- United States

- /

- Commercial Services

- /

- NYSE:WM

A Look at Waste Management’s Valuation Following Stericycle Deal, $3B Sustainability Push, and 2025 Dividend Boost

Reviewed by Kshitija Bhandaru

Waste Management (NYSE:WM) just made headlines with two major moves: acquiring Stericycle to enter the medical waste space and committing $3 billion to renewable energy and recycling efforts. These actions highlight an evolving strategy focused on fresh growth and sustainability.

See our latest analysis for Waste Management.

Waste Management’s expansion moves, including the Stericycle acquisition and significant sustainability investments, have caught investor attention as the stock maintains steady momentum. With the latest share price at $219.25, its year-to-date share price return stands at a healthy 9.3%, while long-term investors have seen a total shareholder return of 45.6% over three years. That performance suggests confidence is building in both the company’s growth prospects and its reliable dividend profile.

If Waste Management’s push into new sectors has you watching for the next breakout, now’s a perfect time to explore fast growing stocks with high insider ownership.

Despite these headline-grabbing moves and consistent shareholder returns, the key question now is whether Waste Management’s share price still offers upside or if the market has already accounted for the company’s future growth plans.

Most Popular Narrative: 14.8% Undervalued

The most widely followed narrative values Waste Management significantly above its last closing price of $219.25, pointing to potential upside if assumptions play out. This perspective highlights the appeal of WM’s aggressive moves into technology and sustainability as major drivers of future growth.

The implementation of technology to supplement the workforce and optimize cost structures is expected to be a significant differentiator for Waste Management. This could potentially lead to improved net margins. The company's strategic investments in sustainability, particularly in the areas of recycling and renewable energy, are showing strong, high-return growth. These initiatives could drive future revenue increases.

Want to know the financial playbook behind this high-flying fair value? The most crucial factor may surprise you. The story involves ambitious profit assumptions and a multiple that would put WM in elite company. Curious which growth levers are in focus and how bold the narrative really is? Click to see the numbers behind the optimism.

Result: Fair Value of $257.3 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, economic pressures in the industrial segment and integration hurdles from the Stericycle acquisition could challenge Waste Management’s expected growth and profitability.

Find out about the key risks to this Waste Management narrative.

Another View: Looking at Valuation Multiples

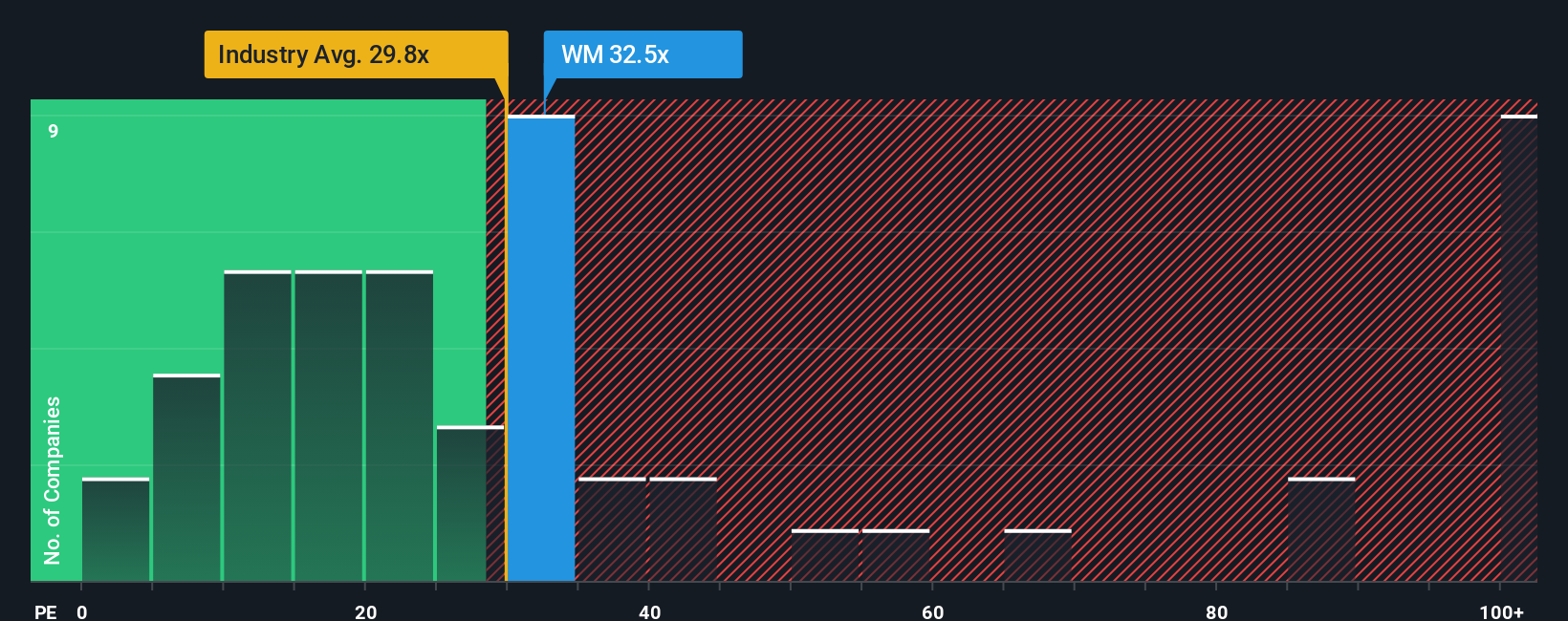

The other side of the coin comes from comparing Waste Management’s current price-to-earnings ratio of 32.5x to industry peers and benchmarks. That is considerably higher than the commercial services industry average of 27.2x, meaning WM is priced at a premium. Interestingly, it is still below its peer group average of 46.7x and not far from a fair ratio of 34.3x, a level the market could adjust toward. The takeaway? A premium price signals confidence, but it also leaves less margin for error if the growth narrative stumbles. Is that premium justified, or is the stock at risk of stretching too far?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Waste Management Narrative

Feel like you see things differently or want a deeper dive into the numbers? In just a few minutes, you can shape your own point of view with Do it your way.

A great starting point for your Waste Management research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Can’t-Miss Investment Ideas?

Every day presents a new chance to get ahead. The best moves often go to investors who act quickly and smartly before the crowd catches on. Check out these handpicked opportunities, each selected for their breakout potential and unique market edge:

- Maximize your income potential by tapping into attractive yields, starting with these 19 dividend stocks with yields > 3% that offer over 3% returns.

- Unlock the momentum fueling this year's technology leaders by reviewing these 24 AI penny stocks poised to benefit most from advances in artificial intelligence.

- Seize undervalued gems before they are widely recognized. See which companies stand out right now in these 894 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waste Management might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WM

Waste Management

Through its subsidiaries, provides environmental solutions to residential, commercial, industrial, and municipal customers in the United States, Canada, Western Europe, and internationally.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives