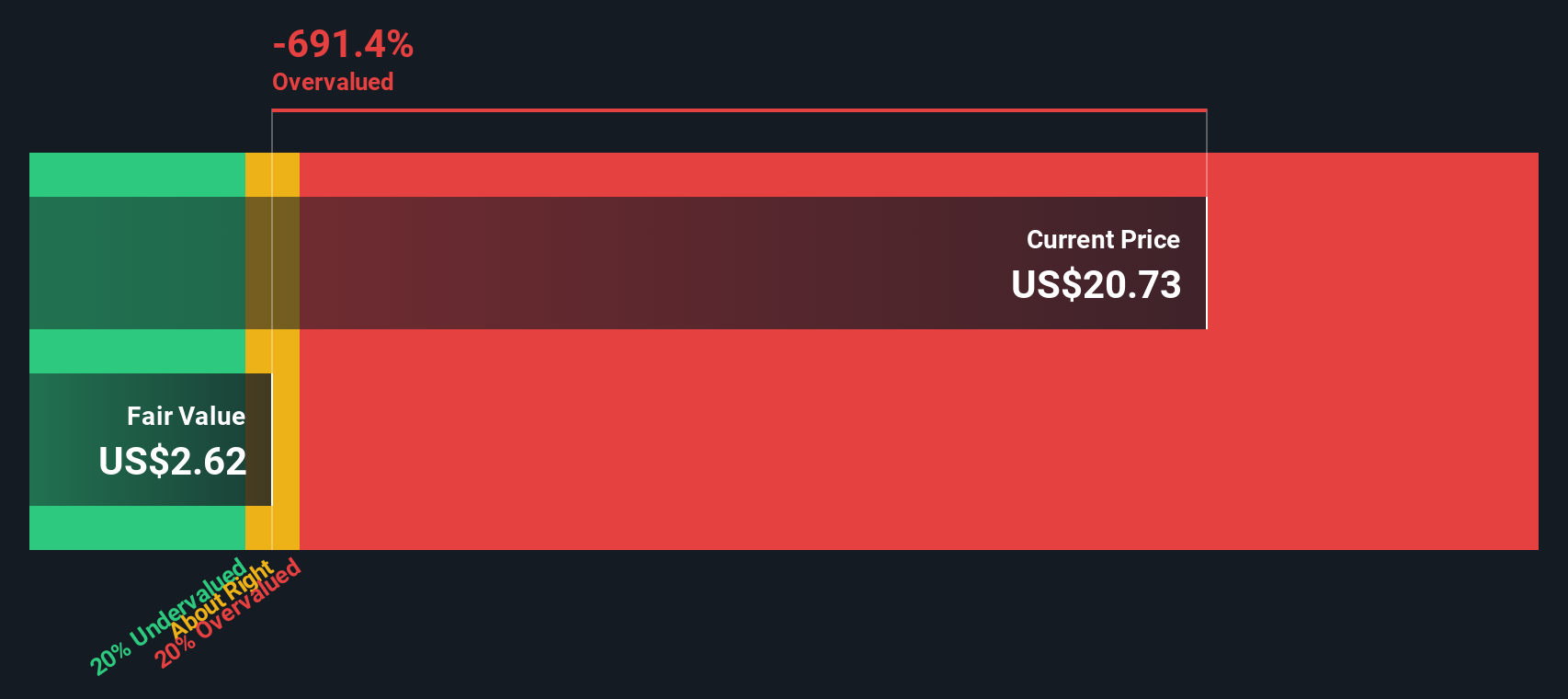

Another View: Discounted Cash Flow Tells a Different Story

While the analyst consensus points to Helen of Troy being undervalued, our SWS DCF model sees things differently, indicating the company is trading well above its estimated fair value. This divergence between methods raises an important question: how much trust can you place in future earnings projections versus current fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Helen of Troy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Helen of Troy Narrative

If this perspective doesn’t align with your own, or you enjoy putting the data to the test yourself, crafting a custom narrative takes just a few minutes. Do it your way.

A great starting point for your Helen of Troy research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for More Smart Investment Moves?

Why limit your investing to just one idea? Supercharge your portfolio by using Simply Wall Street’s expert screeners to uncover standout opportunities tailored to your goals.

- Tap into tomorrow’s innovation by targeting the brightest advances with these 24 AI penny stocks, which are leading the charge in artificial intelligence breakthroughs.

- Maximize your potential returns and focus on value by reviewing these 892 undervalued stocks based on cash flows, packed with strong fundamentals and attractive price points.

- Boost your income by locking in yield with these 19 dividend stocks with yields > 3%, featuring companies offering regular, high-paying dividends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Helen of Troy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HELE

Helen of Troy

Provides various consumer products in the United States, Canada, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives