- United States

- /

- Leisure

- /

- NasdaqGS:HAS

Hasbro (HAS): Evaluating Valuation After Boston Relocation and New Disney Partnership Announcements

Reviewed by Simply Wall St

If you’re wondering what to make of Hasbro (HAS) after a flurry of major announcements, you’re not alone. The company’s decision to relocate its Rhode Island operations to Boston’s Seaport District is a significant step, aimed at fueling innovation and making Hasbro an even bigger draw for top talent. Add expanded brand partnerships, including a deeper collaboration with Disney and fresh launches of iconic names like EASY-BAKE and PLAYSKOOL at Walmart, and you have a company clearly focused on recharging its core business and pushing into new territory.

For shareholders, the moves come on the back of a strong year in the stock. Over the past year, Hasbro’s shares are up roughly 22%, with momentum building. Shares are up 15% in the past three months and more than 40% year-to-date. Recent launches and strategic shifts are sending signals that the company is serious about longer-term growth, though swings earlier in the year have shown investors remain sensitive to how these moves translate into actual performance.

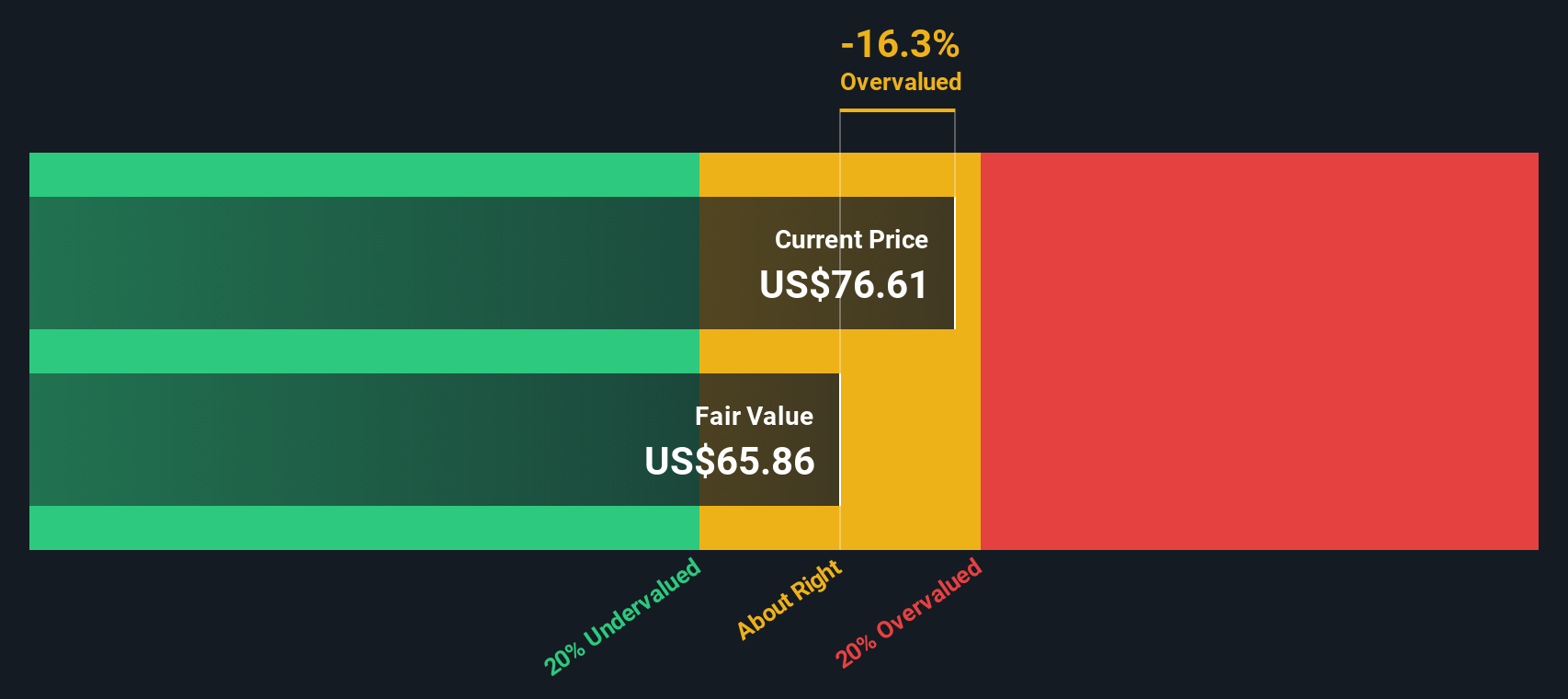

So the big question is, with shares already rallying this year, is Hasbro undervalued after this burst of activity, or are investors already baking future growth into the current price?

Most Popular Narrative: 4076.8% Overvalued

According to the most widely discussed narrative, Hasbro's current valuation is far detached from business reality, with the stock considered vastly overvalued compared to fair value.

Almost none of these brands I listed are making a profit. Yes, I am oversimplifying their stories, but a deep dive into each of them would render novels hundreds of pages thick, brimming with examples of these brands being underutilized and damaged because of poor business decisions.

Think you understand Hasbro's true worth? There is a twist that turns the usual financials on their head. The narrative draws from dramatic changes in forward earnings and a radical recalibration of future profit margins, leading to its shocking conclusion. Curious what drives the mountain of overvaluation claims, or which assumptions are behind this massive mismatch? Press on to see the controversial calculations that set this price target.

Result: Fair Value of $1.90 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a sudden turnaround in key brands or unexpected licensing revenue growth could quickly challenge even the most bearish outlook.

Find out about the key risks to this Hasbro narrative.Another View: What Does the SWS DCF Model Say?

While the popular narrative paints Hasbro as highly overvalued, our SWS DCF model offers a strikingly different perspective. This approach suggests the shares may actually be trading below estimated fair value. Which story matches reality: numbers or narrative?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Hasbro Narrative

If you have your own perspective or want to dig into the details yourself, you can build your own Hasbro view in just a few minutes. Do it your way

A great starting point for your Hasbro research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Smart Investment Ideas?

Don’t let great opportunities slip by. Use the Simply Wall Street Screener to quickly access stocks backed by solid trends and future-focused insights. Open up new possibilities now, before they take off.

- Grow your wealth with steady income by scanning for promising dividend stocks with yields > 3% that consistently deliver yields above 3%.

- Ride the momentum of tomorrow’s innovation by pinpointing groundbreaking quantum computing stocks that are making waves in the quantum computing space.

- Target long-term winners by uncovering smartly priced undervalued stocks based on cash flows based on their future cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hasbro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:HAS

Hasbro

Operates as a toy and game company in the United States, Europe, Canada, Mexico, Latin America, Australia, China, and Hong Kong.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion