- United States

- /

- Commercial Services

- /

- NYSE:VSTS

Vestis (NYSE:VSTS) Eyes Growth with SME Expansion and Cost Initiatives Despite Q4 Revenue Dip

Reviewed by Simply Wall St

Get an in-depth perspective on Vestis's performance by reading our analysis here.

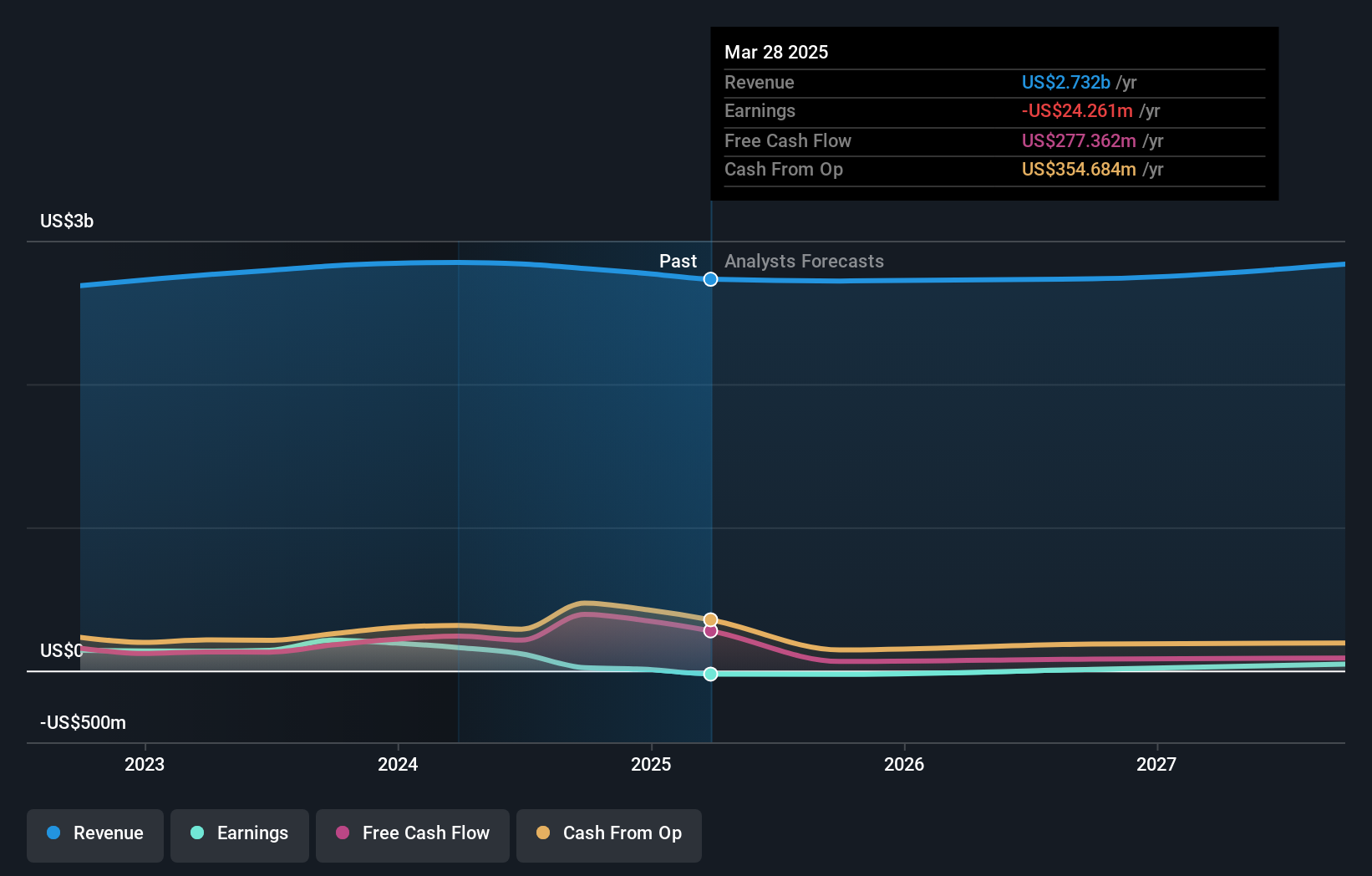

Core Advantages Driving Sustained Success for Vestis

Vestis Corporation has demonstrated significant financial performance, with a notable achievement of $2.8 billion in revenue for fiscal 2024. The adjusted EBITDA of $353 million, exceeding their guidance, reflects a healthy margin of 12.6%. This financial health underscores the company's ability to sustain growth, supported by a forecasted earnings increase of 38.7% annually. Under the leadership of CEO Kim Scott, strategic initiatives such as securing national accounts have been pivotal. Recent wins, including a multiyear deal with a leading food services company, highlight a strong pipeline that is expected to bolster future revenues. Operational efficiencies, particularly through network optimization and merchandise reuse, are projected to yield significant cost savings in fiscal 2025.

Critical Issues Affecting the Performance of Vestis and Areas for Growth

However, the company faces challenges, such as a 4% year-over-year revenue decline in the fourth quarter. CFO Rick Dillon attributes this to lost business despite volume growth. The EBITDA margin also fell to 11.8% from 15.8%, primarily due to pricing erosion and public company costs. Additionally, a 0.7% net profit margin, significantly lower than the previous year's 7.5%, and a low return on equity of 2.3% indicate areas needing improvement. The high Price-To-Earnings Ratio of 102.4x suggests potential overvaluation compared to industry peers. These financial metrics highlight the need for strategic adjustments to align with market expectations.

Areas for Expansion and Innovation for Vestis

Looking ahead, Vestis is poised for expansion by focusing on national accounts and small to medium enterprises (SMEs). CEO Scott expressed optimism about accelerating new business wins in FY '25, with incremental volume expected to surpass lost business by the second quarter. The company's pricing strategy is anticipated to contribute positively to revenue growth, with net price increases expected to enhance fiscal 2025 results. Furthermore, Vestis is implementing cost takeout initiatives to improve its cost structure, potentially supporting better financial outcomes as the year progresses.

Competitive Pressures and Market Risks Facing Vestis

Despite these opportunities, Vestis must navigate economic headwinds and competitive pressures that could impact pricing power and customer retention. Operational challenges, such as service quality improvements and reducing product shortages, remain critical. Scott noted a 50% reduction in shortage-related service requests at pilot locations, with plans for a network-wide rollout. Additionally, the company faces pricing headwinds in the first half of fiscal 2025, with tough comparisons potentially affecting pricing momentum. These factors underscore the importance of strategic agility in maintaining Vestis's market position.

Conclusion

Vestis Corporation's financial performance in fiscal 2024, marked by $2.8 billion in revenue and a 12.6% EBITDA margin, showcases its potential for sustained growth, driven by strategic leadership and a strong pipeline of national accounts. However, challenges such as a 4% revenue decline in the fourth quarter and a diminished net profit margin of 0.7% highlight areas requiring strategic adjustments to meet market expectations. The company's focus on expanding its SME base and optimizing operational efficiencies positions it well for future growth, despite economic headwinds and competitive pressures. Notably, the current share price being lower than the target price suggests potential for appreciation, aligning with the company's initiatives to enhance pricing strategies and cost structures in fiscal 2025, indicating a promising outlook.

Key Takeaways

- Already own Vestis? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VSTS

Vestis

Provides uniform rentals and workplace supplies in the United States and Canada.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives