- United States

- /

- Consumer Durables

- /

- NasdaqGS:GPRO

Why GoPro (GPRO) Is Up 39.5% After Launching AI Licensing Initiative and Filing for New Securities

Reviewed by Simply Wall St

- GoPro recently reported strong quarterly earnings and announced an innovative AI Training Licensing program that utilizes over 125,000 hours of subscriber video content for potential monetization and licensing opportunities.

- As part of its ongoing evolution, GoPro has also filed a registration statement for possible new securities issuance, indicating plans for fundraising or future expansion.

- We'll explore how GoPro's AI Training Licensing initiative could influence the company's long-term revenue and growth outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

GoPro Investment Narrative Recap

For GoPro shareholders, the main belief centers on the company’s ability to transition from hardware to robust recurring revenue streams, especially via subscriptions and content monetization. The recent surge in GoPro shares, sparked by strong quarterly results and the launch of its AI Training Licensing program, directly addresses one of the short-term catalysts, expanding higher-margin subscription and content-based revenues. However, challenges such as declining retail and direct product sales remain material and underscore ongoing risks to profitability. Among recent company updates, the launch of the AI Training Licensing program stands out as most relevant. This initiative aims to convert over 125,000 hours of subscriber content into potential licensing revenue, offering a new stream that could help offset pressures from falling hardware sales and tighter margins. If effectively executed, this shift may support GoPro’s broader efforts to stabilize revenue and improve cash generation. Yet, investors also need to consider recent revenue declines and why a tougher product market could challenge even the most innovative new initiatives...

Read the full narrative on GoPro (it's free!)

GoPro's outlook anticipates $767.0 million in revenue and $59.0 million in earnings by 2028. This scenario assumes a -1.5% annual revenue decline and a $491.3 million earnings increase from current earnings of -$432.3 million.

Uncover how GoPro's forecasts yield a $0.985 fair value, a 58% downside to its current price.

Exploring Other Perspectives

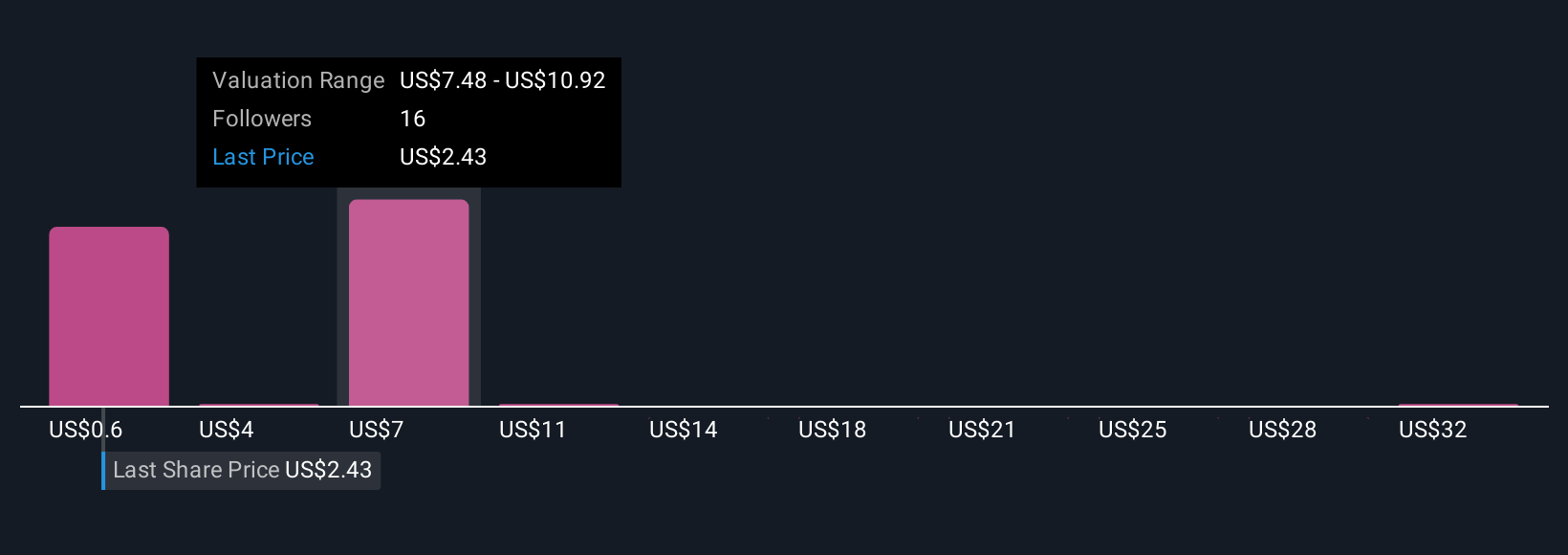

With seven fair value estimates from the Simply Wall St Community ranging from US$0.60 to a striking US$35, perspectives span a wide gap. But even as some anticipate higher cash flows from digital initiatives, risks such as declining retail and direct product sales should prompt careful consideration of GoPro's overall earnings picture.

Explore 7 other fair value estimates on GoPro - why the stock might be worth less than half the current price!

Build Your Own GoPro Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GoPro research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free GoPro research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GoPro's overall financial health at a glance.

No Opportunity In GoPro?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GPRO

GoPro

Provides cameras, mountable and wearable accessories, and subscription and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives