- United States

- /

- Leisure

- /

- NasdaqGS:HAS

Hasbro (HAS): Assessing Valuation After Latest Financial Update and Share Price Swing

Reviewed by Kshitija Bhandaru

See our latest analysis for Hasbro.

Hasbro’s stock has been on a bit of a rollercoaster this year, with a one-day share price drop of nearly 5% following its recent update, but also a strong year-to-date share price return of 25.7%. In the bigger picture, total shareholder return over the past three years stands at a healthy 22.3%, showing momentum despite some volatility in recent months.

If you’re weighing your next move, now is a smart time to broaden your search and discover fast growing stocks with high insider ownership

So, with Hasbro now trading at a clear discount to analyst targets and posting strong net income growth, is there a hidden buying opportunity here? Or is the market already factoring in the company’s future prospects?

Most Popular Narrative: 20% Undervalued

Hasbro’s most-followed valuation narrative places fair value around $89, with shares last closing at $70.95. The difference highlights analyst conviction in recovery and growth despite ongoing volatility.

“Rapidly growing cross-platform digital gaming and licensing revenue, exemplified by Wizards of the Coast (notably Magic: The Gathering's 23%+ YoY growth and MONOPOLY GO!), is expanding Hasbro's addressable market and recurring high-margin earnings streams. This positions the company to capitalize on the global rise of digital entertainment, which should drive outsized revenue and operating profit growth.”

Curious what bold growth assumptions power this eye-catching fair value? The narrative hinges on a digital transformation and a profitability leap, but the true financial levers behind these projections might just surprise you. Want to see which expectations underpin these bullish targets? Only the full story reveals which numbers matter most.

Result: Fair Value of $89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative faces risks if demand for key franchises falters, or if volatile costs from tariffs and licensing unexpectedly squeeze margins.

Find out about the key risks to this Hasbro narrative.

Another View: Multiples Paint a Pricier Picture

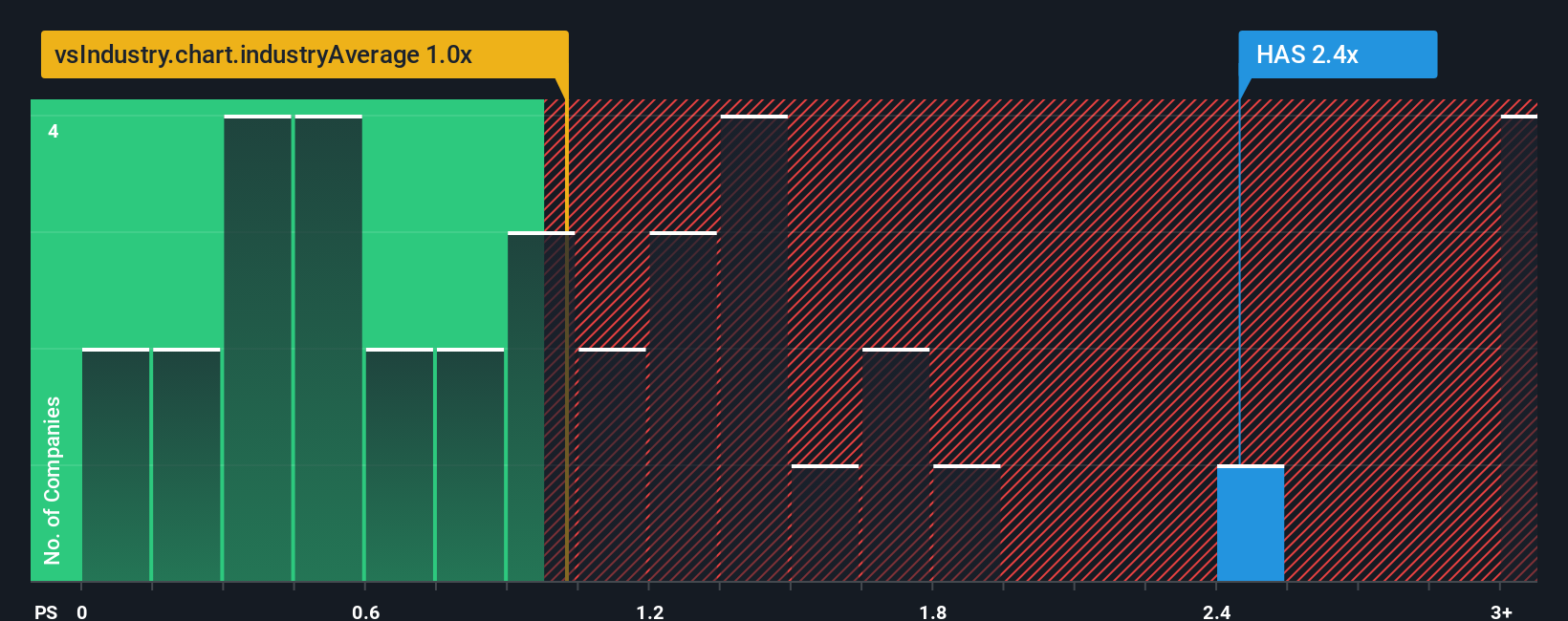

While the fair value model suggests Hasbro is undervalued, a look at its price-to-sales ratio tells a different story. Hasbro trades at 2.3x sales, which is higher than both the US Leisure industry average of 1x and its peer average of 1.2x. The so-called fair ratio, where the market could move towards equilibrium, is estimated at 2x. This raises the question: Is Hasbro’s premium multiple a sign of investor optimism, or does it signal valuation risk if growth stalls?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hasbro Narrative

If you’d rather dig into the numbers yourself and chart a different course, you can create your own perspective in just a few minutes. So why not Do it your way?

A great starting point for your Hasbro research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let opportunities pass you by. Use these powerful tools to confidently uncover today’s most exciting stock picks, tailored to big trends and smart strategies:

- Capture higher yields and steady growth by reviewing these 19 dividend stocks with yields > 3%, which offers strong income potential and reliable payouts above 3%.

- Harness the momentum of medical innovation and future health breakthroughs with these 33 healthcare AI stocks, fueling advances in patient care and diagnostics.

- Target untapped growth stories in tech by checking out these 24 AI penny stocks, focused on real progress in artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hasbro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HAS

Hasbro

Operates as a toy and game company in the United States, Europe, Canada, Mexico, Latin America, Australia, China, and Hong Kong.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives