- United States

- /

- Professional Services

- /

- NYSE:WNS

WNS (NYSE:WNS): Exploring Valuation After a Standout 61% Year-to-Date Gain

Reviewed by Kshitija Bhandaru

Shares of WNS (Holdings) (NYSE:WNS) have been relatively stable over the past month, catching the attention of investors who are trying to gauge where the stock might head next. Performance year to date has been steady, with a 61% gain.

See our latest analysis for WNS (Holdings).

Momentum around WNS (Holdings) is building, as reflected in a standout year-to-date share price return of over 61 percent. That surge dwarfs short-term moves and puts the spotlight on its improving growth outlook and market optimism, even though the 1-year total shareholder return is slightly lower at 56.5 percent. Looking further back, multi-year total returns have seen periods of both progress and pause, but the stock’s current momentum signals renewed investor confidence.

If this kind of momentum gets you thinking about broader market opportunities, it could be the perfect moment to discover fast growing stocks with high insider ownership

The big question for investors now is whether WNS (Holdings) remains undervalued amid its strong run, or if the market has already priced in all the anticipated growth, leaving little room for further upside.

Most Popular Narrative: Fairly Valued

With WNS (Holdings) closing at $76.3 and the popular narrative consensus calling fair value at $76.2, analyst outlook is nearly matched by the current market price. This alignment puts the focus on catalysts and assumptions that underpin the narrative’s cautious optimism.

WNS has entered fiscal 2026 with solid business momentum, a healthy pipeline, and has closed two large transformational deals in banking and financial services as well as the travel vertical. These deals are expected to contribute to revenue growth in the first half of fiscal 2026.

Want to know what lies behind this razor-thin gap between price and fair value? The secret is in growth bets on AI and bold assumptions for future margins. Go beyond the headlines to see which financial levers are powering the consensus view and how they might shift your perspective on what’s possible for WNS.

Result: Fair Value of $76.2 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing client losses and elevated employee attrition remain potential headwinds. These factors could quickly shift sentiment and challenge the current optimistic outlook.

Find out about the key risks to this WNS (Holdings) narrative.

Another View: Multiple-Based Valuation

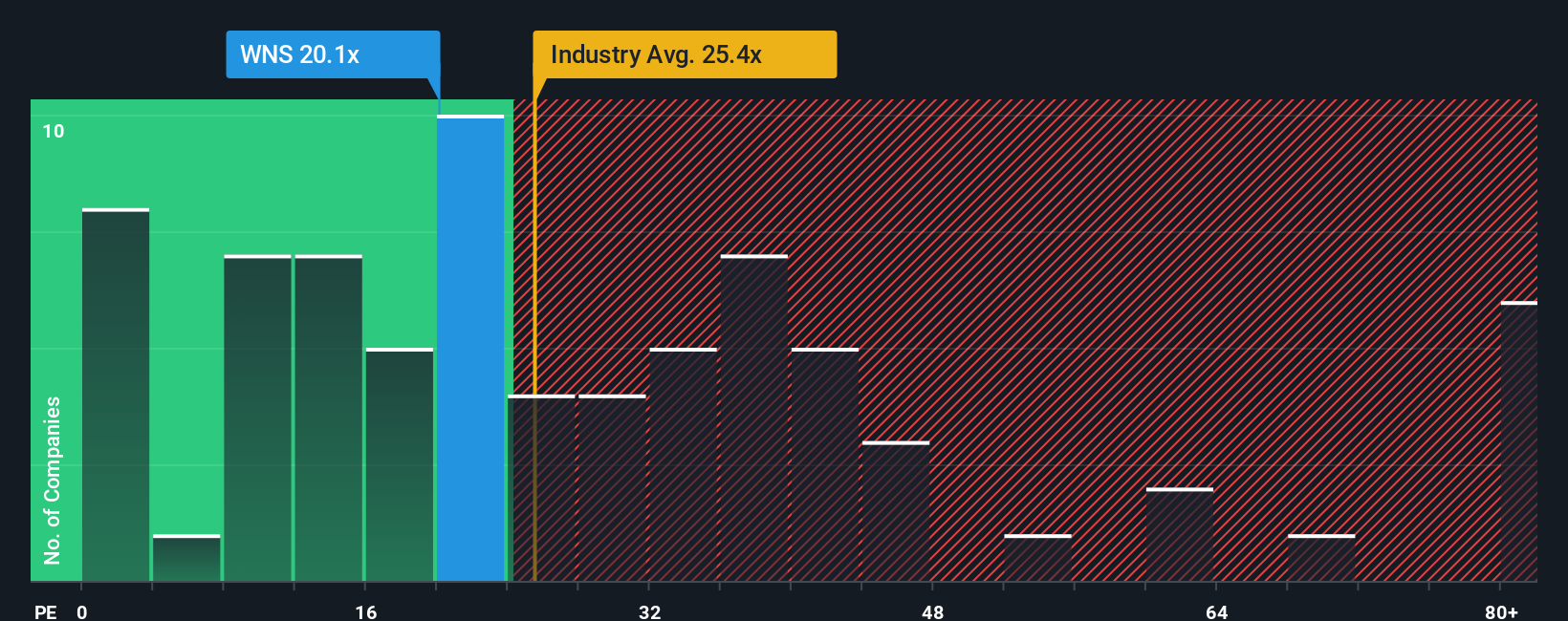

Looking beyond consensus fair value, one popular approach is to compare the price-to-earnings ratio with industry standards. WNS trades at 20.1x earnings, which is notably lower than both the peer average of 29.8x and the industry’s 25.4x. This gap suggests a potential value opportunity or possibly that the market doubts the company’s growth outlook. Will investor sentiment shift and close this valuation gap, or is it a warning of risks under the surface?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own WNS (Holdings) Narrative

If you see the story differently or trust your own analysis more, you can dive in and build your own view in just a few minutes, Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding WNS (Holdings).

Looking for more investment ideas?

Great investing is about seizing opportunities before they go mainstream. Act now and unlock access to stocks on the verge of breakout growth, steady dividends, and emerging tech revolutions. Take charge of your next big move with options built for savvy investors:

- Accelerate your portfolio with these 24 AI penny stocks, capitalizing on the explosive potential of artificial intelligence across fast-evolving industries.

- Secure reliable income streams by choosing these 19 dividend stocks with yields > 3%, offering attractive yields and strong fundamentals in today's unpredictable markets.

- Step ahead of Wall Street and spot bargains through these 893 undervalued stocks based on cash flows, packed with companies whose full value is still waiting to be recognized.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if WNS (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WNS

WNS (Holdings)

A business process management (BPM) company, provides data, voice, analytical, and business transformation services worldwide.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion