- United States

- /

- Commercial Services

- /

- NYSE:WCN

Waste Connections (WCN) Reports Higher Q2 Sales and Net Income in 2025

Reviewed by Simply Wall St

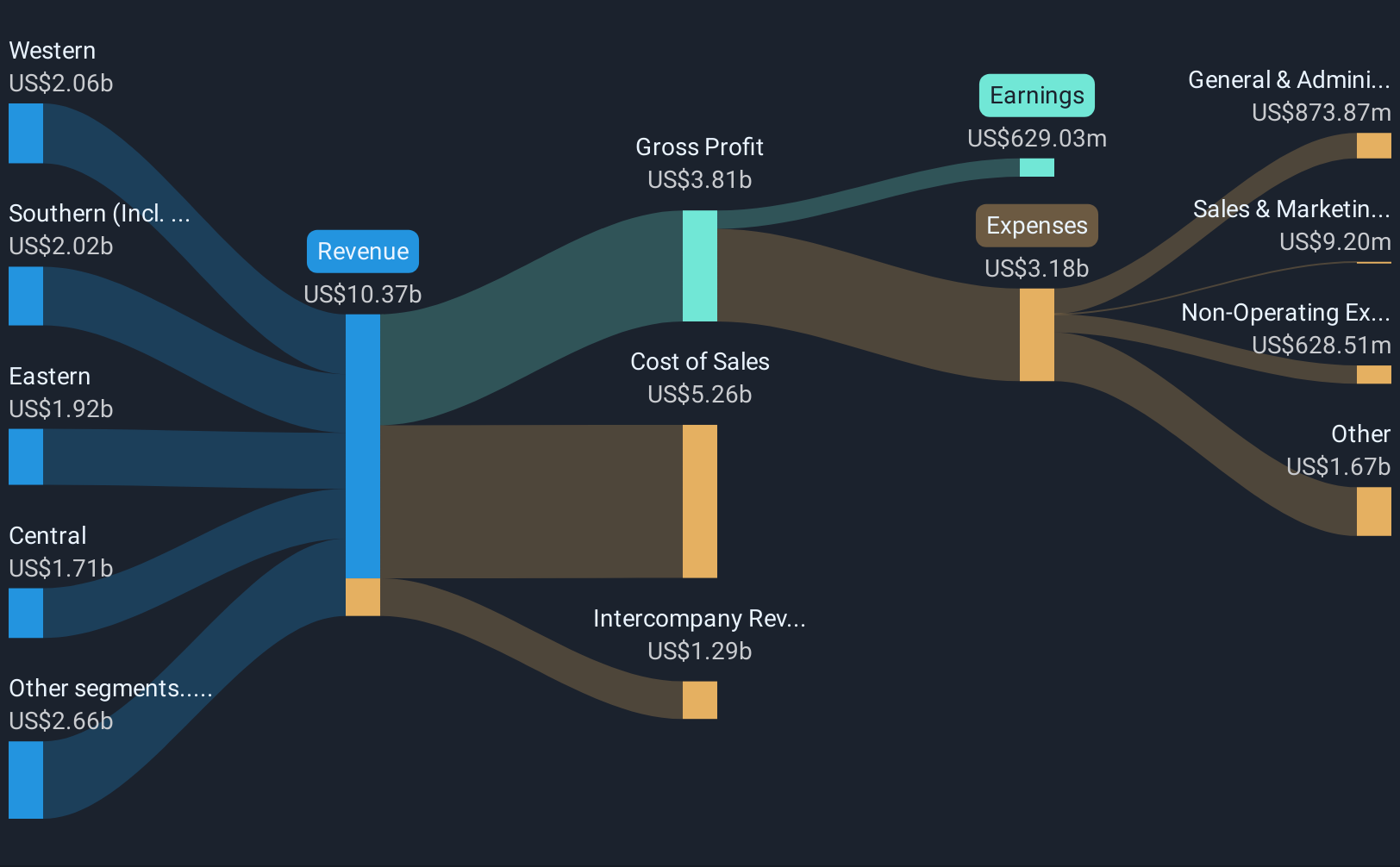

Waste Connections (WCN) recently announced its second-quarter earnings, reporting a rise in both sales and net income compared to the previous year. This strengthens the company's financial standing and may add weight to its stock's flat movement per last week's overall market trend. The broader market saw a 2% rise over the same period, suggesting WCN's positive earnings performance was not enough to significantly exceed market momentum. While earnings highlight its robust operational performance, they did not lead to a notable divergence from the market trend, reflecting alignment with the general market appetite.

The recent earnings report from Waste Connections, showing a rise in both sales and net income, could suggest that the company's effective pricing and acquisition strategies are bearing fruit. This aligns with its narrative of anticipated revenue and margin growth driven by these initiatives. However, recent market performance indicates that these gains have not translated into significant share price movement, likely due to broader market influences.

Over the past five years, Waste Connections' total shareholder return, including dividends, was 88.29%, showcasing a robust long-term performance despite recent short-term underperformance compared to the US Commercial Services industry over the past year. This context highlights the company's relatively strong overall track record despite short-term volatility.

The immediate impact of the earnings announcement on future revenue and earnings forecasts hinges on market confidence in the company's ability to maintain its growth trajectory through acquisitions and operational efficiencies. With analysts forecasting revenue growth of 7.1% annually and earnings expected to increase significantly, the company appears to be on a supportive trajectory. The current share price of US$184.43 reflects a 13.24% discount to the consensus price target of US$209.48, indicating that there might be room for value realization if future performance aligns with these forecasts.

Review our growth performance report to gain insights into Waste Connections' future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waste Connections might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WCN

Waste Connections

Provides non-hazardous waste collection, transfer, disposal, and resource recovery services in the United States and Canada.

Moderate growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives