- United States

- /

- Commercial Services

- /

- NYSE:WCN

Waste Connections (NYSE:WCN) Amends Revolving Credit Agreement With Lenders

Reviewed by Simply Wall St

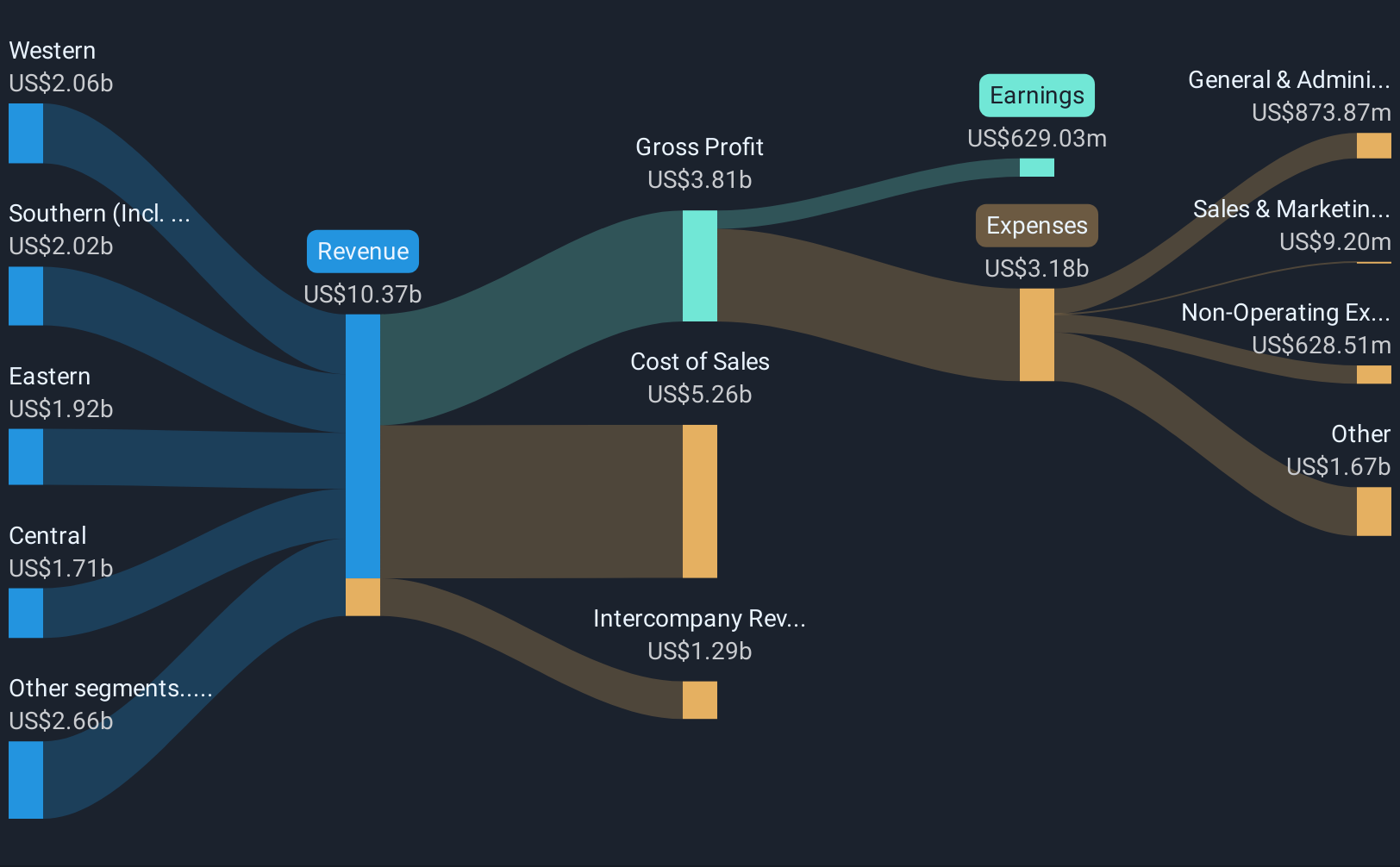

Waste Connections (NYSE:WCN) recently amended its Revolving Credit Agreement, a move potentially aimed at streamlining its financial operations. Over the last quarter, the company's share price increased by 5%. This price change occurred in a broader market context characterized by a rise in major indexes like the S&P 500 and Nasdaq. The company's dividend affirmations and improved earnings for Q1 2025 could have supported its share price. Waste Connections' financial activities and performance updates may have added weight to these broader market advances, offering a solid backdrop for the modest appreciation in its stock value.

The amendment of Waste Connections' Revolving Credit Agreement could streamline its financial structure and potentially improve its financial flexibility. This move, alongside successful acquisitions and strategic facility integrations, lays a foundation for enhanced revenue and earnings. Over the longer term, the company's shares have performed well, delivering a total return of 115.26% over five years. In comparison, Waste Connections' recent performance exceeded the US Commercial Services industry in the past year. The company's earnings have seen a decline recently, making year-over-year comparisons difficult, yet projections suggest substantial annual growth in the coming years.

In light of the latest developments, analysts continue to project an increase in revenues and earnings for Waste Connections, with anticipated revenue of US$1.6 billion by 2028. The price target set by analysts is US$208, slightly above the current share price of US$198.38, indicating that the market may be valuing the stock close to its perceived fair value. These factors, combined with an improved outlook in core pricing and operational efficiencies, may drive the company's future growth trajectory. Nonetheless, potential risks such as reliance on acquisitions and volatile commodity prices could impact margins and overall financial outcomes. It is crucial for investors to carefully examine these variables and form their own assessments based on the current data and forecasts.

Learn about Waste Connections' future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waste Connections might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WCN

Waste Connections

Provides non-hazardous waste collection, transfer, disposal, and resource recovery services in the United States and Canada.

Moderate growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives