- United States

- /

- Commercial Services

- /

- NYSE:WM

Waste Management (NYSE:WM) Expands with Stericycle Integration, Eyes Renewable Energy Growth

Reviewed by Simply Wall St

Waste Management (NYSE:WM) has recently showcased strong operational performance, achieving double-digit growth in operating EBITDA with a margin of 30.5%, driven by cost optimization and pricing strategies. The company is advancing its sustainability initiatives, completing 24 out of 39 planned recycling projects, and is set to expand its market reach through strategic acquisitions like Stericycle. The following report explores key areas such as financial risks, growth opportunities in renewable energy, and the impact of economic uncertainties on Waste Management's strategic outlook.

Click here and access our complete analysis report to understand the dynamics of Waste Management.

Innovative Factors Supporting Waste Management

Waste Management has demonstrated strong operational performance, with a notable double-digit growth in operating EBITDA and an impressive margin of 30.5%. This achievement is largely due to effective cost optimization and disciplined pricing strategies, as highlighted by CEO James Fish. The company's commitment to sustainability is evident through its completion of 24 out of 39 planned recycling projects, which have significantly enhanced capacity and efficiency. These initiatives have not only led to substantial cost savings but also improved margins, showcasing the effectiveness of Waste Management's sustainability efforts. Additionally, strategic acquisitions, including the anticipated integration of Stericycle, are poised to expand service offerings and market reach, driving future revenue and earnings growth.

Critical Issues Affecting the Performance of Waste Management and Areas for Growth

Waste Management faces challenges such as a high net debt to equity ratio of 190.3%, which poses a financial risk. The company's revenue growth of 8.8% per year lags behind the US market average of 8.9%, highlighting a need for improvement. Furthermore, the earnings growth forecast of 10.9% annually is below the US market's 15.4%. The company's dividend yield of 1.33% is also lower than the top 25% of US dividend payers, which stands at 4.19%. These factors suggest areas for potential enhancement to align more closely with industry standards. The valuation of Waste Management, with a Price-To-Earnings Ratio of 34.2x, is below the peer average of 42.7x, yet it remains higher than the industry average of 32.7x, indicating a nuanced position in the market.

Future Prospects for Waste Management in the Market

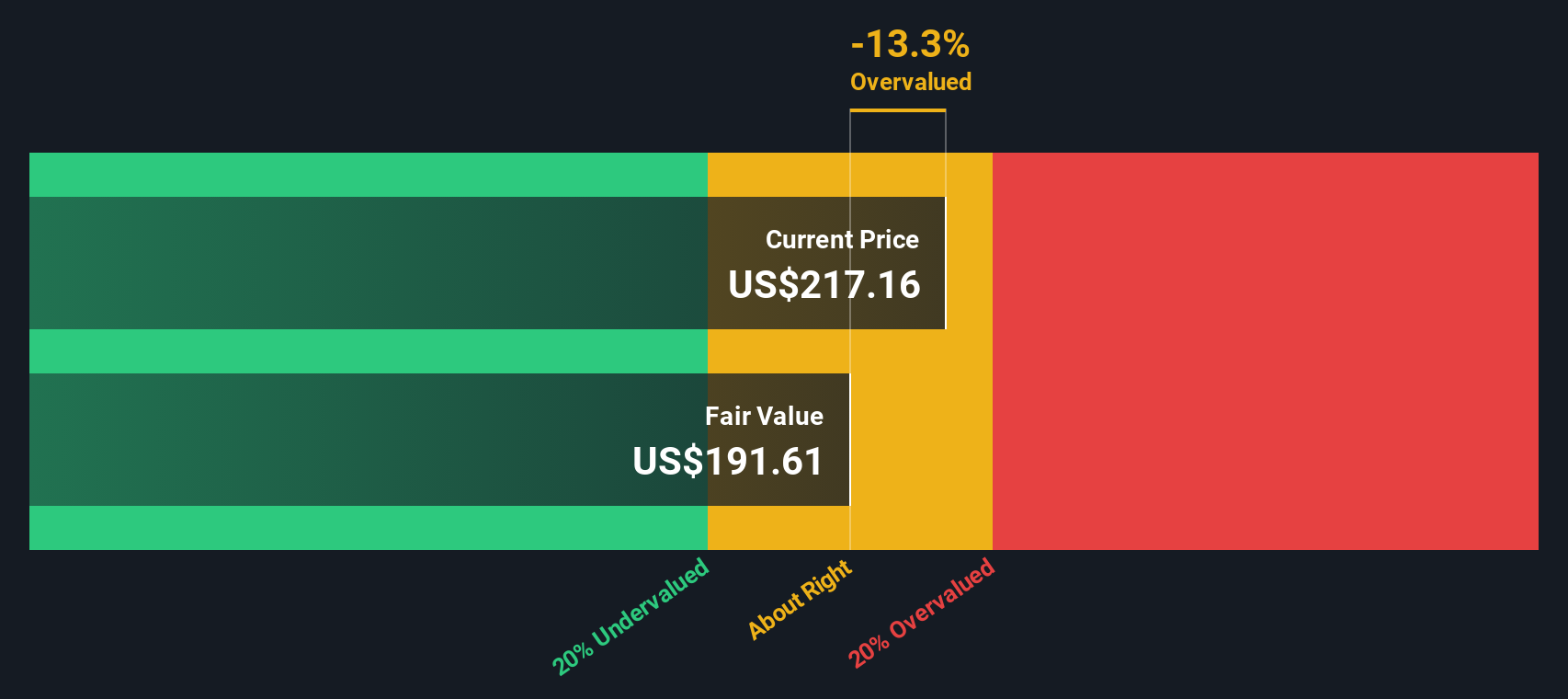

There is significant potential for Waste Management to capitalize on its investments in renewable energy projects, which are expected to become operational soon. These projects align with increasing environmental concerns and regulatory support for sustainable practices. The company's technological advancements, such as the automation of over 800 routes in its residential fleet, present opportunities for further cost reductions and operational efficiencies. Such innovations are likely to enhance Waste Management's competitive advantage and profitability. Trading at a discount to its estimated fair value, the company has room for price appreciation, provided it can improve its revenue growth rate.

Key Risks and Challenges That Could Impact Waste Management's Success

Political and economic uncertainties, particularly during election years, pose risks to business operations and market stability. Changes in regulations or economic policies could impact Waste Management's strategic plans and financial performance. Additionally, persistent wage inflation in frontline roles could increase operational costs, pressuring margins. The company relies on automation to mitigate these costs, highlighting the potential threat of labor market dynamics. Moreover, volatility in recycling commodity prices has previously impacted performance, indicating a vulnerability to external market conditions that could affect profitability.

Conclusion

Waste Management's strategic focus on sustainability and technological advancements has resulted in commendable operational performance, evidenced by strong EBITDA growth and enhanced margins. However, the company's high debt levels and slower revenue growth compared to market averages highlight areas for improvement. With its investments in renewable energy and automation, Waste Management is well-positioned to capitalize on future growth opportunities, despite challenges such as economic uncertainties and wage inflation. Trading at a Price-To-Earnings Ratio of 34.2x, which is below its peers but above the industry average, Waste Management presents a nuanced investment opportunity, with potential for price appreciation contingent on improved revenue growth and market conditions.

Key Takeaways

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Waste Management, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Waste Management might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WM

Waste Management

Through its subsidiaries, provides environmental solutions to residential, commercial, industrial, and municipal customers in the United States, Canada, Western Europe, and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives