- United States

- /

- Consumer Durables

- /

- NasdaqCM:ATER

Aterian, Inc. (NASDAQ:ATER) Surges 42% Yet Its Low P/S Is No Reason For Excitement

Despite an already strong run, Aterian, Inc. (NASDAQ:ATER) shares have been powering on, with a gain of 42% in the last thirty days. But the last month did very little to improve the 58% share price decline over the last year.

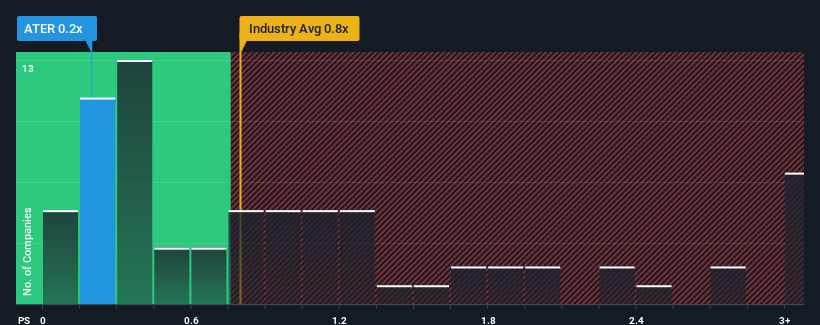

In spite of the firm bounce in price, considering around half the companies operating in the United States' Consumer Durables industry have price-to-sales ratios (or "P/S") above 0.8x, you may still consider Aterian as an solid investment opportunity with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Aterian

What Does Aterian's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Aterian's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Aterian's future stacks up against the industry? In that case, our free report is a great place to start.How Is Aterian's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Aterian's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 40% decrease to the company's top line. As a result, revenue from three years ago have also fallen 39% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 25% during the coming year according to the three analysts following the company. Meanwhile, the broader industry is forecast to expand by 5.0%, which paints a poor picture.

With this information, we are not surprised that Aterian is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Aterian's stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's clear to see that Aterian maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Plus, you should also learn about these 4 warning signs we've spotted with Aterian.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ATER

Aterian

Operates as a technology-enabled consumer products company in North America and internationally.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives