- United States

- /

- Luxury

- /

- NasdaqGS:GIII

G-III Apparel (GIII) Q3 EPS Rebound Tests Bullish Margin Expansion Narrative

Reviewed by Simply Wall St

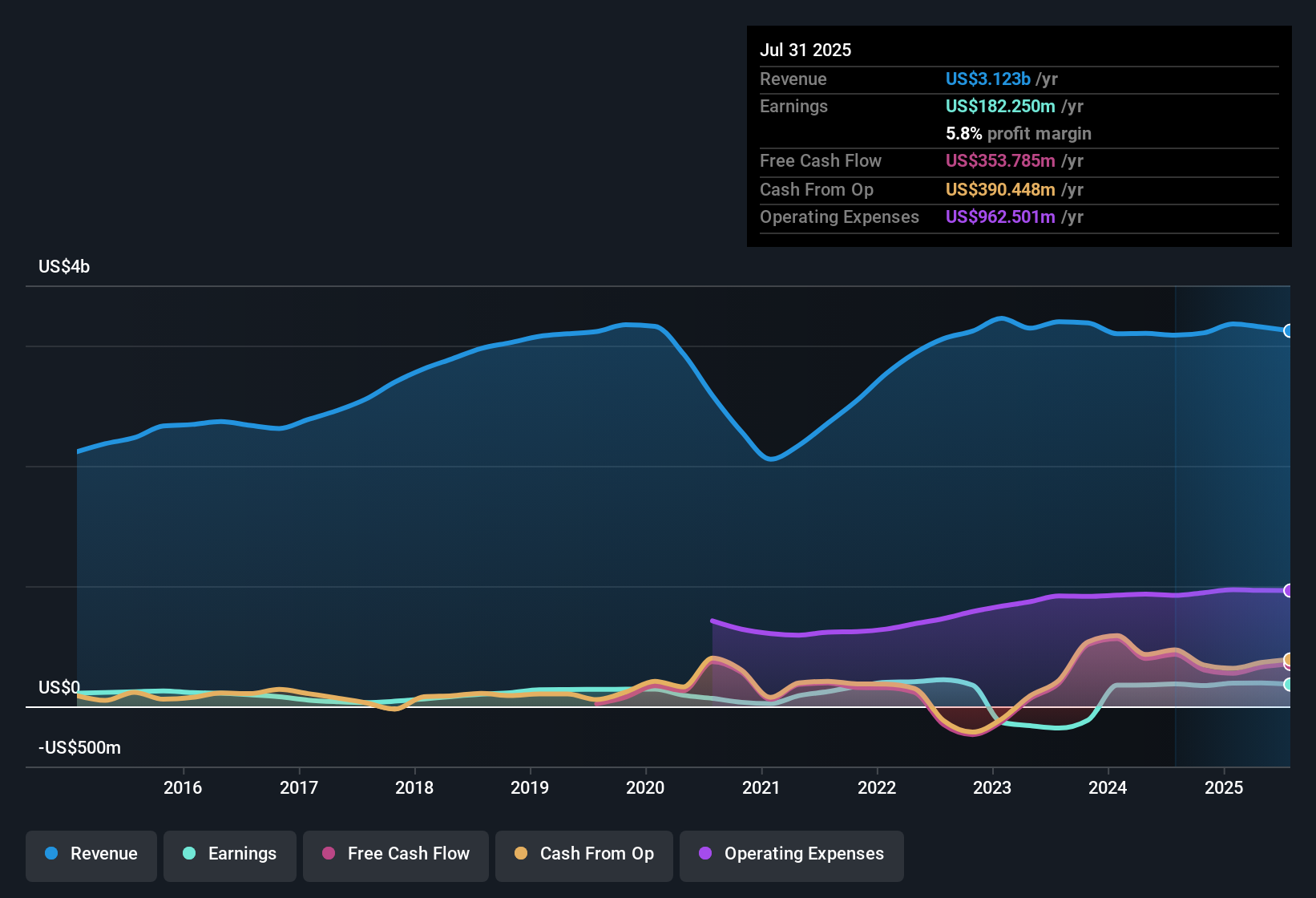

G-III Apparel Group (GIII) posted Q3 2026 revenue of about $988.6 million with basic EPS of $1.91, setting the tone for a quarter where headline results and recent trends are firmly in focus for investors. The company has seen quarterly revenue move from $644.8 million in Q2 2025 to $613.3 million in Q2 2026 and then to $988.6 million in the latest quarter, while basic EPS shifted from $0.54 in Q2 2025 to $0.26 in Q2 2026 and now $1.91, against a backdrop of trailing 12 month net profit margin easing from 5.6% to 4.9% as investors weigh resilient profitability against signs of pressure on margins.

See our full analysis for G-III Apparel Group.With the latest numbers on the table, the next step is to see how this margin story lines up with the prevailing narratives around G-III's long term earnings power and risk profile.

See what the community is saying about G-III Apparel Group

Five year growth meets weaker last twelve months

- Over the last five years, earnings grew about 10.1% per year, but the most recent 12 month net income of $148.1 million is lower than the earlier trailing figure of $195.5 million, showing that the recent period has not kept up with the longer term trend.

- Consensus narrative leans on owned brand growth like DKNY and Karl Lagerfeld to support future earnings, which sits in contrast to the softer trailing picture

- Analysts expect earnings to reach $191.6 million, up from $173.6 million in the narrative. The latest trailing data in this set shows $148.1 million, so the current run rate still has ground to make up.

- The same narrative looks for margins to move toward 6.4%. Trailing net margin stands at 4.9%, down from 5.6%, so the numbers today do not yet reflect that improvement.

Margins slip while mix is expected to improve

- Trailing net margin is 4.9%, down from 5.6% a year earlier, even though Q3 2026 net income of $80.6 million is noticeably higher than Q2 2026 net income of $10.9 million and Q1 2026 net income of $7.8 million. The recent quarterly rebound is therefore happening on a thinner margin base than a year ago.

- Consensus narrative argues that higher margin owned brands and international expansion will eventually support better profitability, and the current numbers give a mixed read on that claim

- On one hand, trailing twelve month revenue at about $3.0 billion has dipped from $3.2 billion a few quarters ago, so the company is trying to improve mix while overall sales have been easing.

- On the other hand, the expectation that margins can rise from 5.6% to 6.4% over three years is being measured against a current 4.9% margin, so execution on brand mix and cost control has to work just to get back to past levels before improving further.

Cheap 8.8x P/E versus peers but with softer outlook

- The stock trades on a P/E of 8.8 times trailing earnings, compared with a peer average of 36.9 times and a US Luxury industry average of 20.6 times. A DCF fair value of about $36.68 versus the current $30.82 suggests the shares sit roughly 16% below that estimate.

- Consensus narrative highlights long term brand growth, but the valuation gap also reflects concerns that profits and revenue may not grow quickly

- Revenue is projected in this dataset to decline around 3.3% per year over the next three years, which contrasts with the idea of strong double digit growth from key brands and helps explain why the market is not paying industry level multiples.

- To reach the analyst style scenario in the narrative, the company would need to sustain EPS growth to about $4.04 while the share price only needs to support a P/E around 10.3. Today’s 8.8 multiple and discount to DCF fair value tilt the numbers toward upside only if those growth and margin assumptions play out.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for G-III Apparel Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Turn that view into a concise narrative in just a few minutes and share your angle with the community: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding G-III Apparel Group.

See What Else Is Out There

G-III’s softer recent margins, slower revenue trend, and cautious growth outlook contrast with the more upbeat long term narrative investors are hoping will play out.

If you want businesses already delivering consistent expansion instead of waiting for a turnaround, use our stable growth stocks screener (2091 results) today to quickly spot companies with steadier revenue and earnings trajectories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GIII

G-III Apparel Group

Designs, sources, distributes, and markets women’s and men’s apparel in the United States and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)