- United States

- /

- Commercial Services

- /

- NYSE:WCN

Waste Connections (NYSE:WCN) Eyes Growth with NYC Franchise Model and Renewable Natural Gas Expansion

Reviewed by Simply Wall St

Get an in-depth perspective on Waste Connections's performance by reading our analysis here.

Core Advantages Driving Sustained Success for Waste Connections

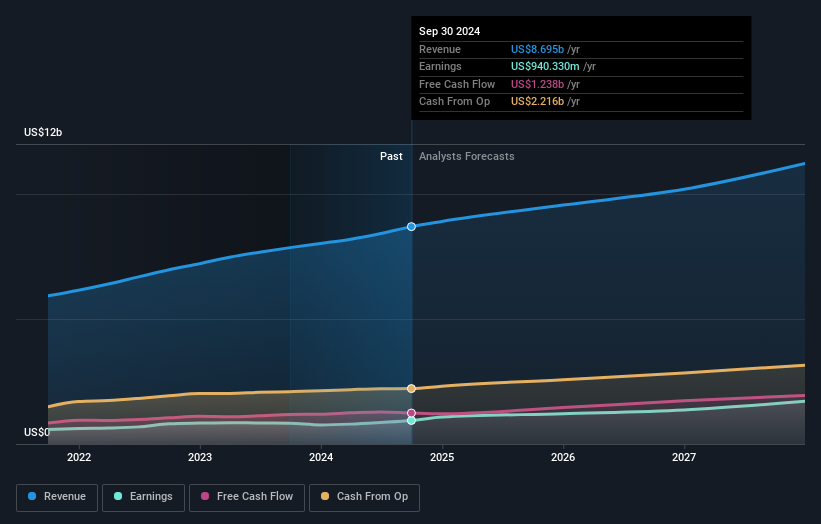

With a year-over-year revenue increase of 13.3%, reaching $2.34 billion, and a 17.3% rise in adjusted EBITDA to $787.4 million, Waste Connections showcases strong operational and financial performance. The EBITDA margin improved to 33.7%, reflecting strategic efficiency gains. Ronald Mittelstaedt, President and CEO, highlighted the company's momentum, setting a positive outlook for 2024 and beyond. Their acquisition strategy, including significant deals like Royal Waste Services, enhances their market position, particularly in New York City. This strategic expansion is complemented by improved employee retention and safety metrics, with a notable reduction in voluntary turnover and safety incidents.

Challenges Constraining Waste Connections's Potential

The company faces hurdles such as commodity price volatility, with a 15% drop in values due to external factors like port strikes. Mary Whitney, CFO, noted these challenges could pressure near-term margins. Additionally, the integration of acquisitions has led to margin dilution, requiring operational efficiencies to counteract these impacts. Waste Connections's earnings growth of 13.2% lagged behind the industry average of 15.1%, and its Return on Equity stands at 11.4%, below the 20% benchmark. Moreover, the company is trading at approximately 3% below its estimated fair value, yet its high Price-To-Earnings Ratio compared to peers suggests it might be considered expensive.

Areas for Expansion and Innovation for Waste Connections

The rollout of a franchise model in New York City offers significant growth potential, transforming an already strong market into one with exceptional long-term value. Holding 15 commercial zones, this initiative promises efficiency and expansion opportunities. Furthermore, Waste Connections's investment in Renewable Natural Gas (RNG) facilities aligns with sustainability goals, providing a future revenue stream expected to come online in 2026. These strategic moves position the company to capitalize on emerging market opportunities and enhance its competitive edge.

Market Volatility Affecting Waste Connections's Position

Economic and regulatory uncertainties pose potential risks, particularly with the upcoming election, as noted by Ronald Mittelstaedt. These factors could influence the company's strategic direction and financial stability. Additionally, severe weather events, such as Hurricane Helene, have already impacted operations, with a 5% year-over-year revenue decrease in affected markets. Such disruptions highlight the vulnerability of Waste Connections to external environmental factors, which could challenge its market positioning and operational continuity.

Conclusion

Waste Connections demonstrates strong operational and financial performance, with a significant increase in revenue and EBITDA, driven by strategic acquisitions and efficiency improvements. However, challenges such as commodity price volatility and integration-related margin dilution pose short-term risks, potentially pressuring margins. The company's strategic initiatives, including the franchise model in New York City and investment in Renewable Natural Gas facilities, offer promising long-term growth and sustainability prospects. Despite trading below its estimated fair value, the high Price-To-Earnings Ratio compared to peers suggests that investors may perceive the stock as expensive, reflecting confidence in the company's future growth potential amidst current market uncertainties.

Seize The Opportunity

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Waste Connections, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Waste Connections might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WCN

Waste Connections

Provides non-hazardous waste collection, transfer, disposal, and resource recovery services in the United States and Canada.

Moderate growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives